Annuitants May Choose to Have Their Monthly Payments Electronically Deposited to a Federally Insured Checking or Form

Understanding the Electronic Deposit Option for Annuitants

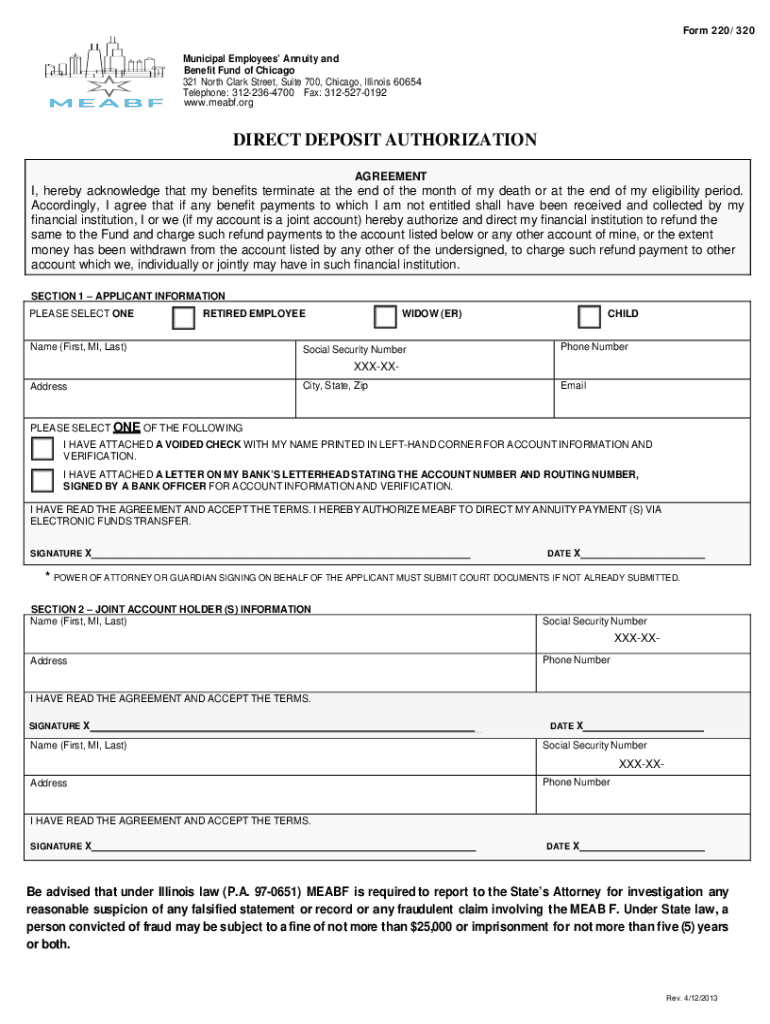

The option for annuitants to have their monthly payments electronically deposited into a federally insured checking account provides a convenient and secure way to receive funds. This method reduces the risk of lost or stolen checks and allows for quicker access to funds. Annuitants can choose this option during the application process or at any time thereafter, ensuring flexibility in managing their payments.

Steps to Complete the Electronic Deposit Request

To request electronic deposit of monthly payments, annuitants should follow these steps:

- Gather necessary information, including bank account details and routing numbers.

- Access the required form, which may be available online or through customer service.

- Fill out the form completely, ensuring all information is accurate to avoid delays.

- Submit the form as instructed, either online, by mail, or in person, depending on the options provided.

- Confirm with the financial institution that the deposit setup is complete.

Eligibility Criteria for Electronic Deposits

To qualify for electronic deposits, annuitants must meet specific criteria, which typically include:

- Being an active annuitant receiving monthly payments.

- Having a checking account with a bank or credit union that is federally insured.

- Providing accurate banking information to ensure successful deposits.

Required Documents for Setting Up Electronic Deposits

When applying for electronic deposits, annuitants may need to provide the following documents:

- A completed request form for electronic deposits.

- Proof of identity, such as a government-issued ID.

- Bank account information, including account and routing numbers.

Legal Considerations for Electronic Payments

Annuitants should be aware of the legal implications of choosing electronic deposits. This method is governed by federal regulations that ensure the security and reliability of electronic transactions. Annuitants must also understand their rights regarding unauthorized transactions and the process for disputing any errors that may occur.

Potential Issues with Electronic Deposits

While electronic deposits offer many benefits, there are potential issues to consider. These may include:

- Delays in processing due to banking holidays or technical issues.

- Errors in account information that could lead to failed deposits.

- Changes in banking policies that may affect the deposit process.

Examples of Electronic Deposit Scenarios

Annuitants may encounter various scenarios when using electronic deposits. For example, an annuitant who travels frequently may prefer electronic deposits to ensure timely access to funds without the need to visit a bank. Additionally, those managing household finances can benefit from the automatic nature of electronic deposits, allowing for better budgeting and financial planning.

Quick guide on how to complete annuitants may choose to have their monthly payments electronically deposited to a federally insured checking or

Complete Annuitants May Choose To Have Their Monthly Payments Electronically Deposited To A Federally Insured Checking Or effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly and without delays. Manage Annuitants May Choose To Have Their Monthly Payments Electronically Deposited To A Federally Insured Checking Or on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and electronically sign Annuitants May Choose To Have Their Monthly Payments Electronically Deposited To A Federally Insured Checking Or with ease

- Locate Annuitants May Choose To Have Their Monthly Payments Electronically Deposited To A Federally Insured Checking Or and click on Get Form to begin.

- Use the tools we have provided to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Generate your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Annuitants May Choose To Have Their Monthly Payments Electronically Deposited To A Federally Insured Checking Or and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the annuitants may choose to have their monthly payments electronically deposited to a federally insured checking or

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How the insurer determines how much each payment will be?

Insurer Determines Payment Amount: While the annuitant decides the time period for the benefits, the insurance company (insurer) determines the amount of each payment. The insurer calculates the payment amount based on factors such as the annuitant's age, gender, life expectancy, and the total amount of money invested.

-

What type of annuity guarantees to pay an income to the annuitant?

A fixed annuity provides fixed-dollar income payments backed by guarantees in the contract.

-

What annuity payout option provides for lifetime payments to the annuitant but guarantees a certain minimum term?

D) Life with period certain. The life with period certain option is designed to pay the annuitant an income for life, but guarantees a minimum period of payments whether the individual is alive or not.

-

Under which installments does the annuitant select the amount of each payment and the insurer determines how long they will pay benefits?

Final answer: The Fixed Amount installment option allows an annuitant to select a consistent payment amount with the insurer determining the duration of benefits, which is signNow in managing retirement income but does not account for inflation over time.

-

Under which installments option does the annuitant select the amount of each payment and the insurer determines how long they will pay benefits?

Final answer: The Fixed Amount installment option allows an annuitant to select a consistent payment amount with the insurer determining the duration of benefits, which is signNow in managing retirement income but does not account for inflation over time.

-

Does OPM pay your annuity for the prior month or the next month?

Retirement law specifies annuities are payable once each month on the first business day of the month. Sundays and Federal holidays are not business days. Your payment covers the annuity due for the month before the month in which the payment is made.

-

What is the settlement option that pays a specified amount to an annuitant?

(The settlement option that pays a specified amount to an annuitant, but pays no residual value to a beneficiary is known as life income.)

-

What are federal annuity payments?

Your FERS Annuity is, in short, the pension you receive from the Federal Employee Retirement System. After you retire, you'll receive monthly annuity payments from the government for the rest of your life.

Get more for Annuitants May Choose To Have Their Monthly Payments Electronically Deposited To A Federally Insured Checking Or

- Indiana surplus funds list jyz kurbis suppe de form

- Relevant life policy trust and nomination forms royal london

- Charity and business amendment form

- Openreach pia pdf form

- Sa2 form

- Sa1form fillable final pdf ulster university

- Application remove ship register form

- Acknowledgment of receipt of notice of privacy practices for protected health information i acknowledge that i have received a

Find out other Annuitants May Choose To Have Their Monthly Payments Electronically Deposited To A Federally Insured Checking Or

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer

- Can I Electronic signature Wisconsin High Tech Memorandum Of Understanding

- How Do I Electronic signature Wisconsin High Tech Operating Agreement

- How Can I Electronic signature Wisconsin High Tech Operating Agreement

- Electronic signature Delaware Legal Stock Certificate Later

- Electronic signature Legal PDF Georgia Online

- Electronic signature Georgia Legal Last Will And Testament Safe

- Can I Electronic signature Florida Legal Warranty Deed

- Electronic signature Georgia Legal Memorandum Of Understanding Simple

- Electronic signature Legal PDF Hawaii Online

- Electronic signature Legal Document Idaho Online

- How Can I Electronic signature Idaho Legal Rental Lease Agreement

- How Do I Electronic signature Alabama Non-Profit Profit And Loss Statement

- Electronic signature Alabama Non-Profit Lease Termination Letter Easy

- How Can I Electronic signature Arizona Life Sciences Resignation Letter

- Electronic signature Legal PDF Illinois Online

- How Can I Electronic signature Colorado Non-Profit Promissory Note Template