Charity and Business Amendment Form

What is the Charity And Business Amendment Form

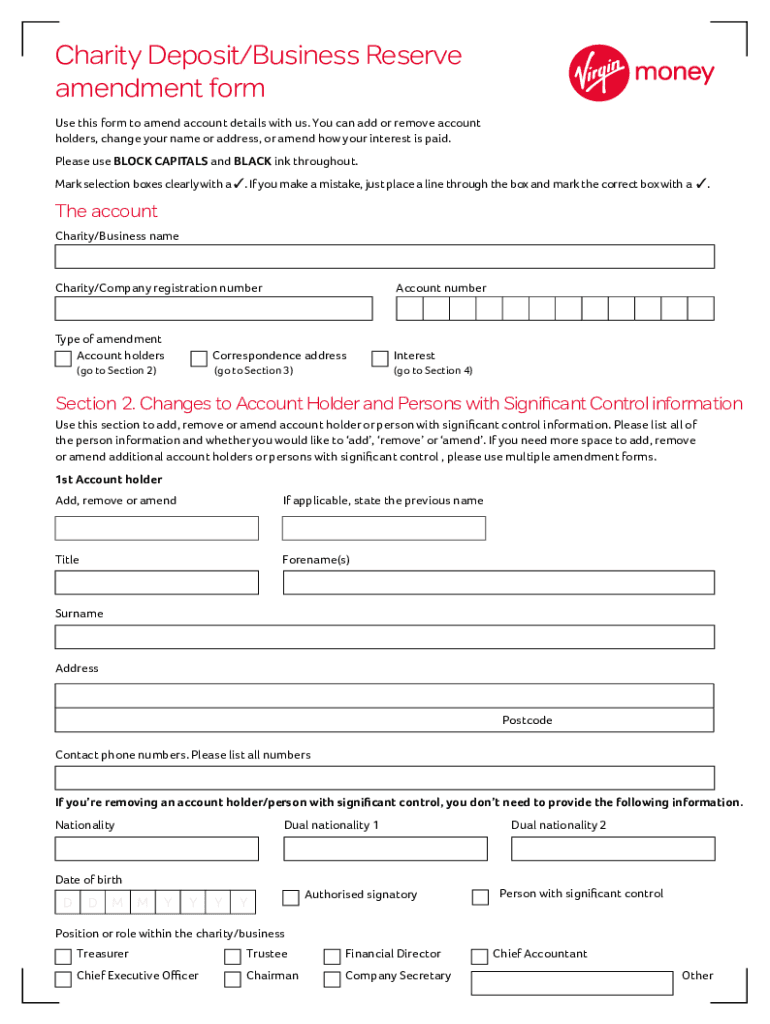

The Charity and Business Amendment Form is a crucial document used by organizations to make official changes to their charitable status or business structure. This form allows entities to update their information with relevant authorities, ensuring compliance with state and federal regulations. It may include changes such as amendments to the organization’s name, address, or purpose, as well as modifications to the board of directors or other key personnel. Understanding the purpose of this form is essential for maintaining transparency and legal standing in the nonprofit sector.

How to use the Charity And Business Amendment Form

Using the Charity and Business Amendment Form involves several straightforward steps. First, ensure you have the correct version of the form for your specific needs. Next, gather all necessary information and documentation that supports the amendments you wish to make. This may include meeting minutes, resolutions, or other relevant records. Once completed, review the form for accuracy and completeness before submitting it to the appropriate state or federal agency. Utilizing an electronic signature solution can streamline this process, ensuring that your submission is both secure and compliant with legal standards.

Steps to complete the Charity And Business Amendment Form

Completing the Charity and Business Amendment Form involves a series of clear steps:

- Identify the specific amendments required for your organization.

- Obtain the latest version of the form from the relevant authority.

- Fill in the required fields accurately, including any supporting information.

- Attach necessary documentation that validates the amendments.

- Review the form for any errors or omissions.

- Sign the form electronically or in print, as required.

- Submit the completed form to the appropriate agency, either online or via mail.

Legal use of the Charity And Business Amendment Form

The legal use of the Charity and Business Amendment Form is governed by various state and federal laws. To ensure that your amendments are recognized, it is important to adhere to the specific legal requirements set forth by regulatory bodies. This includes compliance with the Internal Revenue Service (IRS) guidelines and state nonprofit corporation laws. Proper use of the form not only protects the organization's legal standing but also enhances its credibility with donors and stakeholders.

Key elements of the Charity And Business Amendment Form

Key elements of the Charity and Business Amendment Form typically include:

- The name of the organization making the amendment.

- The specific changes being proposed.

- Contact information for the organization.

- Signatures of authorized representatives.

- Date of the amendment.

Each of these elements plays a vital role in ensuring that the form is complete and legally valid. Missing information can lead to delays or rejections in processing the amendment.

Form Submission Methods

The Charity and Business Amendment Form can be submitted through various methods, depending on the requirements of the regulatory body. Common submission methods include:

- Online submission through the agency's official website.

- Mailing a physical copy of the form to the designated office.

- In-person submission at local offices, if applicable.

Choosing the right submission method can help ensure that your amendments are processed in a timely manner.

Quick guide on how to complete charity and business amendment form

Effortlessly Prepare Charity And Business Amendment Form on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, as you can obtain the necessary form and securely store it digitally. airSlate SignNow equips you with all the essentials to create, modify, and eSign your documents quickly and efficiently. Handle Charity And Business Amendment Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

The Easiest Way to Edit and eSign Charity And Business Amendment Form with Ease

- Locate Charity And Business Amendment Form and click Get Form to begin.

- Use our tools to complete your form.

- Mark important sections of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all details and click the Done button to save your updates.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns over missing or lost files, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign Charity And Business Amendment Form and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the charity and business amendment form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Charity And Business Amendment Form?

A Charity And Business Amendment Form is a legal document used to modify or update an existing agreement related to charitable organizations and business collaborations. This form ensures that changes in terms, conditions, or obligations are officially documented, providing clarity and compliance for all parties involved.

-

How can airSlate SignNow help with the Charity And Business Amendment Form?

airSlate SignNow streamlines the process of creating, sending, and eSigning your Charity And Business Amendment Form. With its user-friendly interface and robust features, businesses can efficiently manage amendments without the hassle of paperwork, saving time and reducing errors in the documentation process.

-

What are the costs associated with using airSlate SignNow for Charity And Business Amendment Forms?

Pricing for airSlate SignNow varies based on the plan you choose, but it is generally cost-effective compared to traditional document handling methods. Each plan includes access to essential features for managing your Charity And Business Amendment Form, making it a budget-friendly solution for businesses looking to streamline their operations.

-

Are there specific features in airSlate SignNow designed for Charity And Business Amendment Forms?

Yes, airSlate SignNow offers features such as customizable templates, real-time tracking, and secure eSignature options specifically designed to facilitate the completion of Charity And Business Amendment Forms. These features enhance document accuracy and integrity, ensuring that your amendments comply with legal standards.

-

Can I integrate airSlate SignNow with other tools for managing my Charity And Business Amendment Forms?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and productivity tools, allowing you to manage your Charity And Business Amendment Form workflows alongside your existing processes. This integration capability helps in keeping your documents organized and accessible, enhancing overall efficiency.

-

Is airSlate SignNow legally compliant for Charity And Business Amendment Forms?

Yes, airSlate SignNow is designed to comply with legal standards for eSignatures, making it a reliable choice for handling your Charity And Business Amendment Form. The platform ensures that all signed documents are securely stored and can be easily accessed for future reference, thus maintaining compliance with relevant laws.

-

What benefits do businesses gain from using airSlate SignNow for their Charity And Business Amendment Forms?

Using airSlate SignNow for your Charity And Business Amendment Form provides key benefits such as improved efficiency, faster turnaround times, and reduced paperwork. It allows businesses to focus on their core activities while ensuring that all amendment procedures are handled smoothly and securely.

Get more for Charity And Business Amendment Form

Find out other Charity And Business Amendment Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form

- Can I Sign Kentucky Courts Document

- How To eSign New York Banking Word

- Can I eSign South Dakota Banking PPT

- How Can I eSign South Dakota Banking PPT