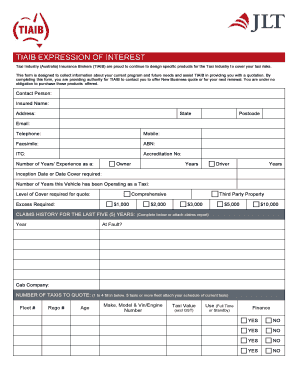

Tiaib Insurance Form

What is the Tiaib Insurance

The Tiaib Insurance is a specialized insurance product designed to provide coverage for specific risks associated with various industries and professions. It offers financial protection against liabilities that may arise during the course of business operations. This type of insurance is particularly relevant for professionals who require tailored coverage to address unique risks that standard insurance policies may not cover.

How to obtain the Tiaib Insurance

Obtaining Tiaib Insurance involves several key steps. First, individuals or businesses should assess their specific insurance needs based on their industry and operational risks. Next, they can consult with licensed insurance agents or brokers who specialize in Tiaib Insurance. These professionals can provide guidance on policy options, coverage limits, and premiums. After selecting a suitable policy, applicants will need to complete an application form, provide necessary documentation, and may undergo an underwriting process before the policy is issued.

Key elements of the Tiaib Insurance

Understanding the key elements of Tiaib Insurance is crucial for effective coverage. Important components include:

- Coverage Types: This may include general liability, professional liability, and specific endorsements tailored to industry needs.

- Policy Limits: The maximum amount the insurer will pay for a covered claim, which should align with potential risk exposure.

- Exclusions: Specific situations or conditions that are not covered by the policy, which should be clearly outlined in the policy documentation.

- Premiums: The cost of the insurance policy, which can vary based on coverage limits, the applicant's risk profile, and other factors.

Steps to complete the Tiaib Insurance

Completing the Tiaib Insurance process involves a series of organized steps:

- Assess your insurance needs based on your business activities and risks.

- Research and select a reputable insurance provider that offers Tiaib Insurance.

- Consult with an insurance agent to discuss your options and gather necessary information.

- Complete the application form with accurate details about your business and risk factors.

- Submit required documentation, which may include financial statements and proof of business operations.

- Review the policy terms and conditions before finalizing the purchase.

Legal use of the Tiaib Insurance

The legal use of Tiaib Insurance is governed by state regulations and industry standards. It is essential for policyholders to ensure compliance with local laws regarding insurance coverage. This includes understanding the legal obligations related to disclosures, claims processes, and maintaining adequate coverage levels. Failure to comply with legal requirements could result in penalties or denial of claims.

Eligibility Criteria

Eligibility for Tiaib Insurance typically depends on several factors, including:

- The nature of the business or profession seeking coverage.

- The applicant's claims history and overall risk profile.

- Compliance with industry regulations and standards.

- Specific underwriting criteria set by the insurance provider.

Quick guide on how to complete tiaib insurance

Complete Tiaib Insurance effortlessly on any device

Managing documents online has gained popularity among organizations and individuals alike. It offers an ideal eco-conscious alternative to traditional printed and signed documents, allowing you to access the correct template and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly and efficiently. Handle Tiaib Insurance on any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and electronically sign Tiaib Insurance with ease

- Find Tiaib Insurance and click on Get Form to begin.

- Use the tools available to fill out your document.

- Emphasize important sections of your documents or conceal private information with tools specifically designed for that purpose, provided by airSlate SignNow.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Tiaib Insurance and ensure effective communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tiaib insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is EIDL insurance?

Economic Injury Disaster Loans. Small businesses, small agricultural cooperatives, and most private nonprofit organizations located in a declared disaster area and which have suffered substantial economic injury may be eligible for an SBA Economic Injury Disaster Loan (EIDL).

-

What type of insurance is americo?

Americo offers a strong portfolio of Term, Universal, and Whole Life insurance products designed to help protect you and your family through all stages of life.

-

Why isn t Mounjaro covered by my insurance?

Without insurance, the average monthly cost of Mounjaro is between $1,000 to $1,200, depending on the pharmacy. Although your medical team may prescribe Mounjaro off-label for weight loss, your insurance company may only cover Mounjaro for Type 2 diabetes, since that's what it is FDA approved for.

-

What is the deductible for earthquake insurance?

The deductible for earthquake insurance is usually 10%–20 % of your coverage limit. For example, if you insured your home for $200,000, a 10% deductible would be $20,000, which you will have to pay. Remember, a larger deductible means you'll have to pay more for losses.

-

What is the most common reason premium audits are conducted?

Insurance companies conduct premium audits for two basic reasons: To determine if your existing coverage is adequate for your business's needs. To ensure you're paying the correct amount for proper coverage.

-

How to get my insurance company to cover Mounjaro?

Your doctor may need to fill out a “prior authorization” form, which is paperwork submitted to the insurance company to determine your eligibility for Mounjaro. It can take several days or longer to hear back on the decision.

-

What is Eqvet insurance?

Earthquake (EQVET) Insurance merupakan asuransi yang secara khusus menjamin kerugian dari risiko gempa bumi, letusan gunung berapi, dan tsunami.

-

What is earned but not reported premium?

Earned But Not Reported (EBNR) refers to the premium amounts that an insurance company anticipates to receive for insurance policies that have been effectively provided but for which the final contracts are not yet entirely completed, and thus, the exact premium amounts are yet to be fully determined and reported.

-

What type of insurance is Allianz?

Health & Life Insurance Addressing the health and wellbeing protection needs of our clients worldwide, we offer international health, life and disability insurance, as well as a wide range of health and protection services to private individuals, families, organizations and partners.

-

What is Allianz insurance used for?

Whether you're looking to protect your personal property, like your home or automobile, or to cover your personal liability, we're here to help you plan your future (or your next adventure) from birth to retirement.

-

What is EBUB insurance?

Earned but Unbilled Premium The estimate for EBUB may be determined using actuarially or statistically supported aggregate calculations using historical company unearned premium data, or per policy calculations.

-

What is IDII insurance?

Individual Disability Income Insurance (IDII)

Get more for Tiaib Insurance

- Salary slip sample employee form

- Application for deceased claim how to fill form

- Form 1943 wisconsin department of financial institutions wdfi

- Work agreement template form

- Wire transfer agreement template form

- Wholesale retail agreement template 787748702 form

- Work experience agreement template form

- Work from home agreement template form

Find out other Tiaib Insurance

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure