Vat 255 Form

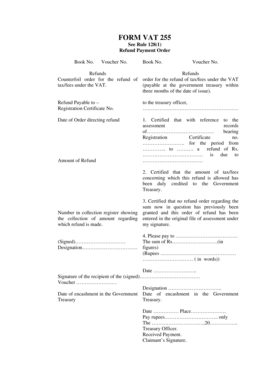

What is the VAT 255 Form

The VAT 255 form is a document used primarily for claiming a refund of Value Added Tax (VAT) in specific circumstances. This form is particularly relevant for businesses and individuals who have incurred VAT on goods and services that are eligible for reimbursement. The form allows taxpayers to formally request a refund from the tax authorities, ensuring compliance with tax regulations while facilitating the recovery of funds.

How to Use the VAT 255 Form

To effectively use the VAT 255 form, taxpayers must first ensure they meet the eligibility criteria for a VAT refund. Once confirmed, the form should be filled out accurately, providing all necessary details regarding the VAT paid and the reasons for the refund request. It is crucial to keep supporting documentation, such as invoices and receipts, as these may be required to substantiate the claim. After completing the form, it can be submitted through the appropriate channels as specified by the tax authority.

Steps to Complete the VAT 255 Form

Completing the VAT 255 form involves several key steps:

- Gather all relevant invoices and receipts that detail the VAT paid.

- Fill out the form with accurate information, including your personal or business details.

- Clearly state the reason for the VAT refund, ensuring it aligns with the eligibility criteria.

- Double-check all entries for accuracy to avoid delays in processing.

- Submit the completed form along with any required documentation to the designated tax authority.

Key Elements of the VAT 255 Form

The VAT 255 form contains several critical sections that must be completed to ensure a valid submission. Key elements include:

- Your name and contact information.

- Details of the VAT incurred, including amounts and dates.

- Reason for the refund request.

- Supporting documentation, such as invoices.

Each section must be filled out with precision to facilitate a smooth review process by the tax authorities.

Filing Deadlines / Important Dates

Filing deadlines for the VAT 255 form can vary based on specific regulations. It is essential to be aware of these dates to avoid penalties or missed opportunities for refunds. Generally, taxpayers should submit their claims within a specified period after the VAT was incurred. Checking with the relevant tax authority for exact deadlines is advisable to ensure compliance.

Who Issues the Form

The VAT 255 form is typically issued by the tax authority responsible for VAT administration in your jurisdiction. In the United States, this may involve state-level tax agencies or the Internal Revenue Service (IRS) if applicable. It is important to obtain the correct version of the form from the official source to ensure it meets all regulatory requirements.

Quick guide on how to complete vat 255 form

Finalize Vat 255 Form effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to generate, edit, and eSign your documents promptly without interruptions. Handle Vat 255 Form on any gadget using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Vat 255 Form with minimal effort

- Obtain Vat 255 Form and then click Get Form to begin.

- Utilize the tools we offer to finish your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, cumbersome form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Vat 255 Form and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat 255 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Can I get a VAT refund in the USA?

It's a sales tax paid by consumers (not businesses), and it doesn't exist in the United States. Only visitors—including U.S. tourists—are able to qualify for a VAT refund. Keep in mind, VAT is often factored into the price of a product (so a €100 dress with a 20 percent VAT rate might have a price tag of €120).

-

Can I claim tax back on purchases in the US?

Most of the US States do not offer Tax Refunds for tourists. There are only two exceptions: one is Texas, and the second is Washington State. In the past, Louisiana used to offer tourist tax refunds, but they discontinued the program in mid-2024.

-

Can you get VAT tax refund after leaving Europe from the USA?

Based on the guidelines set by the European Union, non-EU residents can get a VAT refund on goods purchased in Europe if they show the purchased items and appropriate VAT refund documents to customs upon departure within three months of purchase.

-

Can I claim VAT back in the USA?

The United States Government does not refund sales tax to foreign visitors. The foreign country in which you paid the Value Added Tax (VAT) is responsible for refunding the tax. Some countries won't refund after the fact, so check with the Foreign Embassies & Consulates office of the country you visited. Also.

-

What is 255 VAT?

To find the total figure when you add VAT to £255, you first need to know what the current standard UK VAT rate is. At present the standard UK VAT rate is 20% and has been that way since the 4th of January 2011. Total Amount: Therefore, £255 plus VAT (20%) is £306.

-

Where do I get VAT forms?

Contact HMRC using the helpline number on the VAT: general enquiries page to request a paper form VAT1 Application for registration. If you phone HMRC, an adviser will ask you questions to confirm your reasons for requesting a paper form.

-

Who is eligible for VAT refund in UAE?

Be at least 18 years old. Make purchases from retailers participating in the Tourist Refund Scheme. Meet a minimum purchase amount of AED 250. Ensure the goods are not consumed or used in the UAE.

-

How does VAT tax work in USA?

No, the United States has no VAT. The federal government raises money primarily through the income tax system. The states and local governments establish and collect their own sales taxes.

Get more for Vat 255 Form

- Jbu transcript request form john brown university jbu

- New referral form format new doc

- Subway application for additional information fillable

- Cb13 bond form

- Credit rating form xls

- Thepressreleaseengine comshannan moon personidmoon shannanshannan moon is sheriff coroner public form

- Fillable form 22 15 1220 personal property fill io

- Travel registration form

Find out other Vat 255 Form

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter

- Electronic signature Arizona Finance & Tax Accounting Promissory Note Template Computer

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple