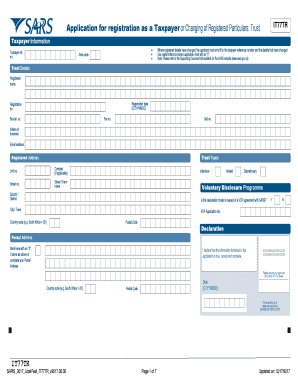

Application for Registration as a Taxpayer or Changing of Registered Particulars Trust Form

Understanding the IT3A SARS Form

The IT3A SARS form is primarily used for reporting income derived from investments, such as interest and dividends, to the South African Revenue Service (SARS). This form is essential for taxpayers who receive income from sources outside of traditional employment. By accurately completing the IT3A form, individuals ensure compliance with tax regulations and facilitate the proper assessment of their tax liabilities.

Steps to Complete the IT3A SARS Form

Completing the IT3A SARS form involves several key steps:

- Gather necessary information: Collect all relevant financial documents, including bank statements and investment records.

- Fill out personal details: Enter your name, address, and taxpayer identification number accurately.

- Report income: Detail the income received from investments, ensuring that all amounts are correctly reported.

- Review and verify: Double-check all entries for accuracy to avoid any discrepancies that could lead to penalties.

- Submit the form: Choose your preferred submission method, whether online, by mail, or in person.

Required Documents for the IT3A SARS Form

To successfully complete the IT3A SARS form, you will need to provide various supporting documents, including:

- Investment statements from financial institutions.

- Bank statements showing interest earned.

- Any previous tax returns that might provide context for your current income.

Having these documents ready will streamline the process and ensure that all reported information is accurate.

Form Submission Methods

The IT3A SARS form can be submitted through multiple channels, providing flexibility for taxpayers:

- Online submission: Use the SARS eFiling platform for a quick and efficient process.

- Mail: Send the completed form to the designated SARS office address.

- In-person: Visit a local SARS office to submit the form directly.

Legal Use of the IT3A SARS Form

The IT3A SARS form serves a legal purpose by ensuring that all income from investments is reported to the tax authorities. Failing to submit this form accurately can lead to legal repercussions, including fines or audits. It is crucial for taxpayers to understand their obligations and the importance of maintaining compliance with tax laws.

Eligibility Criteria for the IT3A SARS Form

Eligibility for using the IT3A SARS form generally includes individuals who:

- Receive income from investments, such as interest or dividends.

- Are registered as taxpayers with SARS.

- Meet the income thresholds set by SARS for reporting purposes.

Understanding these criteria helps ensure that the correct form is used for tax reporting.

Penalties for Non-Compliance

Failure to submit the IT3A SARS form or inaccuracies in reporting can result in significant penalties. These may include:

- Monetary fines based on the amount of unpaid tax.

- Interest on overdue tax payments.

- Potential audits by SARS, leading to further scrutiny of financial records.

It is essential for taxpayers to be aware of these consequences and to take the necessary steps to comply with tax regulations.

Quick guide on how to complete application for registration as a taxpayer or changing of registered particulars trust

Effortlessly Prepare Application For Registration As A Taxpayer Or Changing Of Registered Particulars Trust on Any Device

Managing documents online has gained traction among businesses and individuals alike. It offers a fantastic eco-friendly substitute to conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and electronically sign your documents quickly without any hold-ups. Handle Application For Registration As A Taxpayer Or Changing Of Registered Particulars Trust on any system with airSlate SignNow's Android or iOS applications and enhance any document-focused process today.

How to Edit and Electronically Sign Application For Registration As A Taxpayer Or Changing Of Registered Particulars Trust with Ease

- Find Application For Registration As A Taxpayer Or Changing Of Registered Particulars Trust and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize signNow sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all details and then click on the Done button to save your changes.

- Choose your preferred method for sending your form, whether by email, SMS, an invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you select. Edit and electronically sign Application For Registration As A Taxpayer Or Changing Of Registered Particulars Trust to ensure seamless communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for registration as a taxpayer or changing of registered particulars trust

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

Get more for Application For Registration As A Taxpayer Or Changing Of Registered Particulars Trust

- Chapter 32 an age of limits pdf form

- Utah ccim psa commercial sales agreement form

- Depaul university ferpa waiver form

- Affidavit for passport 32948423 form

- Opwdd application form

- En cargo conferred all agent adrenal para realizer form

- Limousine service contract template form

- Limo service contract template form

Find out other Application For Registration As A Taxpayer Or Changing Of Registered Particulars Trust

- Help Me With Install eSign in eSignPay

- How To Save eSign in Android

- How Do I Save eSign in Android

- Help Me With Save eSign in Android

- Can I Save eSign in Android

- How To Add eSign in Android

- How Do I Add eSign in Android

- How To Implement eSign in ERP

- How To Install eSign in Grooper

- How To Implement eSign in CMS

- Can I Implement eSign in ERP

- How To Implement eSign in SalesForce

- How Do I Implement eSign in SalesForce

- Help Me With Implement eSign in SalesForce

- How Can I Implement eSign in SalesForce

- Can I Implement eSign in SalesForce

- How To Implement eSign in DropBox

- How Do I Implement eSign in DropBox

- How To Implement eSign in CRM

- Help Me With Implement eSign in DropBox