It 2105 Form

What is the IT 2105

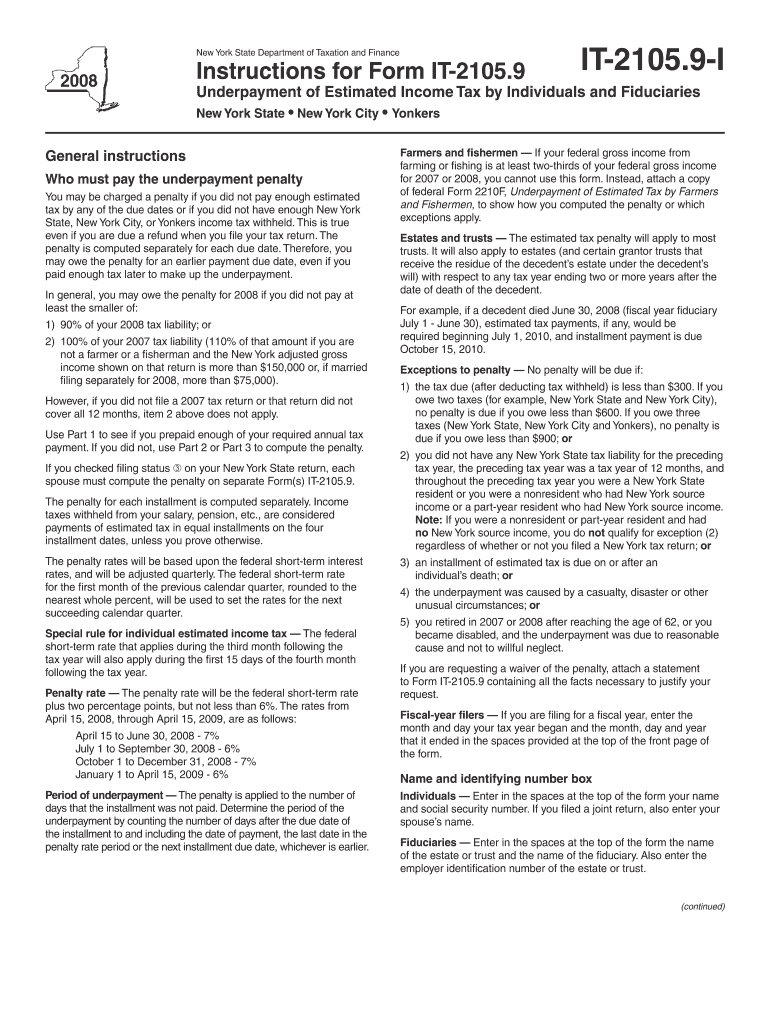

The IT 2105 is a tax form used in the United States, primarily for reporting certain types of income or tax credits. This form is typically utilized by individuals and businesses to ensure compliance with federal tax regulations. It is essential for accurately documenting specific financial activities and may be required for various tax-related purposes. Understanding the purpose of the IT 2105 is crucial for maintaining proper tax records and fulfilling obligations to the Internal Revenue Service (IRS).

How to use the IT 2105

Using the IT 2105 involves several steps to ensure accurate completion and submission. First, gather all necessary financial documents, including income statements and relevant tax records. Next, fill out the form by entering the required information in the designated fields. It is important to double-check all entries for accuracy. Once completed, the form can be submitted to the IRS either electronically or via mail, depending on individual preferences and circumstances. Familiarizing oneself with the form's layout and instructions can significantly ease the process.

Steps to complete the IT 2105

Completing the IT 2105 requires careful attention to detail. Follow these steps for successful submission:

- Gather all required documentation, such as income statements and previous tax returns.

- Review the form instructions to understand the specific requirements for each section.

- Fill in personal information, including your name, address, and Social Security number.

- Enter financial data accurately, ensuring that all calculations are correct.

- Review the completed form for any errors or omissions.

- Submit the form electronically or print it for mailing, ensuring it is sent to the correct IRS address.

Legal use of the IT 2105

The IT 2105 must be used in accordance with IRS regulations to ensure compliance with U.S. tax laws. It is legally binding and serves as an official record of the information provided. Failing to use the form correctly can result in penalties or delays in processing. It is important to be aware of the legal implications of submitting inaccurate information, as this could lead to audits or other tax-related issues. Consulting with a tax professional can provide guidance on the legal aspects of using the IT 2105.

Filing Deadlines / Important Dates

Filing deadlines for the IT 2105 are crucial for compliance with tax regulations. Typically, forms must be submitted by April 15 for individual taxpayers, though extensions may be available under certain circumstances. It is important to stay informed about any changes to deadlines, as these can vary from year to year. Marking important dates on a calendar can help ensure timely submission and avoid penalties associated with late filings.

Required Documents

To complete the IT 2105, several documents may be required. These typically include:

- Income statements, such as W-2s or 1099s.

- Previous tax returns for reference.

- Any supporting documents related to deductions or credits claimed.

Having these documents ready can streamline the process of filling out the IT 2105 and help ensure accuracy.

Quick guide on how to complete it 2105 6232745

Effortlessly prepare [SKS] on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to easily find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly and without delay. Handle [SKS] on any gadget using the airSlate SignNow Android or iOS applications and simplify your document-related tasks today.

The easiest way to modify and electronically sign [SKS] effortlessly

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you want to share your form: via email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets your document management needs in just a few clicks from your preferred device. Modify and electronically sign [SKS] for seamless communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to IT 2105

Create this form in 5 minutes!

How to create an eSignature for the it 2105 6232745

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a reasonable cause for penalty abatement in NY?

As stated above typically the best way to seek penalty relief is to prove Reasonable Cause. Reasonable Cause may be established if the taxpayer can demonstrate that he or she exercised ordinary business care and prudence in meeting the tax obligations, but nevertheless failed to file or pay on time.

-

How to waive underpayment penalty?

To request a waiver when you file, complete IRS Form 2210 and submit it with your tax return. With the form, attach an explanation for why you didn't pay estimated taxes in the specific time period that you're requesting a waiver for. Also attach documentation that supports your statement.

-

What is an IT 2105?

IT-2105 is a form used for estimating tax liability and determining the appropriate amount of income tax withholding for New York State and City personal income tax purposes.

-

How do I avoid penalties on estimated taxes?

Penalty for underpayment of estimated tax Generally, most taxpayers will avoid this penalty if they owe less than $1,000 in tax after subtracting their withholdings and credits, or if they paid at least 90% of the tax for the current year, or 100% of the tax shown on the return for the prior year, whichever is smaller.

-

What is the mailing address for NY state tax returns?

Where to mail your income tax return New York Form IT-201 Resident Income Tax Return Receiving a Refund Making a Payment State Processing Center PO Box 61000 Albany NY 12261-0001 State Processing Center PO Box 15555 Albany NY 12212-5555 https://.tax.ny.gov/pit/file/return_assembly_mail.htm

-

How to avoid NYS estimated tax penalty?

To avoid a penalty for the underpayment of taxes to NYS, your payments must be made on time and the total amount of your New York State payment must be at least 90% of the amount of tax shown on your current income tax return or 100% of your last year's tax return.

-

What is Safe Harbor estimated tax payment?

Estimated tax payment safe harbor details The IRS will not charge you an underpayment penalty if: You pay at least 90% of the tax you owe for the current year, or 100% of the tax you owed for the previous tax year, or. You owe less than $1,000 in tax after subtracting withholdings and credits.

-

Do I have to pay NYS estimated taxes?

New York State requires taxpayers to make estimated payments if $300 or more in New York State, New York City, and/or Yonkers tax is expected to be owed after deducting credits and the total tax withheld.

Get more for IT 2105

- Business license tax fee schedulevariable flat rate form

- Lc amendment letter format in word

- County of shasta application for permit department of form

- Contractors registration application in south downey ca form

- Business financial statement form

- Prospective client questionnaire mary walker tax services form

- Hotel safety deposit box form fill out and sign printable

- Noncore gas transportation service contract form

Find out other IT 2105

- eSign Connecticut Hold Harmless (Indemnity) Agreement Mobile

- eSign Hawaii Hold Harmless (Indemnity) Agreement Mobile

- Help Me With eSign Hawaii Hold Harmless (Indemnity) Agreement

- How To eSign Louisiana Hold Harmless (Indemnity) Agreement

- eSign Nevada Hold Harmless (Indemnity) Agreement Easy

- eSign Utah Hold Harmless (Indemnity) Agreement Myself

- eSign Wyoming Toll Manufacturing Agreement Later

- eSign Texas Photo Licensing Agreement Online

- How To eSign Connecticut Quitclaim Deed

- How To eSign Florida Quitclaim Deed

- Can I eSign Kentucky Quitclaim Deed

- eSign Maine Quitclaim Deed Free

- How Do I eSign New York Quitclaim Deed

- eSign New Hampshire Warranty Deed Fast

- eSign Hawaii Postnuptial Agreement Template Later

- eSign Kentucky Postnuptial Agreement Template Online

- eSign Maryland Postnuptial Agreement Template Mobile

- How Can I eSign Pennsylvania Postnuptial Agreement Template

- eSign Hawaii Prenuptial Agreement Template Secure

- eSign Michigan Prenuptial Agreement Template Simple