D 407 Estates and Trusts DOR Web Site Dor State Nc Form

Understanding the D 407 Estates And Trusts DOR Web Site Dor State NC

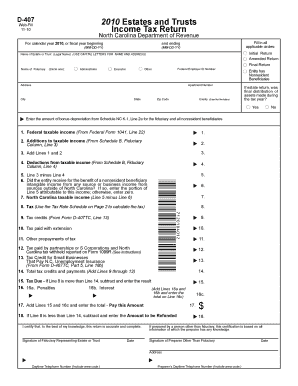

The D 407 Estates And Trusts DOR Web Site is a crucial resource for individuals and entities involved in estate planning and trust management in North Carolina. This form is specifically designed to assist users in reporting and managing estates and trusts for tax purposes. It provides a structured approach to ensure compliance with state regulations, making it an essential tool for both personal and professional use.

This form is utilized by executors, trustees, and beneficiaries to report income, deductions, and distributions related to estates and trusts. Understanding its purpose and functionality is vital for effective estate management and to avoid potential legal complications.

How to Utilize the D 407 Estates And Trusts DOR Web Site Dor State NC

Using the D 407 form involves several straightforward steps. Begin by accessing the DOR Web Site, where the form is available for download or online completion. Ensure that you have all necessary documentation, including financial records related to the estate or trust.

Once you have gathered the required information, fill out the form accurately, paying close attention to detail. After completing the form, you can submit it electronically or via mail, depending on your preference and the specific guidelines provided on the website. Familiarizing yourself with the submission process helps streamline the experience and ensures timely compliance.

Steps to Complete the D 407 Estates And Trusts DOR Web Site Dor State NC

Completing the D 407 form involves a systematic approach:

- Gather Documentation: Collect all relevant financial documents, including income statements, deductions, and distribution records.

- Access the Form: Visit the DOR Web Site to download or fill out the D 407 form online.

- Fill Out the Form: Carefully enter all required information, ensuring accuracy to avoid delays or penalties.

- Review: Double-check all entries for completeness and correctness before submission.

- Submit: Choose your preferred submission method—online or via mail—and follow the instructions provided.

Key Elements of the D 407 Estates And Trusts DOR Web Site Dor State NC

The D 407 form includes several key components that users must understand:

- Identification Information: This section requires details about the estate or trust, including names and identification numbers.

- Income Reporting: Users must report all income generated by the estate or trust during the reporting period.

- Deductions: The form allows for the reporting of eligible deductions, which can reduce taxable income.

- Distributions: Any distributions made to beneficiaries must be accurately reported to ensure compliance with tax laws.

Legal Use of the D 407 Estates And Trusts DOR Web Site Dor State NC

The D 407 form is legally mandated for reporting purposes under North Carolina tax law. Executors and trustees are responsible for ensuring that the form is completed and submitted accurately and on time. Failure to comply with these legal requirements can result in penalties, including fines and interest on unpaid taxes.

Understanding the legal implications of using the D 407 form is essential for maintaining compliance and protecting the interests of all parties involved in the estate or trust. It is advisable to consult with a legal professional if there are any uncertainties regarding the form's requirements or the reporting process.

State-Specific Rules for the D 407 Estates And Trusts DOR Web Site Dor State NC

North Carolina has specific regulations governing the use of the D 407 form. These rules dictate how estates and trusts must report income, deductions, and distributions. Familiarity with state-specific guidelines is crucial for compliance and proper tax reporting.

Additionally, the state may have unique deadlines and requirements for submission that differ from federal guidelines. Staying informed about these state-specific rules helps ensure that users can navigate the complexities of estate and trust management effectively.

Quick guide on how to complete d 407 estates and trusts dor web site dor state nc

Complete [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the resources required to create, modify, and electronically sign your documents swiftly without any delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and eSign [SKS] with ease

- Find [SKS] and then click Get Form to initiate the process.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to D 407 Estates And Trusts DOR Web Site Dor State Nc

Create this form in 5 minutes!

How to create an eSignature for the d 407 estates and trusts dor web site dor state nc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Who must file a NC trust return?

The fiduciary responsible for administering the estate or trust is responsible for filing the return and paying the tax.

-

Do you have to pay taxes on money you inherit in NC?

State Taxes in North Carolina As mentioned above, North Carolina does not have a state inheritance tax. This means that if, for example, you are a beneficiary in Raleigh, you do not have to worry about paying state taxes on the inheritance you receive.

-

Do beneficiaries pay taxes on estate distributions in NC?

As mentioned above, North Carolina does not have a state inheritance tax. This means that if, for example, you are a beneficiary in Raleigh, you do not have to worry about paying state taxes on the inheritance you receive.

-

What is form D 400 North Carolina?

Form D-400, also known as the North Carolina Individual Income Tax Return, is an official document used by residents of North Carolina to report their annual taxable income and calculate their state income tax liability for the preceding year.

-

Where do I mail my 1041 estates and trusts?

Mailing addresses for Form 1041 And you are not enclosing a check or money order...And you are enclosing a check or money order... Internal Revenue Service P.O. Box 409101 Ogden, UT 84409 Internal Revenue Service P.O. Box 409101 Ogden, UT 844092 more rows • Aug 26, 2024

-

Who pays rollback taxes in NC?

The seller is obligated to pay any deferred, discounted or rollback taxes ing to the Offer to Purchase and Contract. The information in this article has been taken from the Buyer and Seller Advisories, which are available to NC REALTORS® online at ncrealtors.org.

-

What is a form D407 in NC?

(A) Who must file Form D-407 - A fiduciary must file North Carolina Form D-407 for the estate or trust if the fiduciary is required to file a federal income tax return for estates and trusts and (1) the estate or trust derives income from North Carolina sources or (2) the estate or trust derives any income which is for ...

-

How do I set up a trust fund in NC?

How to Create a Trust in North Carolina Step 1: Determine Trust Assets. ... Step 2: Name a Trustee and Beneficiaries. ... Step 3: Draft and Sign the Trust Documents. ... Step 4: Transfer Ownership (Title) to the Trust.

Get more for D 407 Estates And Trusts DOR Web Site Dor State Nc

- Form of government and city officials vbgov com city of

- Childs registration form

- Form 24ed001e msw 1 this is an application for master of social work stipend okdhs

- Student disability services ncc commnet form

- Yale cognition and development lab yale university cogdevlab sites yale form

- Emergency form ndm

- Dear developmental faculty nctc commnet form

- Application for developmental disabillities rockdale cares inc rockdalecares form

Find out other D 407 Estates And Trusts DOR Web Site Dor State Nc

- eSign Maine Car Dealer Executive Summary Template Free

- eSign Car Dealer Document Maryland Fast

- eSign Maine Car Dealer Executive Summary Template Secure

- Help Me With eSign Indiana Business Operations Lease Agreement Template

- eSign Maine Car Dealer Executive Summary Template Fast

- eSign Car Dealer Document Maryland Simple

- eSign Maine Car Dealer Executive Summary Template Simple

- eSign Maine Car Dealer Executive Summary Template Easy

- eSign Maine Car Dealer Executive Summary Template Safe

- eSign Car Dealer Document Maryland Easy

- How Can I eSign Indiana Business Operations Lease Agreement Template

- eSign Car Dealer Document Maryland Safe

- Can I eSign Indiana Business Operations Lease Agreement Template

- eSign Indiana Business Operations Lease Termination Letter Online

- eSign Indiana Business Operations Lease Termination Letter Computer

- eSign Indiana Business Operations Lease Termination Letter Mobile

- eSign Indiana Business Operations Lease Termination Letter Now

- eSign Indiana Business Operations Lease Termination Letter Later

- eSign Indiana Business Operations Lease Termination Letter Myself

- eSign Indiana Business Operations Lease Termination Letter Free