Total Tax from Recapture of Income Tax Credits from Form 44, Part II, Line 7 Tax Idaho

Understanding the Total Tax From Recapture Of Income Tax Credits From Form 44, Part II, Line 7 Tax Idaho

The Total Tax From Recapture Of Income Tax Credits from Form 44, Part II, Line 7 in Idaho refers to the amount of tax that a taxpayer must pay when they have previously claimed certain income tax credits but no longer qualify for them. This recapture occurs when the taxpayer's circumstances change, affecting their eligibility for these credits. The tax recapture ensures that taxpayers return the benefits received from credits that are no longer applicable.

Steps to Complete the Total Tax From Recapture Of Income Tax Credits From Form 44, Part II, Line 7 Tax Idaho

To complete the Total Tax From Recapture Of Income Tax Credits, follow these steps:

- Review your previous tax filings to identify any income tax credits claimed.

- Determine if there have been any changes in your eligibility for those credits.

- Calculate the amount of tax credit that needs to be recaptured based on the changes in your situation.

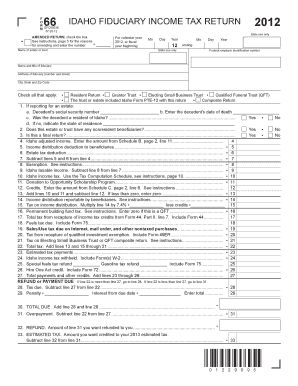

- Fill out Form 44, ensuring you provide accurate information on Part II, Line 7.

- Submit the completed form with your tax return by the designated deadline.

Legal Use of the Total Tax From Recapture Of Income Tax Credits From Form 44, Part II, Line 7 Tax Idaho

The legal use of the Total Tax From Recapture Of Income Tax Credits is crucial for compliance with Idaho tax laws. Taxpayers must accurately report any recaptured credits to avoid potential penalties. Understanding the legal implications helps ensure that taxpayers fulfill their obligations while minimizing the risk of audits or disputes with tax authorities.

State-Specific Rules for the Total Tax From Recapture Of Income Tax Credits From Form 44, Part II, Line 7 Tax Idaho

Idaho has specific rules governing the recapture of income tax credits. These rules dictate when and how recapture applies, including the types of credits subject to recapture and the conditions under which recapture is triggered. Familiarizing yourself with these state-specific regulations is essential for accurate tax reporting and compliance.

Examples of Using the Total Tax From Recapture Of Income Tax Credits From Form 44, Part II, Line 7 Tax Idaho

Examples can clarify how the Total Tax From Recapture Of Income Tax Credits works in practice. For instance, if a taxpayer claimed a credit for energy-efficient home improvements but later sold the home within the recapture period, they would need to report the recaptured amount on Form 44, Part II, Line 7. This ensures that the benefits received from the credit are returned appropriately.

Required Documents for the Total Tax From Recapture Of Income Tax Credits From Form 44, Part II, Line 7 Tax Idaho

When preparing to report the Total Tax From Recapture Of Income Tax Credits, gather the following documents:

- Your previous tax returns that include claimed credits.

- Documentation of any changes in eligibility, such as sale agreements or changes in income.

- Form 44, which must be filled out accurately to reflect the recapture amount.

Quick guide on how to complete total tax from recapture of income tax credits from form 44 part ii line 7 tax idaho

Effortlessly Complete [SKS] on Any Device

Managing documents online has increasingly gained traction among organizations and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents quickly and without holdups. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

How to Modify and Electronically Sign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Select relevant portions of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Decide how you want to send your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow takes care of all your document management needs with just a few clicks from your chosen device. Edit and electronically sign [SKS] to ensure seamless communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the total tax from recapture of income tax credits from form 44 part ii line 7 tax idaho

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does recapture of tax credits mean?

If you're in the situation where you have to file IRS Form 4255, you might have to pay back a tax credit you've earned in prior years. This process, known as recapture, occurs if you claim a credit—in this case, a credit for a specific type of business investment—and then no longer qualify for that credit.

-

What does recapture mean in a mortgage?

A federal subsidy recapture is the repayment of a mortgage subsidy if the home is disposed of within nine years of receiving a federally subsidized loan. Federal mortgage subsidies occur when a homebuyer receives a lower interest rate or a mortgage credit certificate.

-

What does recapture mean in taxes?

What is recapture? Recapture tax is paying back the federal government for the benefit of a lower interest mortgage loan. When tax-exempt mortgage bonds are used for financing, the borrower receives a benefit.

-

What does it mean to carry back a tax credit?

Carrybacks from an unused credit year are applied against tax liability before carrybacks from a later unused credit year. To the extent an unused credit cannot be carried back to a particular preceding taxable year, the unused credit must be carried to the next succeeding taxable year to which it may be carried.

-

How to amend an Idaho tax return?

If you need to change or amend an accepted Idaho State Income Tax Return for the current or previous Tax Year, you need to complete Form 40 (residents) or Form 43 (nonresidents and part-year residents).

-

Is a tax credit money you get back?

Tax credits are amounts you subtract from your bottom-line tax due when you file your tax return. Most tax credits can reduce your tax only until it signNowes $0. Refundable credits go beyond that to give you any remaining credit as a refund.

-

What is the Idaho investment tax credit?

3% Investment Tax Credit An investment tax credit on all new depreciable, tangible, personal property (machinery and equipment) used in Idaho.

-

What does NRF mean on an Idaho tax return?

• Nonresident, or. • Nonresident alien for federal purposes and are. required to file an Idaho income tax return.

Get more for Total Tax From Recapture Of Income Tax Credits From Form 44, Part II, Line 7 Tax Idaho

- Fellow application ahrmm ahrmm form

- Maine real estate commission maine form

- F627 037 000 plumber continuing education course application lni wa form

- Cover amp thank you letters bu form

- Detailed a2z floorplan features list form

- Case oriented symposium on bleeding and nichols institute form

- Services oriented architectures what why and what to watch for form

- Six degrees of connection sachome form

Find out other Total Tax From Recapture Of Income Tax Credits From Form 44, Part II, Line 7 Tax Idaho

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe

- Electronic signature Legal Document Colorado Online

- Electronic signature Washington High Tech Contract Computer