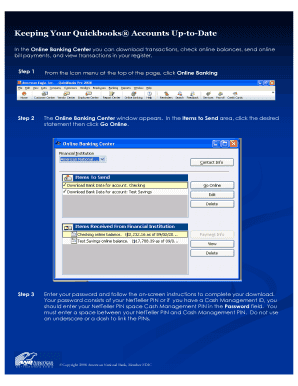

Keeping Your Quickbooks Accounts Up to Date Form

Understanding Keeping Your Quickbooks Accounts Up to Date

Keeping your QuickBooks accounts up to date is essential for accurate financial management. This process involves regularly entering transactions, reconciling bank statements, and ensuring that all financial records reflect current business activities. By maintaining accurate records, businesses can make informed decisions, prepare for tax season, and avoid potential issues with financial audits.

Steps to Maintain Your Quickbooks Accounts

To effectively keep your QuickBooks accounts up to date, follow these key steps:

- Regularly enter transactions: Input all sales, expenses, and other financial activities promptly to ensure your records are current.

- Reconcile bank accounts: Monthly reconciliation of bank statements helps identify discrepancies and ensures that your records match your bank's records.

- Review financial reports: Regularly generate and review reports, such as profit and loss statements, to assess your business's financial health.

- Backup your data: Regularly back up your QuickBooks data to prevent loss due to software issues or hardware failures.

Required Documents for Quickbooks Updates

To keep your QuickBooks accounts accurate, gather the following documents:

- Receipts: Keep all receipts for purchases and expenses to support your entries.

- Invoices: Maintain copies of invoices sent to clients for sales tracking.

- Bank statements: Use these to reconcile your accounts and verify transactions.

- Payroll records: Ensure payroll entries are accurate and reflect employee payments.

IRS Guidelines for Quickbooks Accounting

Understanding IRS guidelines is crucial for maintaining compliance while using QuickBooks. Accurate record-keeping helps ensure that your business meets tax obligations. The IRS requires businesses to keep records that substantiate income, expenses, and other financial transactions. This includes maintaining documentation for deductions claimed on tax returns.

Penalties for Non-Compliance with Quickbooks Records

Failure to keep your QuickBooks accounts up to date can lead to several penalties, including:

- Tax penalties: Inaccurate reporting can result in fines or additional taxes owed.

- Audit risks: Poor record-keeping increases the likelihood of an audit by the IRS.

- Cash flow issues: Inaccurate records can lead to poor financial decisions, impacting business operations.

Software Compatibility with Quickbooks

Ensuring that your QuickBooks software is compatible with other tools can enhance your accounting efficiency. QuickBooks integrates well with various applications, including payment processors and payroll services. This compatibility allows for streamlined data entry and reduces the risk of errors, making it easier to keep your accounts up to date.

Quick guide on how to complete keeping your quickbooks accounts up to date

Manage [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without any delays. Handle [SKS] on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The simplest way to edit and eSign [SKS] with ease

- Find [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or conceal sensitive details with the tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Keeping Your Quickbooks Accounts Up to Date

Create this form in 5 minutes!

How to create an eSignature for the keeping your quickbooks accounts up to date

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are two ways to update the chart of accounts in QuickBooks Online?

Edit an account Navigate to Transactions and select Chart of accounts (Take me there). Locate the account you'd like to edit. Select the dropdown arrow next to Account history or Run report (depending on the account). Select Edit.

-

How do I make sure QuickBooks is updated?

Quickbooks Software Update Go to the Help menu at the top, and then choose Update QuickBooks Desktop. Select the Options tab, and then click Mark All. Choose Save. Proceed to the Update Now tab. Check the Rest Update box, and then click Get Updates.

-

How do I know if QuickBooks is updated?

QuickBooks Desktop for Windows: Open QuickBooks Desktop. Press F2 (or Ctrl+1) to open the Product Information window. Check your current version and release.

-

Does QuickBooks update automatically?

0:10 0:59 And if you're ready to update you can select update. Now however if you want to review your optionsMoreAnd if you're ready to update you can select update. Now however if you want to review your options or turn on automatic updates. Select options then select yes for automatic updates.

-

How do I refresh QuickBooks?

Go to Menu ☰, then tap More Options ⋮. Tap Settings, then Refresh Data.

-

How do I update accounts in QuickBooks?

Edit an account Go to the Lists menu, then select Chart of Accounts. Right-click on the account that you want to edit. Select Edit Account. Update the account details. Select Save & Close.

-

How do I make sure my QuickBooks is up to date?

Quickbooks Software Update Go to the Help menu at the top, and then choose Update QuickBooks Desktop. Select the Options tab, and then click Mark All. Choose Save. Proceed to the Update Now tab. Check the Rest Update box, and then click Get Updates.

-

How do I keep QuickBooks up to date?

Go to Help and select Update QuickBooks Desktop. Select Update Now, then Get Updates.

Get more for Keeping Your Quickbooks Accounts Up to Date

- Resume guidelines foothill college foothill form

- How did brisbane get its busways australasian transport form

- Name andor address change form

- Employee39s withholding exemption certificate auburnschools form

- Temp hire application legal network form

- Form 7004 rev november application for automatic extension of time to file certain business income tax information and other

- Youth program application swmnpic form

- Iowa state university hrs iastate form

Find out other Keeping Your Quickbooks Accounts Up to Date

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT