Okla Form 511 2013-2026

What is the Oklahoma Form 511?

The Oklahoma Form 511 is the state income tax return form used by residents of Oklahoma to report their income and calculate their tax liability. This form is essential for individuals to fulfill their tax obligations to the Oklahoma Tax Commission. It captures various income sources, deductions, and credits that can affect the overall tax amount owed or refunded. Understanding this form is crucial for accurate tax reporting and compliance with state regulations.

How to Obtain the Oklahoma Form 511

The Oklahoma Form 511 can be obtained through several convenient methods:

- Visit the official Oklahoma Tax Commission website, where the form is available for download in PDF format.

- Request a physical copy by contacting the Oklahoma Tax Commission directly via phone or mail.

- Access the form through various tax preparation software that includes state tax filing options.

Ensuring you have the correct and most current version of the form is important for accurate filing.

Steps to Complete the Oklahoma Form 511

Completing the Oklahoma Form 511 involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income from all sources on the appropriate lines of the form.

- Claim any eligible deductions and credits to reduce your taxable income.

- Calculate your tax liability based on the provided tax tables.

- Sign and date the form before submission.

Following these steps carefully ensures that your tax return is accurate and complete.

Filing Deadlines / Important Dates

It is essential to be aware of the filing deadlines for the Oklahoma Form 511 to avoid penalties:

- The standard deadline for filing your state income tax return is April fifteenth each year.

- If you are unable to meet this deadline, you may file for an extension, but any taxes owed must still be paid by the original deadline.

- Keep an eye on any announcements from the Oklahoma Tax Commission regarding changes to deadlines or special provisions.

Required Documents for Filing

To complete the Oklahoma Form 511, you will need several documents:

- W-2 forms from employers showing income earned.

- 1099 forms for any freelance or contract work.

- Documentation for any deductions or credits you intend to claim, such as receipts for charitable contributions.

- Records of any estimated tax payments made during the year.

Having these documents ready will streamline the filing process and help ensure accuracy.

Penalties for Non-Compliance

Failure to file the Oklahoma Form 511 or filing it inaccurately can result in various penalties:

- Late filing penalties may apply if the return is submitted after the April fifteenth deadline.

- Interest will accrue on any unpaid taxes from the due date until paid in full.

- Inaccuracies in reporting income or deductions can lead to additional penalties and potential audits.

Understanding these penalties underscores the importance of timely and accurate tax filing.

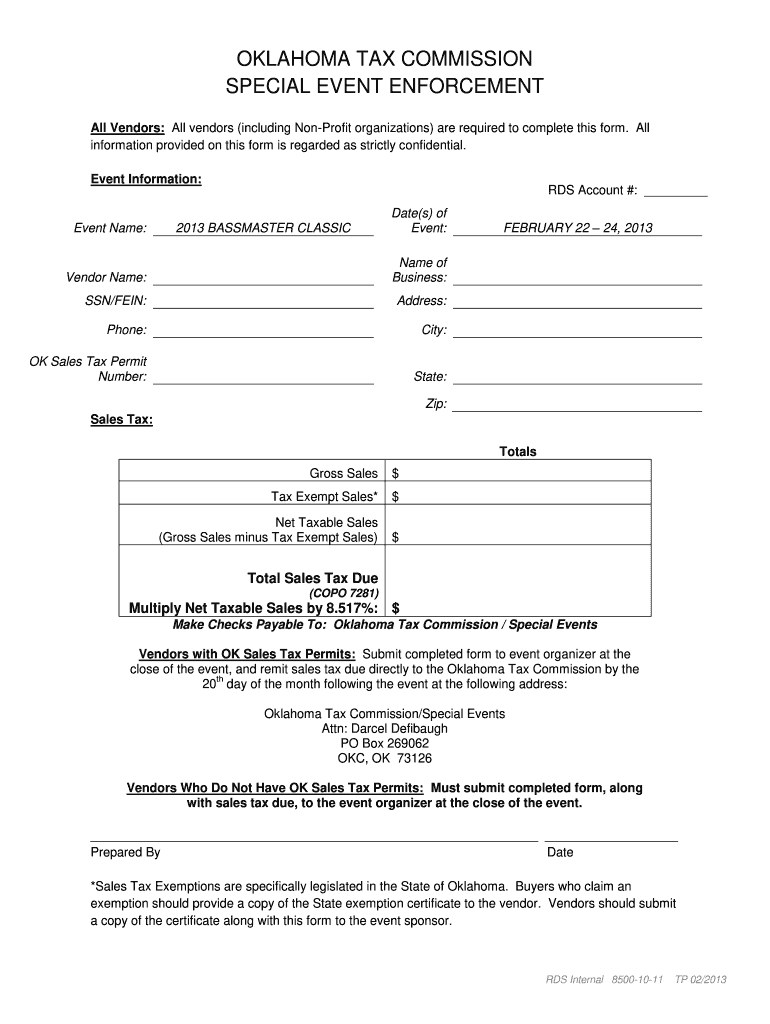

Quick guide on how to complete okla tax commission what is an event permit form

Your assistance manual on preparing your Okla Form 511

If you're eager to discover how to finalize and dispatch your Okla Form 511, here are straightforward guidelines to simplify tax filing.

To begin, simply create your airSlate SignNow account to transform your approach to managing documents online. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to modify, generate, and finalize your income tax forms effortlessly. Utilizing its editor, you can toggle between text, checkboxes, and eSignatures and revert to amend details as necessary. Enhance your tax administration with sophisticated PDF editing, eSigning, and convenient sharing options.

Adhere to the steps below to achieve your Okla Form 511 in just minutes:

- Create your account and start processing PDFs in moments.

- Utilize our directory to obtain any IRS tax form; sift through versions and schedules.

- Click Get form to access your Okla Form 511 in our editor.

- Complete the necessary fillable fields with your details (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-binding eSignature (if necessary).

- Review your document and rectify any errors.

- Save modifications, print your copy, send it to your recipient, and download it to your device.

Utilize this guide to submit your taxes digitally with airSlate SignNow. Please remember that filing on paper can increase errors and delay refunds. Before e-filing your taxes, ensure you check the IRS website for submission regulations specific to your state.

Create this form in 5 minutes or less

FAQs

-

What is a W-10 tax form? Who has to fill one out?

Here is all the information regarding the W-10 tax form from the IRS. But, it is a request to get your Child’s Dependent Care Tax Information. If you are taking care of someone’s child for them you will need to fill it out. Again you are supposed to pay taxes on all Earned Income. But, a lot of people don’t and work under the table. I don’t know many drug dealers getting ready to report their earnings this year. I actually used that scenario in college. You can’t right off bribes as an expense.. Sorry off topic..About Form W10 | Internal Revenue Service

-

What is the right way to fill out Two-Earners Worksheet tax form?

Wages, in this context, are what you expect to appear in box 1 of your W-2.The IRS recommends that the additional withholding be applied to the higher-paid spouse and that the lesser-paid spouse should simply claim zero withholding allowances, as this is usually more accurate (due to the way that withholding is actually calculated by payroll programs, you may wind up with less withheld than you want if you split it).

-

Which form is to be filled out to avoid an income tax deduction from a bank?

Banks have to deduct TDS when interest income is more than Rs.10,000 in a year. The bank includes deposits held in all its branches to calculate this limit. But if your total income is below the taxable limit, you can submit Forms 15G and 15H to the bank requesting them not to deduct any TDS on your interest.Please remember that Form 15H is for senior citizens, those who are 60 years or older; while Form 15G is for everybody else.Form 15G and Form 15H are valid for one financial year. So you have to submit these forms every year if you are eligible. Submitting them as soon as the financial year starts will ensure the bank does not deduct any TDS on your interest income.Conditions you must fulfill to submit Form 15G:Youare an individual or HUFYou must be a Resident IndianYou should be less than 60 years oldTax calculated on your Total Income is nilThe total interest income for the year is less than the minimum exemption limit of that year, which is Rs 2,50,000 for financial year 2016-17Thanks for being here

-

As an employer, what legal and tax forms am I required to have a new employee to fill out?

I-9, W-4, state W-4, and some sort of state new hire form. The New hire form is for dead beat parents. Don’t inform the state in time and guess what? You become personally liable for what should have been garnished from their wages.From the sound of your question I infer that you are trying to make this a DIY project. DO NOT. There are just too many things that you can F up. Seek yea a CPA or at least a payroll service YESTERDAY.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

Create this form in 5 minutes!

How to create an eSignature for the okla tax commission what is an event permit form

How to make an electronic signature for your Okla Tax Commission What Is An Event Permit Form online

How to generate an electronic signature for your Okla Tax Commission What Is An Event Permit Form in Google Chrome

How to create an eSignature for putting it on the Okla Tax Commission What Is An Event Permit Form in Gmail

How to make an electronic signature for the Okla Tax Commission What Is An Event Permit Form from your smartphone

How to make an eSignature for the Okla Tax Commission What Is An Event Permit Form on iOS devices

How to generate an eSignature for the Okla Tax Commission What Is An Event Permit Form on Android OS

People also ask

-

What is the Oklahoma Tax Commission's role in the eSigning process?

The Oklahoma Tax Commission oversees compliance with state tax laws, and integrating eSigning solutions like airSlate SignNow can help businesses in Oklahoma streamline their document management. By using a reputable eSigning platform, you can ensure that your documents meet the necessary legal standards set by the Oklahoma Tax Commission.

-

How does airSlate SignNow support compliance with the Oklahoma Tax Commission?

airSlate SignNow offers electronic signature solutions that are compliant with regulations established by the Oklahoma Tax Commission. By using our platform, businesses can easily eSign and store documents securely, ensuring adherence to state tax laws and reducing the risks of non-compliance.

-

What are the pricing options for using airSlate SignNow in Oklahoma?

airSlate SignNow provides flexible pricing plans designed to meet the needs of businesses in Oklahoma. Our cost-effective solutions allow you to choose the plan that best fits your organization, whether you are a small business or a large enterprise, all while complying with the Oklahoma Tax Commission's requirements.

-

Can airSlate SignNow be integrated with other tools to facilitate Oklahoma tax filings?

Yes, airSlate SignNow easily integrates with various applications that can help streamline your tax filing process for the Oklahoma Tax Commission. By connecting our eSigning solution with your existing financial software, you can ensure a seamless workflow that improves efficiency and accuracy in your tax management.

-

What features does airSlate SignNow offer that benefit Oklahoma businesses?

airSlate SignNow provides features tailored to benefit Oklahoma businesses, including customizable templates, secure storage, and real-time tracking of document statuses. These functionalities not only enhance productivity but also help ensure that your business complies with regulations enforced by the Oklahoma Tax Commission.

-

Is airSlate SignNow secure for sensitive documents related to the Oklahoma Tax Commission?

Absolutely! airSlate SignNow prioritizes the security of your documents, utilizing advanced encryption and compliance measures that align with the Oklahoma Tax Commission's guidelines. You can confidently eSign and manage sensitive tax-related documents without worrying about data bsignNowes or unauthorized access.

-

What benefits does using airSlate SignNow provide for Oklahoma tax compliance?

Using airSlate SignNow can signNowly enhance your Oklahoma tax compliance by simplifying document processes and providing legally binding eSignatures. This helps reduce paperwork errors and ensures that all submissions to the Oklahoma Tax Commission are timely, organized, and compliant.

Get more for Okla Form 511

Find out other Okla Form 511

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation

- How To eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Can I eSign Hawaii Construction Word

- How Do I eSign Hawaii Construction Form

- How Can I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Document

- Can I eSign Hawaii Construction Document

- How Do I eSign Hawaii Construction Form

- How To eSign Hawaii Construction Form