Business Meals Track Form DOC

What is the Business Meals Track Form doc

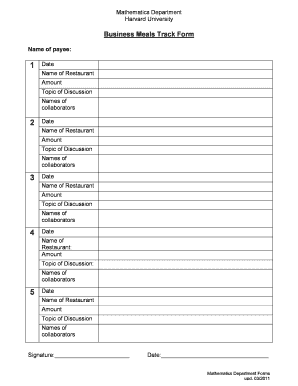

The Business Meals Track Form doc is a specialized document designed to help businesses track and document meal expenses incurred during business-related activities. This form is particularly useful for maintaining accurate records that may be necessary for tax reporting and compliance with IRS regulations. By documenting these expenses, businesses can ensure they maximize their deductions while adhering to legal requirements.

How to use the Business Meals Track Form doc

Using the Business Meals Track Form doc involves several straightforward steps. First, gather all relevant receipts and information related to the meals. This includes the date, location, attendees, and purpose of the meal. Next, fill out the form with these details, ensuring accuracy in the entries. Once completed, the form should be stored securely for future reference, particularly during tax season or in the event of an audit.

Steps to complete the Business Meals Track Form doc

Completing the Business Meals Track Form doc requires careful attention to detail. Follow these steps:

- Collect all meal receipts and relevant information.

- Fill in the date and location of each meal.

- List the names of attendees and their relationship to the business.

- Provide a brief description of the business purpose for each meal.

- Review the form for accuracy before saving or submitting it.

Legal use of the Business Meals Track Form doc

The Business Meals Track Form doc is legally recognized for tracking meal expenses related to business activities. To ensure compliance with IRS guidelines, businesses must accurately document the purpose of each meal and the individuals involved. This documentation is essential for substantiating deductions during tax filings, helping to avoid potential penalties for non-compliance.

IRS Guidelines

The IRS has specific guidelines regarding meal deductions that businesses must follow. Generally, businesses can deduct fifty percent of the cost of meals directly related to the active conduct of a trade or business. It is important to keep detailed records, including the Business Meals Track Form doc, to support these deductions. Familiarity with IRS rules can help businesses navigate the complexities of tax compliance effectively.

Examples of using the Business Meals Track Form doc

There are various scenarios where the Business Meals Track Form doc can be beneficial. For instance, a business owner meeting a client for lunch can use the form to document the meal expense. Similarly, team-building dinners or meals during business travel can also be recorded. Each instance not only helps in tracking expenses but also ensures that the business remains compliant with tax regulations.

Quick guide on how to complete business meals track form doc

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained traction among businesses and individuals. It offers an excellent environmentally friendly alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without interruptions. Manage [SKS] on any device with the airSlate SignNow apps available on Android or iOS and simplify any document-related process today.

The Easiest Way to Modify and Electronically Sign [SKS] with Ease

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Generate your electronic signature with the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, text message, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your chosen device. Modify and electronically sign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Business Meals Track Form doc

Create this form in 5 minutes!

How to create an eSignature for the business meals track form doc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How do you categorize meals with clients?

Classifying meal expenses Here are some common ways meal expenses can be classified: Travel expenses: Meals purchased during business trips, such as conferences or meetings away from your usual workplace. Entertainment expenses: Meals shared with clients or during business meetings aimed at building relationships.

-

How do I claim business meals on my taxes?

Your meal and entertainment expense records should include: Documentary evidence, like: ... Cost of each meal or entertainment expense. ... Date meal or entertainment took place. Name, location, and type of meal or entertainment — like dinner or theater. Reason for meal or entertainment, which includes:

-

Do I need receipts for business meals?

The IRS requires businesses to keep receipts or documentation of the meal expense. The IRS has no specific requirement to keep receipts to document the expense. Businesses should keep a record of all deductible meals.

-

Are business meals an expense?

The answer is most likely yes, however, the amount you can deduct may vary. Figuring out how to calculate your business meals deduction can be confusing. Some business meals are 50% deductible, while others are 0% or 100% deductible. This will depend on the purpose of the meal and who benefits from it.

-

How do you record business meals?

You're going to want to document the amount of the expense of the meal, the time and the place, the business purpose and the names and business relationships of the persons at the meal. The cost, time and place should be automatic, it comes printed on the receipt.

-

How to document business meals?

You're going to want to document the amount of the expense of the meal, the time and the place, the business purpose and the names and business relationships of the persons at the meal. The cost, time and place should be automatic, it comes printed on the receipt.

Get more for Business Meals Track Form doc

- Personal income tax forms current year

- Statement of person claiming refund due a deceased form

- City wage tax refund application city wage tax refund application form

- Wilmington delaware tax return form

- Fact sheet irs ramps up new initiatives using form

- Alaska mining license tax return short form

- Alaska form 662sf mining license tax return short

- Department of revenue corporate income tax electronic form

Find out other Business Meals Track Form doc

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease