New York State Department of Taxation and Finance New York State Depreciation Schedule it 399 Identifying Number as Shown on Ret Form

Overview of the New York State Depreciation Schedule IT-399

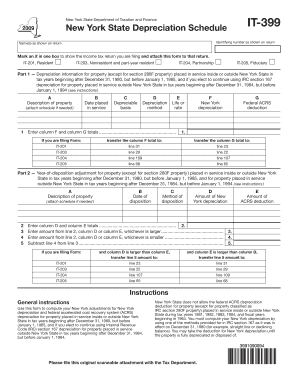

The New York State Depreciation Schedule IT-399 is a crucial form used by taxpayers to report depreciation on their income tax returns. This form is specifically designed for individuals and businesses that need to calculate and claim depreciation on assets in accordance with New York State tax laws. The IT-399 allows taxpayers to provide detailed information about the assets they are depreciating, including the identifying number as shown on the return and names as shown on the return.

How to Complete the IT-399 Form

Completing the IT-399 form involves several steps. Taxpayers should begin by accurately entering their identifying number as it appears on their tax return. Next, they must provide the names of the assets being depreciated. It is essential to mark an X in the appropriate box to indicate the specific income tax return being filed. This ensures that the form is correctly associated with the taxpayer's return. After filling out the form, it should be attached to the income tax return being submitted.

Obtaining the IT-399 Form

Taxpayers can obtain the New York State Depreciation Schedule IT-399 from the New York State Department of Taxation and Finance website. The form is available for download in a PDF format, allowing individuals to print it out for completion. Additionally, the form may be available through tax preparation software that supports New York State tax filings, providing users with an electronic option for filling out and submitting the form.

Key Elements of the IT-399 Form

Several key elements must be included when filling out the IT-399 form. These include:

- Identifying Number: This number must match the one shown on the taxpayer's return.

- Names of Assets: Accurate names of the assets being depreciated should be provided.

- Income Tax Return Selection: Taxpayers must mark an X in the box corresponding to the income tax return they are filing.

Filing Deadlines for the IT-399 Form

It is important for taxpayers to be aware of the filing deadlines associated with the IT-399 form. Generally, the form must be submitted along with the income tax return by the due date of the return. For most individuals, this is typically April 15. However, if the taxpayer is filing for an extension, they should ensure that the IT-399 is submitted by the extended deadline to avoid penalties.

Legal Use of the IT-399 Form

The IT-399 form is legally required for taxpayers who wish to claim depreciation on their assets within New York State. Proper completion and submission of this form ensure compliance with state tax regulations. Failure to file this form when required may result in penalties or the disallowance of the claimed depreciation, impacting the taxpayer's overall tax liability.

Quick guide on how to complete new york state department of taxation and finance new york state depreciation schedule it 399 identifying number as shown on

Accomplish [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the appropriate form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and streamline any document-related task today.

The easiest method to modify and electronically sign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information using the tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Adjust and electronically sign [SKS] to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to New York State Department Of Taxation And Finance New York State Depreciation Schedule IT 399 Identifying Number As Shown On Ret

Create this form in 5 minutes!

How to create an eSignature for the new york state department of taxation and finance new york state depreciation schedule it 399 identifying number as shown on

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form CT 399?

Department of Taxation and Finance Depreciation Adjustment Schedule CT-399 Tax Law Articles 9-A and 33 Legal name of corporation Employer identification number Part 1 Computation of New York State depreciation modifications when computing New York State taxable income List only depreciable property that requires or is ...

-

What is CT 399?

Depreciation Adjustment Schedule. CT-399-I. General information. Corporations taxable under Articles 9-A and 33 are subject to depreciation modifications required under their respective articles when determining New York State taxable income.

-

What is the CT tax extension form?

You may request an extension by filing Form CT-1127, Application for Extension of Time for Payment of Income Tax, on or before the due date of the original return. Attach Form CT-1127 to the front of Form CT-1040 or Form CT-1040 EXT and send it on or before the due date.

-

Who must file Form CT 1040nr PY?

You must file a Connecticut income tax return if your gross income for the 2023 taxable year exceeds: $12,000 and you are married filing separately; $15,000 and you are filing single; $19,000 and you are filing head of household; or.

-

Where do I find depreciation on my tax return?

IRS Form 4562 is used to claim deductions for the depreciation or amortization of tangible or intangible property. Assets such as buildings, machinery, equipment (tangible), or patents (intangible) qualify. Land cannot depreciate, and so it can not be reported on the form.

-

What is form CT 400?

Use Form CT-400 (or CT-400-MN) to make your second installment/declaration of estimated tax due on the 15th day of the sixth month of the current tax year. The third and fourth installments are due on the 15th day of the ninth and twelfth months of the current tax year.

-

What is a tax depreciation schedule?

A tax depreciation schedule shows the deductions you can claim for an investment property and eligible plant and equipment assets. It includes the original value, the estimated effective life, and the depreciation rate for the structural components and the plant and equipment assets.

-

Does NY state recognize bonus depreciation?

Some state residents, including NY and California, are generally taxed on their federal income subject to certain adjustments, including an addback for bonus depreciation. In NY, the top combined NY/NY City tax rate for a NY City resident could be as high as 14.776%.

Get more for New York State Department Of Taxation And Finance New York State Depreciation Schedule IT 399 Identifying Number As Shown On Ret

- Non emergency medical transportation expense log mn form

- Breast cancer questionnaire bdbsb blifemarkbbcomb form

- Minnesota death record application certified death form

- What is quality assuranceqa process methods examples guru99 form

- Authorization form dhs 4695

- Minnesota home care bill of rights for assisted living form

- Initial functional assessment questionnaire spanish gillettechildrens form

- Naloxone administration form

Find out other New York State Department Of Taxation And Finance New York State Depreciation Schedule IT 399 Identifying Number As Shown On Ret

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile

- eSignature Montana Real Estate Quitclaim Deed Fast

- eSignature Montana Real Estate Cease And Desist Letter Easy

- How Do I eSignature Nebraska Real Estate Lease Agreement

- eSignature Nebraska Real Estate Living Will Now

- Can I eSignature Michigan Police Credit Memo

- eSignature Kentucky Sports Lease Agreement Template Easy

- eSignature Minnesota Police Purchase Order Template Free

- eSignature Louisiana Sports Rental Application Free

- Help Me With eSignature Nevada Real Estate Business Associate Agreement

- How To eSignature Montana Police Last Will And Testament

- eSignature Maine Sports Contract Safe

- eSignature New York Police NDA Now