Who Must Make Estimated Tax Payments on Form 1 ES Mass

Understanding Who Must Make Estimated Tax Payments on Form 1 ES Mass

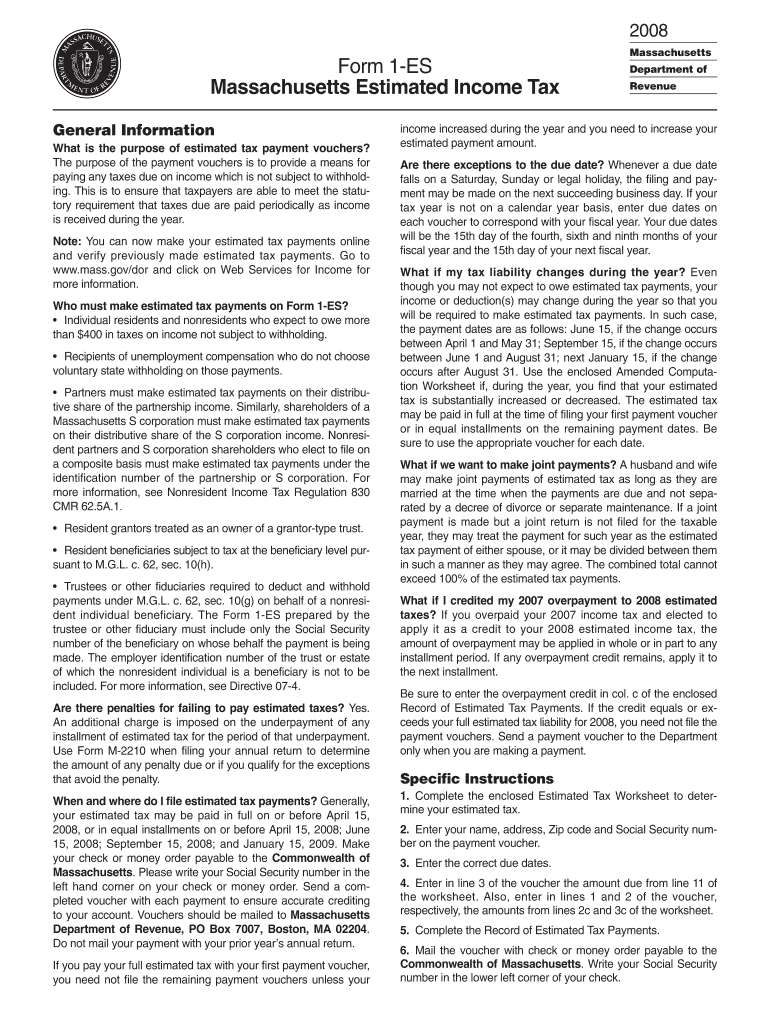

Form 1 ES Mass is used by individuals in Massachusetts to make estimated tax payments. Generally, taxpayers who expect to owe at least $400 in state income tax for the year must file this form. This includes self-employed individuals, retirees with significant income, and those with substantial investment earnings. Understanding who is required to make these payments is crucial to avoid penalties and ensure compliance with state tax laws.

Eligibility Criteria for Estimated Tax Payments

To determine if you must make estimated tax payments using Form 1 ES Mass, consider the following criteria:

- You are an individual taxpayer who expects to owe $400 or more in Massachusetts income tax.

- You had a tax liability in the previous year and filed a return.

- Your income is not subject to withholding, such as self-employment income or rental income.

Meeting these criteria means you are likely required to file Form 1 ES Mass to avoid underpayment penalties.

Steps to Complete Form 1 ES Mass

Completing Form 1 ES Mass involves several steps:

- Gather your financial information, including income sources and deductions.

- Calculate your expected tax liability for the current year.

- Determine the amount you need to pay quarterly based on your calculations.

- Fill out the form accurately, ensuring all required fields are completed.

- Submit the form by the deadlines specified by the Massachusetts Department of Revenue.

Following these steps helps ensure you meet your estimated tax obligations correctly.

Filing Deadlines for Estimated Tax Payments

Estimated tax payments using Form 1 ES Mass are typically due on the following dates:

- April 15 for the first quarter

- June 15 for the second quarter

- September 15 for the third quarter

- January 15 of the following year for the fourth quarter

It is essential to adhere to these deadlines to avoid penalties for late payments.

Penalties for Non-Compliance

Failing to make estimated tax payments can result in penalties. If you do not pay enough tax throughout the year, you may incur a penalty based on the amount owed. The Massachusetts Department of Revenue assesses these penalties to encourage timely payments and compliance with tax laws.

Examples of Taxpayer Scenarios Requiring Estimated Payments

Several scenarios may require individuals to make estimated tax payments:

- A self-employed individual earning significant income without tax withholding.

- A retiree receiving pension or annuity payments that do not have taxes withheld.

- An investor with substantial capital gains or dividend income.

Understanding these scenarios can help taxpayers identify their obligation to file Form 1 ES Mass.

Quick guide on how to complete who must make estimated tax payments on form 1 es mass

Prepare [SKS] effortlessly on any device

Digital document management has gained traction among enterprises and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related workflow today.

How to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive information with features that airSlate SignNow offers specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and press the Done button to preserve your modifications.

- Select your preferred method to send your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to guarantee outstanding communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Who Must Make Estimated Tax Payments On Form 1 ES Mass

Create this form in 5 minutes!

How to create an eSignature for the who must make estimated tax payments on form 1 es mass

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Does Massachusetts require estimated tax payments?

As a taxpayer, you must make quarterly estimated tax payments if the expected tax due on your taxable income not subject to withholding is more than $400. This is to ensure that you are meeting the statutory requirement that taxes due are paid periodically as income is received during the year.

-

Who must file MA form 1?

If you're a full-year resident with an annual Massachusetts gross income of more than $8,000, you must file a Massachusetts tax return. Your home is not in Massachusetts for the entire tax year but you: Maintain a home in Massachusetts; and.

-

Who is required to pay estimated taxes?

Who must pay estimated tax. Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

-

How do I avoid the underpayment penalty in Massachusetts?

No underpayment penalty is due if you owe less than $400, if you are a farmer or fisherman who has at least two-thirds of the payments made, or if you were a full-year resident of the state and did not owe any taxes on your prior year return.

-

Who has to pay estimated taxes in Massachusetts?

Every person who expects to pay more than $400 in Massachusetts income tax on income not covered by Massachusetts withhold- ing must pay Massachusetts estimated taxes. A penalty may be imposed if at least 80% of the tax is not paid throughout the year through withholding and/or estimated payments.

-

Who would be exempt from estimated tax payments?

These percentages may be different if you are a farmer, fisherman, or higher income taxpayer. See Special Rules, later. Exception. You don't have to pay estimated tax for 2023 if you were a U.S. citizen or resident alien for all of 2022 and you had no tax liability for the full 12-month 2022 tax year.

-

Who is required to make estimated tax payments?

Who must pay estimated tax. Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

-

Who generally does not need to pay estimated taxes?

If you work and have income tax withheld from your pay, you'll need to pay estimated tax only if your total withholding (and any tax credits) amounts to less than 90% of the total tax you expect to pay for the year.

Get more for Who Must Make Estimated Tax Payments On Form 1 ES Mass

- Surgical reservation form rush university medical center rush

- My medication list christiana care form

- Obtaining your medical records ucsf department of psychiatry form

- Authorization referral form preferred ipa

- Lic420 form

- Cchealth orgehbody artbody art facility infection prevention and control plan guideline form

- Patient acknowledgement of receipt of dental materials fact sheet form

- Mh 636 annual client treatment plan los angeles county form

Find out other Who Must Make Estimated Tax Payments On Form 1 ES Mass

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy