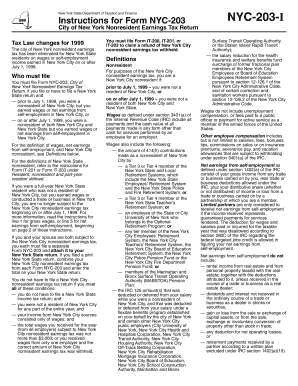

Form NYC 203 I , Instructions for Form NYC 203, NYC203I Tax Ny

Understanding Form NYC 203 I

Form NYC 203 I is a tax form used by individuals and businesses in New York City to report income and calculate the appropriate tax owed. This form is essential for those who have earned income within the city limits. It provides a structured way to disclose various types of income, deductions, and credits that may apply to the taxpayer's situation. Understanding the purpose of this form is crucial for ensuring compliance with local tax regulations.

Steps to Complete Form NYC 203 I

Completing Form NYC 203 I involves several key steps:

- Gather all necessary financial documents, including W-2s, 1099s, and any other income statements.

- Fill in personal information, such as your name, address, and Social Security number.

- Report all sources of income accurately, ensuring that you include any taxable income received during the tax year.

- Calculate deductions and credits that you may qualify for, which can reduce your overall tax liability.

- Double-check all entries for accuracy before submitting the form.

How to Obtain Form NYC 203 I

Form NYC 203 I can be obtained through several methods. It is available for download on the official New York City Department of Finance website. Additionally, taxpayers can request a physical copy by contacting the department directly. Many tax preparation offices also provide this form as part of their services, ensuring that individuals have access to the necessary documentation for filing taxes.

Filing Deadlines for Form NYC 203 I

It is important to be aware of the filing deadlines associated with Form NYC 203 I. Generally, the form must be submitted by the due date for individual income tax returns, which is typically April fifteenth each year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should ensure they file on time to avoid penalties and interest on any unpaid taxes.

Required Documents for Form NYC 203 I

When completing Form NYC 203 I, several documents are necessary to provide accurate information. These include:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Records of other income sources, such as rental income or dividends

- Documentation for any deductions claimed, such as receipts for business expenses or medical costs

Legal Use of Form NYC 203 I

Form NYC 203 I is legally required for individuals and entities that earn income within New York City. Filing this form accurately and on time is essential to comply with local tax laws. Failure to file or inaccuracies in the form can lead to penalties, including fines and interest on unpaid taxes. Understanding the legal implications of this form helps taxpayers fulfill their obligations and avoid potential legal issues.

Quick guide on how to complete form nyc 203 i instructions for form nyc 203 nyc203i tax ny

Accomplish [SKS] seamlessly on any gadget

Online document administration has become increasingly favored by companies and individuals alike. It serves as an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to access the appropriate forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly and without delays. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest approach to modify and eSign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, time-consuming form searches, or errors that necessitate printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and eSign [SKS] and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form NYC 203 I , Instructions For Form NYC 203, NYC203I Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the form nyc 203 i instructions for form nyc 203 nyc203i tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a 203 nonresident income tax return?

NY Form IT-203 is a New York State income tax return for nonresidents and part-year residents. It is used to report income earned in New York State by individuals who are not considered to be full-year residents of the state.

-

How do I respond to a notice of tax in NY?

Log in to or create your Online Services account. Select the ≡ Services menu, then choose Respond to department notice. From the Questionnaire page, in the Notice type section, select I received a notice about my refund, as shown in the image below.

-

What is the 11 month rule for NYS residency?

Generally, you maintain a permanent place of abode for substantially all of the tax year if you maintain it for more than eleven months during the year.

-

How to calculate percentage of services performed in New York?

The percent of services performed in New York State or Yonkers may be computed using days, miles, time, or similar criteria. For example, an individual working in New York State two out of five days for the entire year performs 40% of his or her services in New York State.

Get more for Form NYC 203 I , Instructions For Form NYC 203, NYC203I Tax Ny

- Form 122e

- Request for official information re accs home and fyi

- Instructions 1 form to be completed by physician 2 copy of completed form to be sent to insurance carrier with bill

- Or state and to change doctor or hospital form

- Ides questionnaire form

- Ides questionnaire fill online printable fillable form

- Maine workers permit form

- Work permit mainegov form

Find out other Form NYC 203 I , Instructions For Form NYC 203, NYC203I Tax Ny

- Can I Electronic signature West Virginia Courts PPT

- Send Sign PDF Free

- How To Send Sign PDF

- Send Sign Word Online

- Send Sign Word Now

- Send Sign Word Free

- Send Sign Word Android

- Send Sign Word iOS

- Send Sign Word iPad

- How To Send Sign Word

- Can I Send Sign Word

- How Can I Send Sign Word

- Send Sign Document Online

- Send Sign Document Computer

- Send Sign Document Myself

- Send Sign Document Secure

- Send Sign Document iOS

- Send Sign Document iPad

- How To Send Sign Document

- Fax Sign PDF Online