INHERITANCE TAX PRONOUNCEMENTS Form

What is the Inheritance Tax Pronouncements

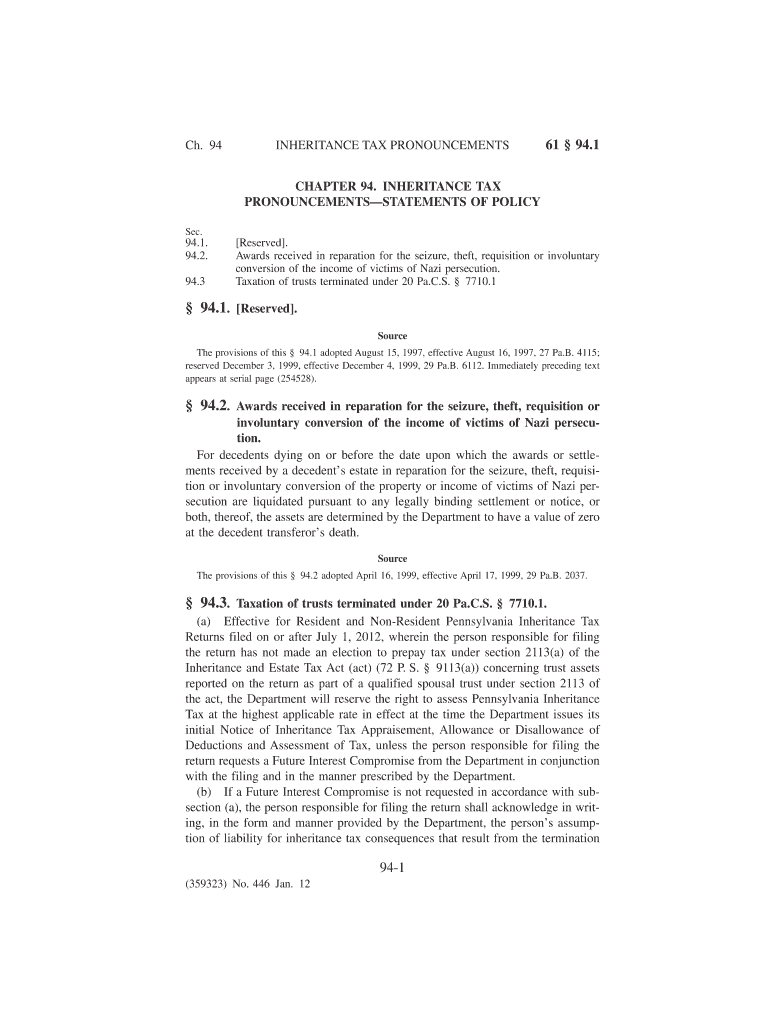

The Inheritance Tax Pronouncements refer to the official statements and regulations issued by state authorities regarding the taxation of inherited assets. These pronouncements clarify how inheritance tax is applied, the rates, and the exemptions that may be available to beneficiaries. In the United States, inheritance tax is not imposed at the federal level, but certain states do have their own inheritance tax laws. Understanding these pronouncements is crucial for individuals who are inheriting assets, as they dictate the tax obligations that may arise from such inheritances.

How to Use the Inheritance Tax Pronouncements

Using the Inheritance Tax Pronouncements involves reviewing the specific regulations applicable in your state to determine your tax obligations. Beneficiaries should carefully read the guidelines to understand how the tax is calculated based on the value of the inherited assets and the relationship to the deceased. It is also important to identify any exemptions or deductions that may apply, as these can significantly reduce the overall tax liability. Consulting with a tax professional can help ensure compliance and optimize tax outcomes.

Steps to Complete the Inheritance Tax Pronouncements

Completing the requirements outlined in the Inheritance Tax Pronouncements generally involves several key steps:

- Gather necessary documentation, including the will, asset valuations, and any relevant financial statements.

- Determine the total value of the estate and the specific assets being inherited.

- Identify the applicable state laws regarding inheritance tax, including rates and exemptions.

- Calculate the inheritance tax owed based on the guidelines provided in the pronouncements.

- File the necessary tax forms with the appropriate state tax authority within the specified deadlines.

Key Elements of the Inheritance Tax Pronouncements

Key elements of the Inheritance Tax Pronouncements include:

- Tax Rates: Different rates may apply based on the value of the inheritance and the relationship of the beneficiary to the deceased.

- Exemptions: Certain amounts may be exempt from taxation, depending on state laws and the beneficiary's relationship to the decedent.

- Filing Requirements: Specific forms and documentation must be submitted to comply with state regulations.

- Deadlines: There are often strict deadlines for filing inheritance tax returns and paying any owed taxes.

State-Specific Rules for the Inheritance Tax Pronouncements

Each state in the U.S. has its own rules regarding inheritance tax, which can vary significantly. Some states impose a tax on all inherited assets, while others may have exemptions for certain beneficiaries, such as spouses or children. It is essential to consult the specific inheritance tax pronouncements for your state to understand the applicable rules. This includes reviewing the tax rates, exemptions, and any potential deductions that may apply to your situation.

Required Documents

When dealing with the Inheritance Tax Pronouncements, several documents are typically required:

- The deceased's will or trust documents.

- Death certificate.

- Asset valuations, including appraisals for real estate and personal property.

- Financial statements that detail the decedent's liabilities and assets.

- Any previous tax returns that may be relevant to the estate.

Quick guide on how to complete inheritance tax pronouncements

Complete INHERITANCE TAX PRONOUNCEMENTS effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can obtain the required form and securely store it online. airSlate SignNow provides you with all the tools you need to create, modify, and eSign your documents promptly without any holdups. Manage INHERITANCE TAX PRONOUNCEMENTS on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused operation today.

How to modify and eSign INHERITANCE TAX PRONOUNCEMENTS with ease

- Find INHERITANCE TAX PRONOUNCEMENTS and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize essential parts of the documents or conceal sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Formulate your signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign INHERITANCE TAX PRONOUNCEMENTS and ensure optimal communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the inheritance tax pronouncements

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What will the federal estate tax exemption be in 2026?

Since then, we have seen the exemption rise to $13,610,000 in 2024 due to inflation. However, on January 1, 2026, the exemption is scheduled to automatically reset (or sunset) to $5,000,000, indexed to inflation (approximately $7,000,000), unless Congress acts prior to then.

-

Is money inherited from a deceased parent taxable?

In general, any inheritance you receive does not need to be reported to the IRS. You typically don't need to report inheritance money to the IRS because inheritances aren't considered taxable income by the federal government. That said, earnings made off of the inheritance may need to be reported.

-

How much can you inherit from your parents before paying taxes?

In 2024, the first $13,610,000 of an estate is exempt from taxes, up from $12,920,000 in 2023. Estate taxes are based on the size of the estate. It's a progressive tax, just like our federal income tax. That means that the larger the estate, the higher the tax rate it is subject to.

-

What is the federal inheritance tax exemption for 2024?

As a result, for 2024, a single taxpayer can claim a federal estate and lifetime gift tax exemption of $13.61 million. Couples making joint gifts can double that amount. This exemption has helped affluent families pass along substantial gifts tax-free.

-

Does the IRS know when you inherit money?

In general, any inheritance you receive does not need to be reported to the IRS. You typically don't need to report inheritance money to the IRS because inheritances aren't considered taxable income by the federal government. That said, earnings made off of the inheritance may need to be reported.

-

How much can you inherit from your parents?

Avoiding inheritance tax in Ireland DaughterSon Total Inheritance €950,000 €950,000 Child Free Threshold €400,000 €400,000 Grandchild Tax-Free Threshold €80,000 €120,000 Great Grandchild Tax-Free Threshold €40,000 5 more rows • Oct 14, 2024

-

How much can you inherit from your parents without paying taxes?

In 2024, the first $13,610,000 of an estate is exempt from the estate tax. A beneficiary may also have to pay capital gains taxes if they sell assets they've inherited, including stocks, real estate or valuables. The federal capital gains tax ranges from 15% to 20%, depending on your tax bracket.

-

How much can a US citizen inherit tax free?

Estate Tax Thresholds You can inherit up to $12.92 million in 2023 without paying federal estate taxes due to the estate tax exemption. However, some states have their own inheritance taxes, so you may still owe taxes to your state. Any estate exceeding the above thresholds could be taxed up to 40%.

Get more for INHERITANCE TAX PRONOUNCEMENTS

- Letter from tenant to landlord containing notice to landlord to withdraw improper rent increase due to violation of rent 497325125 form

- Letter from tenant to landlord about insufficient notice of rent increase rhode island form

- Rhode island letter increase form

- Letter from landlord to tenant about intent to increase rent and effective date of rental increase rhode island form

- Letter from landlord to tenant as notice to tenant to repair damage caused by tenant rhode island form

- Rhode island letter rent form

- Letter from tenant to landlord containing notice to landlord to cease retaliatory decrease in services rhode island form

- Temporary lease agreement to prospective buyer of residence prior to closing rhode island form

Find out other INHERITANCE TAX PRONOUNCEMENTS

- Help Me With Sign West Virginia Electrical Services Contract

- Can I Sign Wyoming Electrical Services Contract

- Sign Ohio Non-Solicitation Agreement Now

- How Can I Sign Alaska Travel Agency Agreement

- How Can I Sign Missouri Travel Agency Agreement

- How Can I Sign Alabama Amendment to an LLC Operating Agreement

- Can I Sign Alabama Amendment to an LLC Operating Agreement

- How To Sign Arizona Amendment to an LLC Operating Agreement

- Sign Florida Amendment to an LLC Operating Agreement Now

- How To Sign Florida Amendment to an LLC Operating Agreement

- How Do I Sign Illinois Amendment to an LLC Operating Agreement

- How Do I Sign New Hampshire Amendment to an LLC Operating Agreement

- How To Sign New York Amendment to an LLC Operating Agreement

- Sign Washington Amendment to an LLC Operating Agreement Now

- Can I Sign Wyoming Amendment to an LLC Operating Agreement

- How To Sign California Stock Certificate

- Sign Louisiana Stock Certificate Free

- Sign Maine Stock Certificate Simple

- Sign Oregon Stock Certificate Myself

- Sign Pennsylvania Stock Certificate Simple