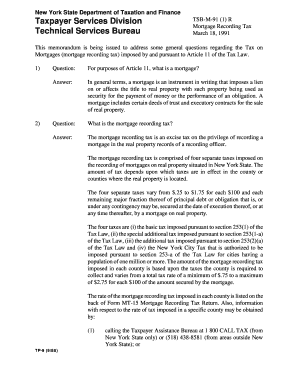

TSB M 91 1 R Form

What is the TSB M 91 1 R

The TSB M 91 1 R is a specific form used in various administrative and legal processes. It serves as a standardized document for individuals and businesses to provide necessary information for compliance with regulatory requirements. Understanding its purpose is crucial for ensuring that all relevant details are accurately reported, which can help avoid complications or delays in processing.

How to use the TSB M 91 1 R

Using the TSB M 91 1 R involves several steps to ensure that all required information is correctly filled out. Start by carefully reading the instructions that accompany the form. Gather all necessary documentation that supports the information you will provide. Complete the form by entering accurate details in the designated fields, making sure to double-check for any errors before submission.

Steps to complete the TSB M 91 1 R

Completing the TSB M 91 1 R requires attention to detail. Follow these steps:

- Review the form's instructions thoroughly.

- Gather all required documents, such as identification and supporting information.

- Fill out the form accurately, ensuring all fields are completed.

- Check the form for any mistakes or missing information.

- Sign and date the form as required.

- Submit the form through the appropriate method, whether online, by mail, or in person.

Legal use of the TSB M 91 1 R

The TSB M 91 1 R must be used in accordance with applicable laws and regulations. This form is often required for specific legal processes, and its proper completion is essential for compliance. Failing to use the form correctly can lead to legal repercussions, including fines or delays in processing. It is important to consult legal guidance if there are uncertainties regarding its use.

Key elements of the TSB M 91 1 R

Key elements of the TSB M 91 1 R include:

- Identification information of the individual or business submitting the form.

- Details pertaining to the specific purpose of the form.

- Any required signatures and dates.

- Supporting documentation that may need to accompany the form.

Who Issues the Form

The TSB M 91 1 R is typically issued by a governmental or regulatory body. This ensures that the form meets the necessary legal standards and requirements for its intended use. Knowing the issuing authority can help users understand the context and importance of the information requested on the form.

Quick guide on how to complete tsb m 91 1 r

Complete [SKS] seamlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to access the appropriate form and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents quickly without hassles. Handle [SKS] on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest method to modify and eSign [SKS] effortlessly

- Obtain [SKS] and click on Get Form to begin.

- Make use of the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes just moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to store your modifications.

- Choose how you wish to deliver your form, through email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow satisfies all your document management needs with just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tsb m 91 1 r

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a mortgage tax?

0:05 1:20 These taxes are separate from property taxes. And are specific to mortgage transactions mortgage taxMoreThese taxes are separate from property taxes. And are specific to mortgage transactions mortgage tax rates can differ depending on the state or locality.

-

Who pays the mortgage tax in NY?

The Bottom Line The mortgage loan borrower must pay the vast majority of the recording tax in New York City, which can be costly. The tax represents a percentage of the mortgage loan amount.

-

How to avoid NY mortgage tax?

The most common way to avoid paying a mortgage recording tax in New York City is to purchase a co-op rather than a condo or another type of residential property. You might wonder why co-ops, but not condos and other residential properties, are exempt from the mortgage recording tax, and the answer is simple.

-

What states have a mortgage tax?

Mortgage Tax States means, collectively, Alabama, Florida, Kansas, Georgia, Minnesota, New York, Oklahoma, Tennessee, Virginia and any other State in which an Individual Property or any Substitute Property may be located which imposes a mortgage recording or other mortgage tax.

-

What is a mortgage tax deduction?

The mortgage interest deduction is a tax incentive for homeowners. It allows them to write off some of the interest charged by their home loan. The deduction reduces your taxable income by the amount of interest paid on the loan during the year, along with some other related expenses.

-

What is Treasury Regulations 1.451 1 A?

Under § 1.451-1(a) of the Income Tax Regulations, income is includible in gross income by a taxpayer that uses an accrual method of accounting when all events have occurred that fix the taxpayer's right to receive that income and the amount of that income can be determined with reasonable accuracy.

Get more for TSB M 91 1 R

- Fee for service submittal detail form

- Illinois department of public health complaint form

- Physician certification form illinois department of public health

- Polst form idph illinoisgov

- Medical forms numeric listing illinoisgov

- Idoi consumer complaint form auto home property illinois

- 46604ai form

- 2015 acc health policy statement on cardiovascular team form

Find out other TSB M 91 1 R

- Electronic signature New Mexico Credit agreement Mobile

- Help Me With Electronic signature New Mexico Credit agreement

- How Do I eSignature Maryland Articles of Incorporation Template

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast