Uniform Sales & Use Tax Certificate Independence Medical

Understanding the Uniform Sales & Use Tax Certificate Independence Medical

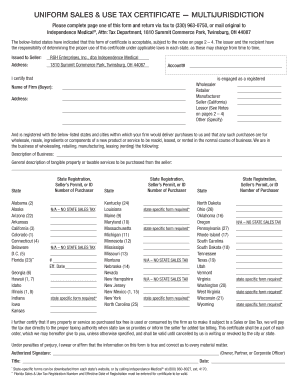

The Uniform Sales & Use Tax Certificate Independence Medical is a crucial document used primarily in the healthcare sector. This certificate allows qualifying medical entities to make tax-exempt purchases of goods and services. It is designed to streamline the purchasing process for medical supplies and equipment, ensuring that eligible organizations do not incur unnecessary sales tax costs. The certificate is recognized across various states, providing a standardized approach to tax exemption in the medical field.

Steps to Complete the Uniform Sales & Use Tax Certificate Independence Medical

Completing the Uniform Sales & Use Tax Certificate involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including the buyer's name, address, and tax identification number. Next, clearly indicate the intended use of the purchased items, specifying that they are for medical purposes. After filling out the required fields, ensure that the certificate is signed by an authorized representative of the medical entity. Finally, retain a copy for your records and provide the original to the seller at the time of purchase.

Legal Use of the Uniform Sales & Use Tax Certificate Independence Medical

The legal use of the Uniform Sales & Use Tax Certificate is essential for compliance with tax regulations. This certificate is valid only when used by eligible medical entities for tax-exempt purchases related to their operations. Misuse of the certificate, such as using it for personal purchases or for items not intended for medical use, can lead to penalties. It is important for organizations to understand the legal implications and ensure that they are using the certificate correctly to avoid any legal issues.

How to Obtain the Uniform Sales & Use Tax Certificate Independence Medical

Obtaining the Uniform Sales & Use Tax Certificate is a straightforward process. Medical entities can typically download the certificate from their state’s tax authority website or request it directly from the appropriate government office. Organizations may need to provide documentation proving their eligibility, such as a business license or tax-exempt status. Once the certificate is obtained, it should be filled out accurately and kept on file for future transactions.

Key Elements of the Uniform Sales & Use Tax Certificate Independence Medical

Several key elements must be included in the Uniform Sales & Use Tax Certificate to ensure its validity. These elements include the purchaser's name and address, the seller's name and address, and a description of the items being purchased. Additionally, the certificate should state the reason for the tax exemption, confirming that the items are for medical use. The signature of an authorized representative is also required to validate the certificate.

Examples of Using the Uniform Sales & Use Tax Certificate Independence Medical

There are various scenarios in which the Uniform Sales & Use Tax Certificate can be utilized. For instance, a hospital purchasing medical equipment such as MRI machines can present this certificate to avoid sales tax. Similarly, a medical clinic acquiring office supplies necessary for patient care may also use the certificate. These examples illustrate how the certificate facilitates tax-exempt purchasing, ultimately reducing operational costs for medical entities.

Quick guide on how to complete uniform sales amp use tax certificate independence medical

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to find the correct template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign [SKS] without hassle

- Find [SKS] and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize relevant sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Select your preferred method to send your form, via email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or mistakes that necessitate printing new copies. airSlate SignNow manages all your document needs in just a few clicks from any chosen device. Edit and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Uniform Sales & Use Tax Certificate Independence Medical

Create this form in 5 minutes!

How to create an eSignature for the uniform sales amp use tax certificate independence medical

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How do I get a US sales tax exemption certificate?

To apply for an initial or renewal tax exemption card, eligible missions and their members should submit an application on the Department's E-Government (E-Gov) system. Applications are generally processed within five business days.

-

Do I need a tax ID to be a reseller?

A retailer needs a sales tax ID for every state where it needs to collect sales tax. Some states will issue a resale certificate when applying for a sales tax ID, while others require a separate application.

-

What is the difference between EIN and sales tax ID?

Banks and other financial institutions also will sometimes request this number from you. There is no difference between a Sales Tax Number, a Sales Tax ID or an EIN - they are exactly the same thing. The IRS name is actually an EIN, which stands for “Employer Identification Number”.

-

What is a US resale certificate?

A resale certificate is a signed document that indicates that the purchaser intends to resell the goods. It is usually provided by a retailer to a wholesale dealer. In addition, manufacturers issue resale certificates to suppliers of materials that become incorporated into the products they manufacture.

-

Is a resale certificate the same as an EIN?

Is a seller's permit/resale license and EIN/Tax ID the same? These are not the same thing. A seller's permit/resale license is the same as a state tax ID, as both are issued by the state for sales tax purposes. An EIN or federal tax ID number, however, is issued by the federal government, not the state.

-

Is an EIN number the same as a seller's permit?

Is a seller's permit the same as an EIN? No, the IRS issues an EIN or (federal tax ID number), whereas a seller's permit is a tax ID that your state issues for local tax.

Get more for Uniform Sales & Use Tax Certificate Independence Medical

- Many skeptical patients do meet financial assistance form

- Refractive surg post op form eye doctors of washington

- Medical equipment and supplies services agreement form

- Date of request memorialcare memorialcare form

- Kadlec financial assistance fill online printable fillable form

- Tlc timesheet form

- Ummc email letterhead form

- Unforeseeable emergency withdrawal form valic

Find out other Uniform Sales & Use Tax Certificate Independence Medical

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF