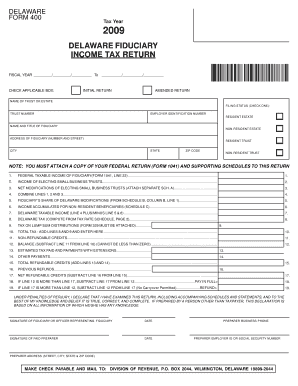

DELAWARE FIDUCIARY INCOME TAX RETURN Division of Revenue Delaware Form

What is the Delaware Fiduciary Income Tax Return?

The Delaware Fiduciary Income Tax Return is a tax form required for estates and trusts operating within the state of Delaware. This form is used to report income generated by the fiduciary entities and calculate the tax owed to the state. It ensures that estates and trusts comply with state tax laws, allowing for the proper allocation of income among beneficiaries. The form is administered by the Division of Revenue in Delaware and is essential for maintaining transparency and accountability in the management of fiduciary assets.

Steps to Complete the Delaware Fiduciary Income Tax Return

Completing the Delaware Fiduciary Income Tax Return involves several key steps:

- Gather necessary documentation, including income statements, deductions, and any relevant tax forms.

- Fill out the form accurately, ensuring all income and deductions are reported correctly.

- Calculate the total tax liability based on the income reported.

- Review the completed form for any errors or omissions before submission.

- Submit the form by the designated deadline to avoid penalties.

Required Documents for Filing

When preparing to file the Delaware Fiduciary Income Tax Return, it is important to have the following documents ready:

- Income statements for the estate or trust, including interest, dividends, and capital gains.

- Documentation of any deductions or credits applicable to the fiduciary entity.

- Previous tax returns, if available, to ensure consistency and accuracy.

- Identification information for the fiduciary, including social security numbers or tax identification numbers.

Filing Deadlines and Important Dates

Filing deadlines for the Delaware Fiduciary Income Tax Return are crucial for compliance. Typically, the return is due on the fifteenth day of the fourth month following the close of the tax year. For estates and trusts operating on a calendar year, this means the return is due by April 15. It is essential to mark these dates on your calendar to avoid late fees or penalties.

Form Submission Methods

The Delaware Fiduciary Income Tax Return can be submitted through various methods:

- Online submission via the Delaware Division of Revenue's e-filing system.

- Mailing a paper copy of the completed form to the appropriate address provided by the Division of Revenue.

- In-person submission at designated state offices, if applicable.

Penalties for Non-Compliance

Failure to file the Delaware Fiduciary Income Tax Return by the deadline can result in significant penalties. These may include:

- Late filing fees, which increase the longer the return is overdue.

- Interest on any unpaid taxes, accruing from the due date until the tax is paid.

- Potential legal action for persistent non-compliance, which may affect the fiduciary's ability to manage the estate or trust.

Quick guide on how to complete delaware fiduciary income tax return division of revenue delaware

Easily prepare [SKS] on any device

Managing documents online has become increasingly favored by businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly, without delays. Manage [SKS] on any device using airSlate SignNow's mobile applications for Android or iOS and streamline your document-related tasks today.

Effortlessly edit and electronically sign [SKS]

- Obtain [SKS] and click on Get Form to begin.

- Employ the tools we provide to complete your document.

- Emphasize key sections of your documents or redact sensitive information using tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, time-consuming searches for forms, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to DELAWARE FIDUCIARY INCOME TAX RETURN Division Of Revenue Delaware

Create this form in 5 minutes!

How to create an eSignature for the delaware fiduciary income tax return division of revenue delaware

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Does Delaware have a fiduciary income tax?

The Delaware fiduciary income tax is imposed on the taxable income of estates and trusts. ( Sec. 1631, Tit. 30, Code ) Delaware taxable income for an estate or trust is generally computed in the same manner as that of an individual, ( Sec.

-

What is a fiduciary income tax return?

Fiduciary income tax is a tax imposed on the income earned by certain types of legal entities, such as trusts and estates, while they hold and manage assets on behalf of beneficiaries.

-

Is a fiduciary tax return the same as an estate tax return?

Fiduciary income taxation is really the income taxation of estates and trusts and that should be contrasted with the estate tax.

-

What is the purpose of the estate tax return?

Estate tax returns are legal documents filed with the government after an individual's death to report the total value of their estate, including assets and liabilities, for tax assessment purposes.

-

What is the difference between a fiduciary and an estate?

An estate or trust of which you are a beneficiary will be managed by a fiduciary. Fiduciaries are those that manage things on behalf of another, and popular types of fiduciaries include trustees, executors, administrators, conservators, and guardians.

-

What is the difference between a 706 and a 1041 estate tax return?

Form 706 ensures that estate taxes are adequately assessed for larger estates, while Form 1041 helps report the estate's income during the settlement process. By understanding these differences, executors and administrators can better manage estate obligations.

-

What is the difference between fiduciary and estate tax return?

Fiduciary tax vs. While fiduciary income tax is the income taxation of a person's estate or trust assets, estate tax is a tax on the right to transfer property when a person passes away.

-

Who must file a Delaware income tax return?

You must file a tax return if you have any gross income from sources in Delaware during the tax year. If your spouse files a married filing separate return and you had no Delaware source income, you do NOT need to file a Delaware return.

Get more for DELAWARE FIDUCIARY INCOME TAX RETURN Division Of Revenue Delaware

- Download dining services application pdf hdh ucsd form

- Transcript request form great basin college gbcnv

- Western state college of law visitor building access card form

- Hr incident report 11 01 17 form

- Li ka shing center access request form uc berkeley

- Guide for authors journal of taibah university medical form

- Change of study form hofstra university hofstra

- News archives page 3 of 5 joe fairless form

Find out other DELAWARE FIDUCIARY INCOME TAX RETURN Division Of Revenue Delaware

- Electronic signature Iowa Legal LLC Operating Agreement Fast

- Electronic signature Legal PDF Kansas Online

- Electronic signature Legal Document Kansas Online

- Can I Electronic signature Kansas Legal Warranty Deed

- Can I Electronic signature Kansas Legal Last Will And Testament

- Electronic signature Kentucky Non-Profit Stock Certificate Online

- Electronic signature Legal PDF Louisiana Online

- Electronic signature Maine Legal Agreement Online

- Electronic signature Maine Legal Quitclaim Deed Online

- Electronic signature Missouri Non-Profit Affidavit Of Heirship Online

- Electronic signature New Jersey Non-Profit Business Plan Template Online

- Electronic signature Massachusetts Legal Resignation Letter Now

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online