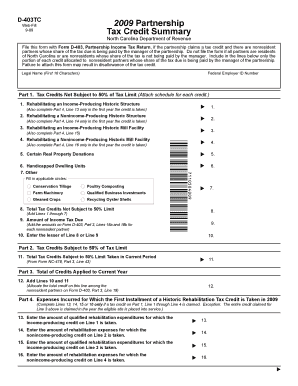

File This Form with Form D 403, Partnership Income Tax Return, If the Partnership Claims a Tax Credit and There Are Nonresident

Understanding the Partnership Income Tax Return Form D 403

The Form D 403 is specifically designed for partnerships that are claiming a tax credit while also having nonresident partners. This form is essential for ensuring compliance with IRS regulations regarding partnership income tax returns. It allows partnerships to report their income, deductions, and credits accurately, which is crucial for both federal and state tax obligations. Nonresident partners must be properly accounted for to ensure that the partnership meets all tax requirements and to avoid potential penalties.

Steps to Complete Form D 403

Completing Form D 403 involves several key steps:

- Gather all necessary financial documents, including income statements, expense reports, and any prior year tax returns.

- Fill out the partnership’s basic information, including the partnership name, address, and Employer Identification Number (EIN).

- Report the partnership's income and deductions accurately, ensuring that all figures are supported by documentation.

- Complete the sections related to nonresident partners, including their share of income and any applicable tax credits.

- Review the form for accuracy and completeness before submission.

Required Documents for Filing Form D 403

To successfully file Form D 403, partnerships need to compile several documents:

- Partnership financial statements for the tax year.

- Records of income and expenses incurred during the year.

- Documentation supporting any tax credits being claimed.

- Information regarding nonresident partners, including their tax identification numbers.

Filing Deadlines for Form D 403

It is important for partnerships to be aware of the filing deadlines associated with Form D 403. Typically, the deadline for filing this form aligns with the standard partnership tax return due date, which is usually the fifteenth day of the third month following the end of the partnership's tax year. Extensions may be available, but they require timely submission of the appropriate forms.

IRS Guidelines for Nonresident Tax Credits

The IRS has specific guidelines that partnerships must follow when claiming tax credits for nonresident partners. These guidelines outline eligibility criteria, documentation requirements, and the calculation of credits. Partnerships should ensure they are familiar with these guidelines to avoid errors that could lead to audits or penalties.

Legal Use of Form D 403

Form D 403 serves a legal purpose in the context of tax compliance for partnerships. By accurately filing this form, partnerships uphold their legal obligations to report income and claim credits. Failure to file correctly can result in legal repercussions, including fines and increased scrutiny from tax authorities.

Quick guide on how to complete file this form with form d 403 partnership income tax return if the partnership claims a tax credit and there are nonresident

Complete [SKS] effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It offers a seamless eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and safely keep it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents promptly without any holdups. Handle [SKS] on any platform using the airSlate SignNow Android or iOS applications and simplify any document-based workflow today.

How to modify and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to begin.

- Use the tools we provide to complete your document.

- Mark important sections of your documents or conceal sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details, then click the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from your preferred device. Alter and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to File This Form With Form D 403, Partnership Income Tax Return, If The Partnership Claims A Tax Credit And There Are Nonresident

Create this form in 5 minutes!

How to create an eSignature for the file this form with form d 403 partnership income tax return if the partnership claims a tax credit and there are nonresident

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

When a partnership files its Form 1065 tax return each partner is liable for paying taxes on?

Form 1065 provides the IRS with a snapshot of a company's financial status for the year. The partners must report and pay taxes on their shares of income from the partnership on their individual tax returns and pay income tax on their earnings regardless of whether earnings were distributed.

-

Do I need to file a partnership tax return?

Partnerships file an information return on Form 1065, U.S. Return of Partnership Income. A domestic partnership must file an information return, unless it neither receives gross income nor pays or incurs any amount treated as a deduction or credit for federal income tax purposes.

-

Does North Carolina tax non-resident remote workers?

Yes. A nonresident employee is subject to NC withholding tax on any part of his wages paid for services performed in this State.

-

Who must file a North Carolina partnership tax return?

Who must file Form D-403. - Every partnership doing business in North Carolina must file a partnership income tax return, Form D-403, for the taxable year if a federal partnership return was required to be filed.

-

Do I need to file an NC return?

A Return is Required if Federal Gross Income Exceeds: Single, $12,750. Married Filing Jointly, $25,500. Married Filing Separately (if spouse does not itemize), $12,750. Married Filing Separately (if spouse claims itemized deductions), $0.

-

Does North Carolina tax non-resident income?

North Carolina imposes a tax on the taxable income of every nonresident who received income from: the ownership of any interest in real or tangible personal property in North Carolina; a business, trade, profession, or occupation carried on in North Carolina; or. gambling activities carried on in North Carolina.

-

Do I need to file a NC nonresident return?

What are the filing requirements for Part Year and Nonresidents? You must file a North Carolina income tax return if you received income while being a part-year resident of NC or received income from NC sources.

-

Does a non-resident have to file taxes?

You must file Form 1040-NR, U.S. Nonresident Alien Income Tax Return only if you have income that is subject to tax, such as wages, tips, scholarship and fellowship grants, dividends, etc. Refer to Foreign Students and Scholars for more information.

Get more for File This Form With Form D 403, Partnership Income Tax Return, If The Partnership Claims A Tax Credit And There Are Nonresident

- Club basketball interest form student life studentlife indianatech

- Ecde 1101 early childhood guidance amp curriculum cscc form

- Washoe tribe scholarship application form

- Byu independent study transcript form

- Three levels of text protocol form

- Www applyweb comcorniadeanstransfer application s reference form applyweb com

- Enrollment review form southern new hampshire university

- Transcript request form 610417969

Find out other File This Form With Form D 403, Partnership Income Tax Return, If The Partnership Claims A Tax Credit And There Are Nonresident

- Electronic signature New York Postnuptial Agreement Template Secure

- How Can I Electronic signature Colorado Prenuptial Agreement Template

- Electronic signature California Divorce Settlement Agreement Template Free

- Electronic signature Virginia Prenuptial Agreement Template Free

- How Do I Electronic signature Maryland Affidavit of Residence

- Electronic signature Florida Child Support Modification Simple

- Electronic signature North Dakota Child Support Modification Easy

- Electronic signature Oregon Child Support Modification Online

- How Can I Electronic signature Colorado Cohabitation Agreement

- Electronic signature Arkansas Leave of Absence Letter Later

- Electronic signature New Jersey Cohabitation Agreement Fast

- Help Me With Electronic signature Alabama Living Will

- How Do I Electronic signature Louisiana Living Will

- Electronic signature Arizona Moving Checklist Computer

- Electronic signature Tennessee Last Will and Testament Free

- Can I Electronic signature Massachusetts Separation Agreement

- Can I Electronic signature North Carolina Separation Agreement

- How To Electronic signature Wyoming Affidavit of Domicile

- Electronic signature Wisconsin Codicil to Will Later

- Electronic signature Idaho Guaranty Agreement Free