Supplemental ScheduleSch SFillableRev 9 09 Income Tax Form

What is the Supplemental Schedule Sch S Fillable Rev 9 09 Income Tax

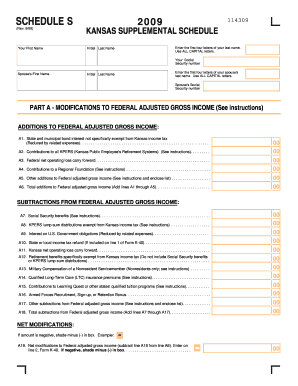

The Supplemental Schedule Sch S Fillable Rev 9 09 Income Tax is a specific tax form used by individuals to report income from sources such as partnerships, S corporations, estates, and trusts. This form is essential for taxpayers who need to detail their share of income, deductions, and credits from these entities. Understanding this form is crucial for accurate tax reporting and compliance with IRS regulations.

How to use the Supplemental Schedule Sch S Fillable Rev 9 09 Income Tax

Using the Supplemental Schedule Sch S Fillable Rev 9 09 Income Tax involves filling out the form accurately to reflect your income from various sources. Start by entering your identifying information at the top of the form. Next, report your income and any deductions related to the partnerships or S corporations you are involved with. Ensure that all figures are accurate and correspond to the information provided on your K-1 forms from the entities.

Steps to complete the Supplemental Schedule Sch S Fillable Rev 9 09 Income Tax

To complete the Supplemental Schedule Sch S Fillable Rev 9 09 Income Tax, follow these steps:

- Gather all necessary documents, including K-1 forms from partnerships and S corporations.

- Fill in your personal information at the top of the form.

- Report your income as listed on your K-1 forms, ensuring accuracy.

- Include any applicable deductions related to your income sources.

- Review the completed form for any errors or omissions.

- Save the form in a secure location for your records.

Legal use of the Supplemental Schedule Sch S Fillable Rev 9 09 Income Tax

The legal use of the Supplemental Schedule Sch S Fillable Rev 9 09 Income Tax is mandated by the IRS for taxpayers who receive income from partnerships, S corporations, estates, or trusts. Filing this form is necessary to ensure compliance with federal tax laws. Failure to accurately report this income may result in penalties, so it is important to use the form correctly and submit it along with your main tax return.

IRS Guidelines

The IRS provides specific guidelines for completing the Supplemental Schedule Sch S Fillable Rev 9 09 Income Tax. Taxpayers should refer to the IRS instructions for this form, which outline how to report various types of income and deductions. It is crucial to follow these guidelines closely to avoid errors that could lead to audits or penalties.

Filing Deadlines / Important Dates

The filing deadlines for the Supplemental Schedule Sch S Fillable Rev 9 09 Income Tax align with the general tax return deadlines. Typically, individual tax returns are due on April 15 of each year. If you need additional time, you may file for an extension, but ensure that you still pay any taxes owed by the original deadline to avoid penalties and interest.

Quick guide on how to complete supplemental schedulesch sfillablerev 9 09 income tax

Handle [SKS] effortlessly on any device

Web-based document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and physically signed documents, as you can easily access the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents promptly and without interruptions. Manage [SKS] on any platform using the airSlate SignNow Android or iOS applications and enhance any document-centered workflow today.

How to modify and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Use the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal weight as a conventional wet signature.

- Verify the details and click on the Done button to save your amendments.

- Choose your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] to ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Supplemental ScheduleSch SFillableRev 9 09 Income Tax

Create this form in 5 minutes!

How to create an eSignature for the supplemental schedulesch sfillablerev 9 09 income tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How to fill out a schedule C tax form?

Steps To Completing Schedule C Step 1: Gather Information. Step 2: Calculate Gross Profit and Income. Step 3: Include Your Business Expenses. Step 4: Include Other Expenses and Information. Step 5: Calculate Your Net Income. If You Have a Business Loss.

-

What is the maximum you can make without filing?

If you were under 65 at the end of 2023 If your filing status is:File a tax return if your gross income is: Single $13,850 or more Head of household $20,800 or more Married filing jointly $27,700 or more (both spouses under 65) $29,200 or more (one spouse under 65) Married filing separately $5 or more1 more row • Aug 14, 2024

-

What is line 9 on Schedule C tax form?

ing to the IRS form instructions for line 9 of Schedule C (Form 1040): You can deduct the actual expenses of operating your car or truck or take the standard mileage rate. This is true even if you used your vehicle for hire (such as a taxi-cab).

-

What is a Schedule E supplemental income?

Schedule E is the form you use to report supplemental income you earn from any of the following sources: renting real estate; royalties; interests in partnerships and S corporations; and distributions received from an estate or trust as well as from certain mortgage investments.

-

What is the free filing limit for FreeTaxUSA?

Free File provides no-cost online tax preparation for federal tax returns and some state filings. The program is a partnership between the IRS and several top tax software companies and is available to filers with an adjusted gross income of $79,000 or less.

-

What is the income limit for free file fillable forms?

Remember, you must access the company through the IRS.gov website (.IRS.gov/freefile) to use Free File. Who is eligible to use Free File? Free File preparation and e-filing assistance is available to taxpayers who have a 2023 Adjusted Gross Income (AGI) of $79,000 or less.

-

What is the income limit for free fillable forms?

The IRS “Free File” program offers free tax prep software to file your own return if you earn $73,000 a year or less. If you make $73,000 or more, you can receive free fillable forms to help with your tax return.

-

What is the cut-off for IRS Free File?

Who is eligible for Free File? For the 2024 tax filing season, people who made $79,000 or less in 2023 are eligible. The income threshold applies to all tax filing statuses, and the income limit refers to your adjusted gross income (AGI), not your gross income.

Get more for Supplemental ScheduleSch SFillableRev 9 09 Income Tax

- Course substitution cuyahoga community college portal tri c form

- International experience exemption form texas tech university

- Financial petition form fresno pacific university fresno

- Transcript from the november 7th football press luncheonohio state form

- School of health sciences immunization cpr and p form

- Academic probation action plan part i to be completed by form

- Golden id tuition reduction form pdf towson university towson

- Data center access authorization form csub

Find out other Supplemental ScheduleSch SFillableRev 9 09 Income Tax

- Sign Wisconsin Construction Purchase Order Template Simple

- Sign Arkansas Doctors LLC Operating Agreement Free

- Sign California Doctors Lease Termination Letter Online

- Sign Iowa Doctors LLC Operating Agreement Online

- Sign Illinois Doctors Affidavit Of Heirship Secure

- Sign Maryland Doctors Quitclaim Deed Later

- How Can I Sign Maryland Doctors Quitclaim Deed

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile