1042A740 NP R 0003 Indd Revenue Ky Form

What is the 1042A740 NP R 0003 indd Revenue Ky

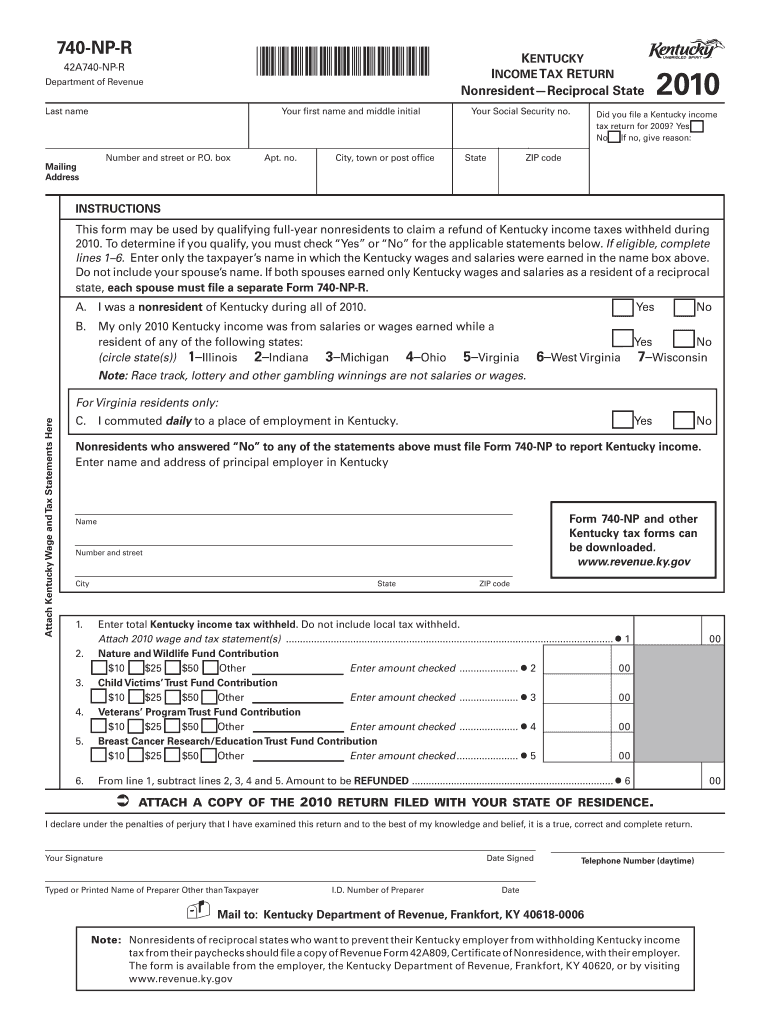

The 1042A740 NP R 0003 indd Revenue Ky is a specific form used primarily for reporting income subject to withholding for non-resident aliens in Kentucky. This form is essential for ensuring compliance with both federal and state tax regulations. It captures various types of income, including but not limited to, dividends, interest, and royalties, which may be subject to different withholding rates depending on treaties and regulations. Understanding this form is crucial for businesses and individuals who engage with non-resident aliens to ensure proper tax reporting and withholding.

How to use the 1042A740 NP R 0003 indd Revenue Ky

Using the 1042A740 NP R 0003 indd Revenue Ky involves several steps to ensure accurate completion. First, gather all relevant income information related to non-resident aliens. It is important to include details such as the recipient's name, address, and taxpayer identification number. Next, complete the form by entering the appropriate income amounts and withholding rates. After filling out the form, review it for accuracy before submission. This form can be submitted electronically or via mail, depending on the specific requirements set forth by the IRS and Kentucky state tax authorities.

Steps to complete the 1042A740 NP R 0003 indd Revenue Ky

Completing the 1042A740 NP R 0003 indd Revenue Ky requires a systematic approach:

- Collect necessary information about the non-resident alien, including their identification and income details.

- Fill in the form accurately, ensuring all income figures and withholding rates are correct.

- Double-check the form for any errors or omissions.

- Submit the completed form either electronically or by mailing it to the appropriate tax authority.

Legal use of the 1042A740 NP R 0003 indd Revenue Ky

The legal use of the 1042A740 NP R 0003 indd Revenue Ky is mandated by IRS regulations regarding income reporting for non-resident aliens. It is crucial for compliance with tax laws to ensure that all applicable taxes are withheld properly. Failing to use this form correctly can result in penalties for both the payer and the recipient. Understanding the legal implications of this form helps businesses navigate their responsibilities effectively.

IRS Guidelines

The IRS provides specific guidelines for the 1042A740 NP R 0003 indd Revenue Ky, outlining who must file the form, what income types are reportable, and the appropriate withholding rates. These guidelines also detail the documentation required to support the entries made on the form. It is important to refer to the latest IRS publications to ensure compliance with any updates or changes in tax law.

Filing Deadlines / Important Dates

Filing deadlines for the 1042A740 NP R 0003 indd Revenue Ky are critical to avoid penalties. Typically, the form must be filed by March fifteenth of the year following the tax year in which the income was paid. It is advisable to check the IRS website for any updates or changes to these deadlines, as they can vary based on specific circumstances or legislative changes.

Quick guide on how to complete 1042a740 np r 0003 indd revenue ky

Complete [SKS] easily on any device

Online document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without wait times. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The simplest way to modify and eSign [SKS] effortlessly

- Find [SKS] and click on Get Form to begin.

- Make use of the tools we offer to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and press the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of missing or lost documents, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 1042A740 NP R 0003 indd Revenue Ky

Create this form in 5 minutes!

How to create an eSignature for the 1042a740 np r 0003 indd revenue ky

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Is Kentucky eliminating state income tax?

We are on track to eliminate Kentucky's individual income tax, and we are doing so while providing for the necessary programs that Kentuckians depend on.” The bill helped Kentucky's income tax go down from 5% to 4.5% in 2023 before going down another half-percentage point to 4% in 2024.

-

Why is my KY refund taking so long?

If any of your information (address, bank account, etc.) changed since last year, there may be additional security steps to verify your identity to protect you and the Commonwealth. This may result in extended refund processing times.

-

What is a 740 NP-R for Kentucky?

Taxpayers who qualify for this exemption and have no other Kentucky taxable income should file Form 740-NP-R, Kentucky Income Tax Return, Nonresident–Reciprocal State, to obtain a refund.

-

How do I contact the IRS in Kentucky?

If you are an individual and have questions regarding a Form W-2 or a Form 1099 that you have either received or should have received, please call the general IRS assistance toll-free number at 800-829-1040.

-

What is a 740 NP-R for Kentucky?

Taxpayers who qualify for this exemption and have no other Kentucky taxable income should file Form 740-NP-R, Kentucky Income Tax Return, Nonresident–Reciprocal State, to obtain a refund.

-

Where to find Kentucky state tax liability?

It is asking what the tax liability was for KY. The tax liability is the tax on the income you earned. This is not the amount from your paycheck/W2 or the amount you may have to pay when filing. You can find it on your Kentucky tax return.

-

Where do I mail my KY state tax return?

Where do I mail my forms? For Refunds: Kentucky Department of Revenue, PO Box 856970, Louisville, KY 40285-6970. For Balance Due: Kentucky Department of Revenue, PO Box 856980, Louisville, KY 40285-6980.

-

How do I contact the KY Department of Revenue?

Public Service Branch Phone(502) 564-8175. Fax(502) 564-8192. Kentucky Department of Revenue. Public Service Branch 501 High Street, Station 32. Frankfort, KY 40601.

-

Who do I call about Ky state taxes?

Have additional questions? If you have additional questions, you can contact the Department of Revenue through their website or call them at 502-564-4581.

Get more for 1042A740 NP R 0003 indd Revenue Ky

- Notaries equipment company new jersey notary public application form

- Permit application to construct a private non whitesidehealth form

- Application for non resident admission bisd303 form

- A review of the sample design for the california health interview amstat form

- Come rain or shine form

- Sfyo kansas gov ethics ks form

- Yokohama participating dealers nba com form

- Ready to file your state taxes here are the details form

Find out other 1042A740 NP R 0003 indd Revenue Ky

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy

- How To eSignature Maryland Business Operations Business Letter Template

- How Do I eSignature Arizona Charity Rental Application

- How To eSignature Minnesota Car Dealer Bill Of Lading

- eSignature Delaware Charity Quitclaim Deed Computer