Form it 203 BNonresident and Part Year Resident EFile

What is the Form IT-203-B Nonresident and Part-Year Resident E-File

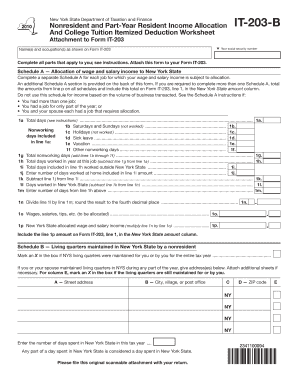

The Form IT-203-B is a tax form used by nonresidents and part-year residents of New York State to report their income and calculate their tax liability. This form is essential for individuals who earn income in New York but do not reside there for the entire year. It allows taxpayers to accurately report their income, claim any applicable credits, and determine the tax owed to the state. Understanding the purpose and requirements of the IT-203-B is crucial for compliance with state tax laws.

How to Use the Form IT-203-B Nonresident and Part-Year Resident E-File

Using the Form IT-203-B involves several steps that ensure proper completion and submission. First, gather all necessary documents, including W-2 forms, 1099s, and any other income statements. Next, fill out the form with accurate information regarding your income, deductions, and credits. After completing the form, review it for accuracy before submitting it electronically. E-filing is a convenient option that allows for faster processing and confirmation of your submission.

Steps to Complete the Form IT-203-B Nonresident and Part-Year Resident E-File

Completing the Form IT-203-B can be broken down into a series of straightforward steps:

- Gather all relevant income documentation, including forms from employers and financial institutions.

- Enter your personal information, including your name, address, and Social Security number.

- Report your total income earned while in New York, including wages and other earnings.

- Calculate your deductions and credits to determine your taxable income.

- Review the completed form for any errors or omissions.

- E-file the form through an approved electronic filing method.

Required Documents for the Form IT-203-B Nonresident and Part-Year Resident E-File

To successfully complete the Form IT-203-B, certain documents are necessary. These include:

- W-2 forms from all employers for the tax year.

- 1099 forms for any freelance or contract work.

- Records of any other income received during the year.

- Documentation for any deductions or credits you plan to claim.

Filing Deadlines for the Form IT-203-B Nonresident and Part-Year Resident E-File

It is important to be aware of the filing deadlines for the Form IT-203-B to avoid penalties. Typically, the deadline for submitting this form coincides with the federal tax filing deadline, which is usually April 15. However, if you are unable to file by this date, you may apply for an extension. Be sure to check for any specific state announcements regarding changes to deadlines or extensions.

Legal Use of the Form IT-203-B Nonresident and Part-Year Resident E-File

The legal use of the Form IT-203-B is governed by New York State tax laws. This form must be used by individuals who meet the criteria of being a nonresident or part-year resident and who have earned income in New York. Accurate reporting is essential, as failure to comply with state tax regulations can result in penalties or legal consequences. Understanding the legal implications of using this form is vital for all taxpayers.

Quick guide on how to complete form it 203 bnonresident and part year resident efile

Complete [SKS] effortlessly on any device

Online document administration has gained popularity among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing users to find the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize critical sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a standard wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or forgotten files, tedious form searches, or errors that necessitate printing fresh document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign [SKS] and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Form IT 203 BNonresident And Part Year Resident EFile

Create this form in 5 minutes!

How to create an eSignature for the form it 203 bnonresident and part year resident efile

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is 201 NYS tax form?

Enhanced paper filing with a fill-in form Electronic filing is the fastest, safest way to file—but if you must file a paper Resident Income Tax Return, use our enhanced fill-in Form IT-201 with 2D barcodes. Benefits include: no more handwriting—type your entries directly into our form.

-

Are there three types of tax return forms?

The simplest IRS form is the Form 1040EZ. The 1040A covers several additional items not addressed by the EZ. And finally, the IRS Form 1040 should be used when itemizing deductions and reporting more complex investments and other income.

-

What is an IT-203 B form?

ProWeb: New York Form IT-203-B Nonresident and Part-Year Resident Income Allocation. New York Form IT-203-B is used to allocate income to the state during the period of the taxpayer's (and spouse's) period of nonresidency and to indicate where in the state the taxpayer and/or spouse maintained living quarters, if any.

-

What is NY IT-203 C?

(8/15) Purpose of form. Married nonresidents and part-year residents who are required to file a joint New York State return must use the combined income of both spouses to determine the base tax subject to the income percentage allocation, even if only one spouse has New York source income.

-

Do I have to file a New York nonresident tax return?

ing to Form IT-203-I, you must file a New York part-year or nonresident return if: You have any income from a New York source and your New York AGI exceeds your New York State standard deduction. You want to claim a refund for any New York State, New York City, or Yonkers taxes that were withheld from your pay.

-

What is a 203 nonresident income tax return?

NY Form IT-203 is a New York State income tax return for nonresidents and part-year residents. It is used to report income earned in New York State by individuals who are not considered to be full-year residents of the state.

-

Which form s are part-year residents and nonresidents required to file in connecticut?

Connecticut Nonresident and Part-Year Resident Income Tax Information. File and pay Form CT-1040NR/PY electronically using myconneCT at portal.ct.gov/DRS-myconneCT.

-

What is the difference between IT-203 and IT 201?

If one of you was a New York State resident and the other was a nonresident or part-year resident, you must each file a separate New York return. The resident must use Form IT-201. The nonresident or part-year resident, if required to file a New York State return, must use Form IT-203.

Get more for Form IT 203 BNonresident And Part Year Resident EFile

- The city of yukon requires contractor registration per ordinance 18 cityofyukonok form

- Bridging the income gap economics sas upenn form

- Systemic risk and the refinancing ratchet effect web mit form

- Business name list exactly as it appears in documents form

- Form a information and permission form seattle al anon

- Contact us missouri secretary of state form

- Financial guarantee form eap eap ucop

- Sales tax filing options louisiana department of revenue form

Find out other Form IT 203 BNonresident And Part Year Resident EFile

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself

- eSignature California Bank Loan Proposal Template Now

- Can I eSign Indiana Medical History

- eSign Idaho Emergency Contract Form Myself

- eSign Hawaii General Patient Information Fast

- Help Me With eSign Rhode Island Accident Medical Claim Form

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure