Supplemental Schedule SCH S Rev 8 10 Kansas Department of Form

What is the Supplemental Schedule SCH S Rev 8 10 Kansas Department Of

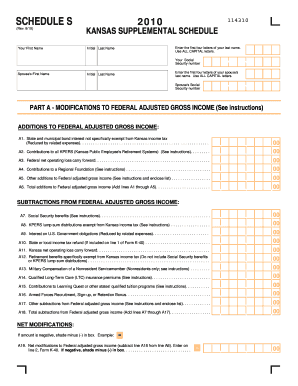

The Supplemental Schedule SCH S Rev 8 10 is a specific form used by the Kansas Department of Revenue for reporting income from various sources. This form is primarily utilized by individuals who need to report income that is not included on their primary tax return. It provides a structured way to disclose additional income, ensuring compliance with state tax regulations.

How to use the Supplemental Schedule SCH S Rev 8 10 Kansas Department Of

To effectively use the Supplemental Schedule SCH S Rev 8 10, individuals must first gather all relevant income documentation. This includes records of any additional earnings, such as rental income, royalties, or other miscellaneous sources. Once the necessary information is compiled, the individual can fill out the form, ensuring that all sections are completed accurately. After completing the form, it should be submitted alongside the main tax return to the Kansas Department of Revenue.

Steps to complete the Supplemental Schedule SCH S Rev 8 10 Kansas Department Of

Completing the Supplemental Schedule SCH S Rev 8 10 involves several key steps:

- Gather all income documentation related to additional earnings.

- Obtain the Supplemental Schedule SCH S Rev 8 10 form from the Kansas Department of Revenue website or other official sources.

- Fill out the form, ensuring all required fields are completed accurately.

- Review the form for any errors or omissions.

- Submit the completed form along with your main tax return by the designated filing deadline.

Key elements of the Supplemental Schedule SCH S Rev 8 10 Kansas Department Of

Important elements of the Supplemental Schedule SCH S Rev 8 10 include sections for reporting various types of income, such as:

- Rental income from real estate properties.

- Royalties from intellectual property.

- Income from partnerships or S corporations.

- Other miscellaneous income sources that are not reported elsewhere.

Each section requires specific details to ensure accurate reporting and compliance with Kansas tax laws.

Filing Deadlines / Important Dates

Filing deadlines for the Supplemental Schedule SCH S Rev 8 10 align with the general tax filing deadlines in Kansas. Typically, individuals must submit their tax returns, including this supplemental schedule, by April fifteenth. It is important to stay informed about any changes in deadlines or extensions that may be announced by the Kansas Department of Revenue.

Legal use of the Supplemental Schedule SCH S Rev 8 10 Kansas Department Of

The legal use of the Supplemental Schedule SCH S Rev 8 10 is crucial for compliance with Kansas tax laws. Failing to report additional income accurately can lead to penalties or fines. Therefore, it is essential for taxpayers to understand the legal implications of the information they provide on this form and ensure that all reported income is legitimate and verifiable.

Quick guide on how to complete supplemental schedule sch s rev 8 10 kansas department of

Accomplish [SKS] effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents rapidly without delays. Manage [SKS] on any platform with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign [SKS] with minimal effort

- Find [SKS] and select Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow supplies specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, either by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate creating new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Supplemental Schedule SCH S Rev 8 10 Kansas Department Of

Create this form in 5 minutes!

How to create an eSignature for the supplemental schedule sch s rev 8 10 kansas department of

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What income is not taxable in Kansas?

A broad tax relief package signed by Gov. Kelly went into effect in June 2024, eliminating state taxes on Social Security income in Kansas. Income from federal government-designated Kansas state and local government, and military retirement plans is tax-exempt. Railroad benefits are also exempt.

-

What type of pension is not taxable?

Nontaxable pension or annuity payments or disability benefits that are paid under a law administered by the Department of Veterans Affairs (VA). Pension or annuity payments or disability benefits that are excluded from income under any provision of federal law other than the Internal Revenue Code.

-

What pensions are not taxable in Kansas?

The following benefits are exempt from Kansas tax: Federal Civil Service Retirement or Disability Fund payments and any other amounts received as retirement benefits from employment by the federal government or for service in the United States Armed Forces.

-

What is schedule S on a Kansas tax return?

If you have items of income that are taxable to Kansas that were not included on your federal return, those items must be reported on Schedule S, Part A. Complete all applicable fields on this page to report any additional income not included on your federal return. State and Municiple Bond Interest.

-

Will Social Security income be taxed in Kansas in 2024?

A tax cut package adopted by the Kansas Legislature in June means Kansans will no longer be taxed on their Social Security benefits, starting with 2024 income.

-

What retirement benefits are exempt from Kansas income tax?

Retirement income from a 401(k), pension or IRA is fully taxable at the regular Kansas income tax rates of 3.1% to 5.7%. One exception is public pension income, whether from a federal, state or local government pension. Public pension income is fully exempt from the Kansas income tax.

-

Will social security be taxed in Kansas for 2024?

A tax cut package adopted by the Kansas Legislature in June means Kansans will no longer be taxed on their Social Security benefits, starting with 2024 income. Before making the change, Kansas was one of only 10 states that taxed on Social Security payments.

-

What is a Schedule S?

Purpose of Schedule Schedule S (Form 1120-F) is used by foreign corporations to claim an exclusion from gross income under section 883 and to provide reporting information required by the section 883 regulations.

Get more for Supplemental Schedule SCH S Rev 8 10 Kansas Department Of

- Mga internship form

- International student admission application diablo valley form

- Physicians ada job accommodation request disability verification form

- Fall 2018 bachelor of science in microbiology form

- Associate degree nursing program student handbook 2019 2020 academic year form

- Student name student id b0 form

- 2018 2019 verification work sheet v1 form

- New preferred first name policycal lutheran registrar form

Find out other Supplemental Schedule SCH S Rev 8 10 Kansas Department Of

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract