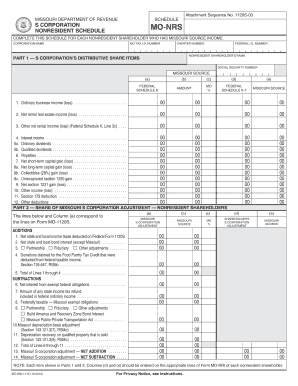

NONRESIDENT SCHEDULE Form

What is the NONRESIDENT SCHEDULE

The NONRESIDENT SCHEDULE is a tax form used by individuals who are not residents of the United States but have income sourced from within the country. This schedule is typically part of the larger tax return process for nonresident aliens, allowing them to report their U.S. income and calculate their tax liability. It is essential for ensuring compliance with U.S. tax laws and for determining any potential tax obligations based on income earned in the United States.

How to use the NONRESIDENT SCHEDULE

To effectively use the NONRESIDENT SCHEDULE, individuals must first gather all necessary financial documentation related to their U.S. income. This includes any forms such as W-2s or 1099s that report earnings. Once the relevant information is collected, users can fill out the schedule by providing details about their income, deductions, and applicable credits. The completed form is then submitted along with the main tax return to the Internal Revenue Service (IRS).

Steps to complete the NONRESIDENT SCHEDULE

Completing the NONRESIDENT SCHEDULE involves several key steps:

- Gather all necessary income documentation, including W-2s and 1099s.

- Determine the applicable income sources and any deductions you may qualify for.

- Fill out the schedule by entering the required information accurately.

- Review the completed form for any errors or omissions.

- Submit the NONRESIDENT SCHEDULE along with your tax return by the filing deadline.

Filing Deadlines / Important Dates

Filing deadlines for the NONRESIDENT SCHEDULE are crucial to avoid penalties. Generally, nonresident aliens must file their tax returns by April fifteenth of the year following the tax year in question. However, if you are a nonresident who is not required to file a return, it is still advisable to submit the form if you have any U.S. income. It is important to stay informed about any extensions or changes to deadlines that may occur.

Required Documents

When preparing to complete the NONRESIDENT SCHEDULE, several documents are necessary:

- Income statements such as W-2s or 1099s.

- Documentation of any deductions or credits you plan to claim.

- Identification information, including your Individual Taxpayer Identification Number (ITIN) or Social Security Number (SSN).

- Any previous tax returns or schedules that may provide context for your current filing.

IRS Guidelines

The IRS provides specific guidelines for completing the NONRESIDENT SCHEDULE. These guidelines outline eligibility criteria, acceptable income sources, and the necessary documentation required for accurate reporting. It is important for filers to familiarize themselves with these guidelines to ensure compliance and to avoid potential issues with the IRS. Regular updates to tax laws may also affect how the form should be completed, so staying informed is essential.

Quick guide on how to complete nonresident schedule

Complete [SKS] effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can obtain the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage [SKS] on any device with airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign [SKS] without stress

- Access [SKS] and then click Get Form to begin.

- Utilize the tools we offer to finalize your document.

- Highlight relevant parts of your documents or obscure sensitive information with tools specifically designed for that by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form hunting, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in a few clicks from your preferred device. Edit and eSign [SKS] and ensure effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to NONRESIDENT SCHEDULE

Create this form in 5 minutes!

How to create an eSignature for the nonresident schedule

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is considered a nonresident?

A nonresident is a person who is not a resident of California. Generally, nonresidents are: Simply passing through. Here for a brief rest or vacation.

-

What is the Schedule A on the 1040nr?

The official name of Form 1040-NR (Schedule A) is “Itemized Deductions.” It serves the purpose of allowing nonresident aliens of the United States to calculate and claim allowable deductions against their income, thus potentially reducing their overall tax liability.

-

How do I know if I am resident or nonresident?

If you are not a U.S. citizen, you are considered a nonresident of the United States for U.S. tax purposes unless you meet one of two tests. You are a resident of the United States for tax purposes if you meet either the green card test or the substantial presence test for the calendar year (January 1 – December 31).

-

What is a nonresident employee?

An individual whose permanent home is in a different location from where they work. Non-resident Extended Definition. In the context of U.S. payroll, non-residents usually refer to an employee who lives in a different state than the workplace location.

-

What is schedule A on a tax return?

For individual taxpayers, Schedule A is used in conjunction with Form 1040 to report itemized deductions. If you choose to claim itemized deductions instead of the standard deduction, you would use Schedule A to list your deductions. Your itemized total is then subtracted from your taxable income.

-

Where to find 1040 schedule A?

Go to .irs.gov/ScheduleA for instructions and the latest information.

-

What is a Schedule 1 on 1040NR?

Schedule 1 is used to report types of income that aren't listed on the 1040, such as capital gains, alimony, unemployment payments, and gambling winnings. Schedule 1 also includes some common adjustments to income, like the student loan interest deduction and deductions for educator expenses.

-

What is the schedule NEC for 1040NR?

If you file Form 1040-NR, use Schedule NEC (Form 1040-NR) to figure your tax on income that is not effectively connected with a U.S. trade or business and to figure your capital gains and losses from sales or exchanges of property that is not effectively connected with a U.S. business.

Get more for NONRESIDENT SCHEDULE

- College of engineering and engineering technology niu form

- Office of international education study abroad application guidelines tamiu form

- Managing projects speclink form

- New tools to consider in blackboard 9 1 form

- Commission file number 1 31227 form

- Gas sample form no 79 982 electronic commerce system user

- New youth 4 h member paper enrollment form ca4h

- One day event consent form sfcatholic

Find out other NONRESIDENT SCHEDULE

- Sign West Virginia Quitclaim Deed Free

- How Can I Sign North Dakota Warranty Deed

- How Do I Sign Oklahoma Warranty Deed

- Sign Florida Postnuptial Agreement Template Online

- Sign Colorado Prenuptial Agreement Template Online

- Help Me With Sign Colorado Prenuptial Agreement Template

- Sign Missouri Prenuptial Agreement Template Easy

- Sign New Jersey Postnuptial Agreement Template Online

- Sign North Dakota Postnuptial Agreement Template Simple

- Sign Texas Prenuptial Agreement Template Online

- Sign Utah Prenuptial Agreement Template Mobile

- Sign West Virginia Postnuptial Agreement Template Myself

- How Do I Sign Indiana Divorce Settlement Agreement Template

- Sign Indiana Child Custody Agreement Template Now

- Sign Minnesota Divorce Settlement Agreement Template Easy

- How To Sign Arizona Affidavit of Death

- Sign Nevada Divorce Settlement Agreement Template Free

- Sign Mississippi Child Custody Agreement Template Free

- Sign New Jersey Child Custody Agreement Template Online

- Sign Kansas Affidavit of Heirship Free