W 8 Forms Cover Sheet University of Oregon

What is the W-8 Forms Cover Sheet at the University of Oregon

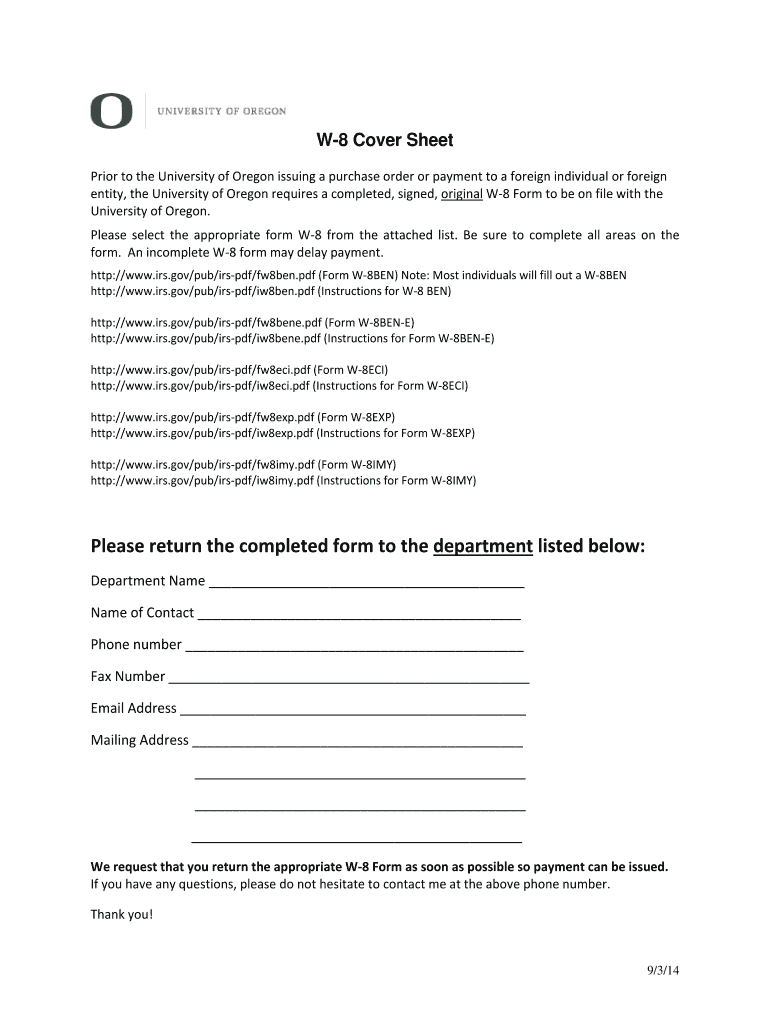

The W-8 Forms Cover Sheet at the University of Oregon is a document designed for foreign individuals and entities to certify their foreign status for tax purposes. This form is essential for non-U.S. citizens or residents who receive income from U.S. sources, as it helps establish eligibility for reduced withholding tax rates under U.S. tax treaties. The cover sheet typically accompanies various W-8 forms, such as the W-8BEN or W-8ECI, and provides necessary context and instructions for proper completion.

How to use the W-8 Forms Cover Sheet at the University of Oregon

To use the W-8 Forms Cover Sheet, individuals must first determine which specific W-8 form applies to their situation. Once identified, the cover sheet should be filled out to include personal information, such as name, address, and taxpayer identification number. It is crucial to follow the instructions on the cover sheet carefully to ensure compliance with IRS requirements. After completing the cover sheet and the corresponding W-8 form, both documents should be submitted to the appropriate department at the University of Oregon.

Steps to complete the W-8 Forms Cover Sheet at the University of Oregon

Completing the W-8 Forms Cover Sheet involves several key steps:

- Identify the correct W-8 form needed for your specific situation.

- Fill out the cover sheet with accurate personal information, including your name, address, and taxpayer identification number.

- Review the instructions provided on the cover sheet to ensure all required information is included.

- Complete the corresponding W-8 form, ensuring that all sections are filled out correctly.

- Submit both the cover sheet and the W-8 form to the designated department at the University of Oregon.

Key elements of the W-8 Forms Cover Sheet at the University of Oregon

The key elements of the W-8 Forms Cover Sheet include:

- Personal Information: This section requires the individual's or entity's name, address, and taxpayer identification number.

- Form Type: Clearly indicate which W-8 form is being submitted.

- Certification: A declaration confirming the accuracy of the information provided and the individual's foreign status.

- Signature: The form must be signed and dated to validate the submission.

Legal use of the W-8 Forms Cover Sheet at the University of Oregon

The legal use of the W-8 Forms Cover Sheet is crucial for compliance with U.S. tax laws. This document allows foreign individuals and entities to claim a reduced rate of withholding tax on income sourced from the U.S. It is essential to ensure that all information is accurate and complete to avoid potential penalties or issues with the IRS. Proper use of the W-8 Forms Cover Sheet can also facilitate smoother financial transactions and compliance with any applicable tax treaties.

Filing Deadlines / Important Dates for the W-8 Forms Cover Sheet at the University of Oregon

Filing deadlines for the W-8 Forms Cover Sheet can vary depending on the nature of the income received. Generally, it is advisable to submit the cover sheet and the corresponding W-8 form before the first payment is made to ensure proper withholding rates are applied. Additionally, if there are any changes in circumstances that affect the information provided, a new W-8 form should be submitted promptly. Keeping track of these deadlines is essential to maintain compliance with IRS regulations.

Quick guide on how to complete w 8 forms cover sheet university of oregon

Effortlessly Prepare [SKS] on Any Device

Digital document management has become increasingly favored by companies and individuals. It serves as an ideal eco-conscious alternative to traditional printed and signed papers, as you can easily find the required form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage [SKS] on any device using airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

How to Modify and eSign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your signature using the Sign feature, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS] and ensure outstanding communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to W 8 Forms Cover Sheet University Of Oregon

Create this form in 5 minutes!

How to create an eSignature for the w 8 forms cover sheet university of oregon

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the difference between w8ben and w8eci?

Form W-8BEN-E, Certificate of Status of Beneficial Owner for United States Tax Withholding and Reporting (Entities). Form W-8ECI, Certificate of Foreign Person's Claim That Income Is Effectively Connected With the Conduct of a Trade or Business in the United States.

-

What is a W8BEN form used for?

The W-8BEN is an Internal Revenue Service (IRS) mandated form to collect correct Nonresident Alien (NRA) taxpayer information for individuals for reporting purposes and to document their status for tax reporting purposes. (The form for entities is the W-8BEN-E.)

-

What is a w8 tax form?

What Are W-8 Forms? W-8 forms are Internal Revenue Service (IRS) forms that foreign individuals and businesses must file to verify their country of residence for tax purposes, signNowing that they qualify for a lower rate of tax withholding.

-

When to use W8ECI?

You must give Form W-8 ECI to the withholding agent or payer if you are a foreign person and you are the beneficial owner of U.S. source income that is (or is deemed to be) effectively connected with the conduct of a trade or business within the United States.

-

Who needs to fill out W-8BEN E?

Who Must Provide Form W-8BEN-E. You must give Form W-8BEN-E to the withholding agent or payer if you are a foreign entity receiving a withholdable payment from a withholding agent, receiving a payment subject to chapter 3 withholding, or if you are an entity maintaining an account with an FFI requesting this form.

-

What is W8 CE?

Purpose of the W-8CE The purpose of this form as provided by the IRS is simply to notify the payer that person is a covered expatriate. This can have a signNow impact on how certain current and future income is taxed once the taxpayer is no longer considered a us person for tax purposes.

Get more for W 8 Forms Cover Sheet University Of Oregon

- Wayne state university neurosurgery neurosurgery med wayne form

- Copy of cds reformatted nyu

- Putnam county sales information from 03 01 to 03 31 disclaimer this information has been compiled from documents recorded in

- Who will preserve their story form

- Ascent american express form

- Request for pre mat transcript evaluation for childhood education coehp uark form

- Example petition for exemption swcleanair form

- Example initial notification form u s environmental protection epa

Find out other W 8 Forms Cover Sheet University Of Oregon

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document

- Help Me With Sign Alabama Courts Form

- Help Me With Sign Virginia Police PPT

- How To Sign Colorado Courts Document

- Can I eSign Alabama Banking PPT

- How Can I eSign California Banking PDF

- How To eSign Hawaii Banking PDF

- How Can I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- How Do I eSign Hawaii Banking Document

- Help Me With eSign Hawaii Banking Document

- How To eSign Hawaii Banking Document

- Can I eSign Hawaii Banking Presentation

- Can I Sign Iowa Courts Form

- Help Me With eSign Montana Banking Form