Sections 3 and 4 Are to Be Completed Where Applicable Form

Understanding the Purpose of Sections 3 and 4

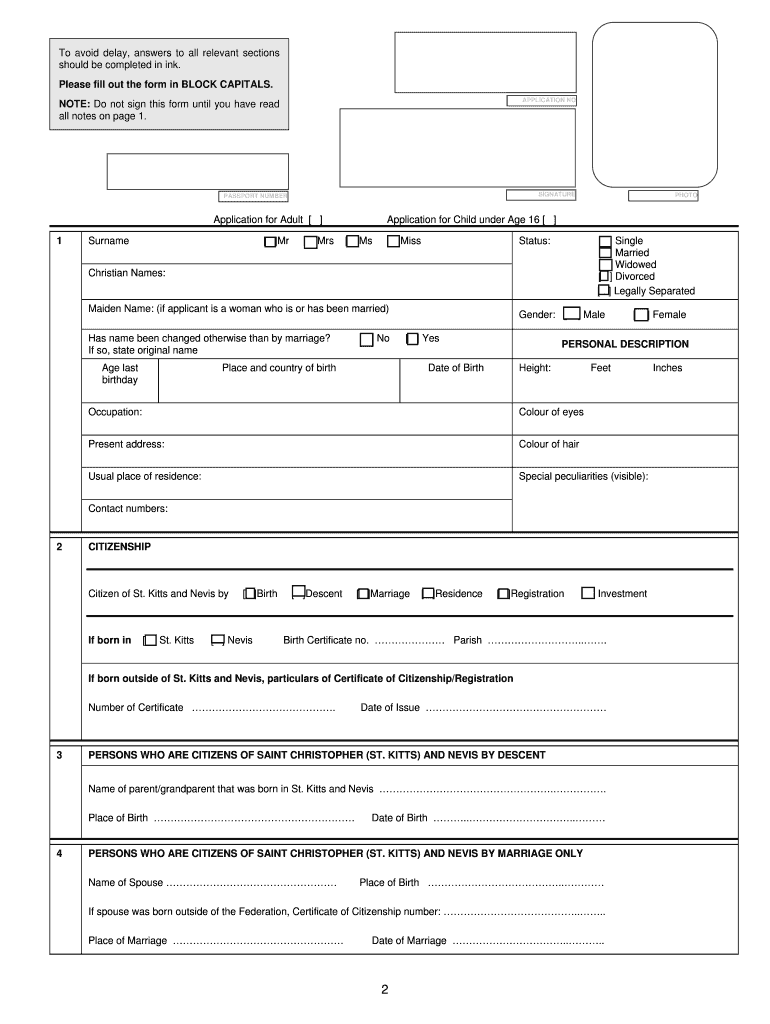

Sections 3 and 4 are designed to gather specific information relevant to the form being completed. These sections typically require details that help clarify the intent and context of the submission. Completing these sections accurately is essential for ensuring that the form is processed correctly and in compliance with applicable regulations.

Steps to Complete Sections 3 and 4

To fill out Sections 3 and 4 effectively, follow these steps:

- Review the instructions provided with the form to understand what information is required in each section.

- Gather any necessary documents or information that may be needed to complete these sections.

- Carefully fill in the required fields, ensuring that all information is accurate and complete.

- Double-check your entries for any errors or omissions before finalizing the form.

Legal Considerations for Sections 3 and 4

Understanding the legal implications of Sections 3 and 4 is crucial. These sections often require information that can affect your legal standing or compliance with regulations. Failing to provide accurate information may result in penalties or delays in processing. It is advisable to consult legal guidelines or a professional if you are uncertain about what to include.

Common Scenarios for Using Sections 3 and 4

Sections 3 and 4 can be relevant in various scenarios, such as:

- Filing tax documents where specific financial details are necessary.

- Submitting applications that require personal or business information.

- Providing information for compliance with regulatory requirements.

Required Documentation for Sections 3 and 4

When completing Sections 3 and 4, you may need to provide supporting documentation. This could include:

- Identification documents, such as a driver’s license or social security number.

- Financial records that substantiate the information provided.

- Any relevant legal documents that support your claims or statements.

Submission Methods for Sections 3 and 4

Once Sections 3 and 4 are completed, the form can typically be submitted through various methods, including:

- Online submission via a designated portal.

- Mailing the completed form to the appropriate address.

- In-person submission at designated offices or agencies.

Quick guide on how to complete sections 3 and 4 are to be completed where applicable

Complete [SKS] effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, edit, and eSign your documents quickly and without delays. Handle [SKS] on any device using airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to edit and eSign [SKS] easily

- Locate [SKS] and then click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and then click on the Done button to save your edits.

- Select your preferred method of delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign [SKS] and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Sections 3 And 4 Are To Be Completed Where Applicable

Create this form in 5 minutes!

How to create an eSignature for the sections 3 and 4 are to be completed where applicable

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does section 3 mean in construction?

Section 3 projects are housing rehabilitation, housing construction, and other public construction projects assisted under HUD programs that provide housing and community development financial assistance when the total amount of assistance to the project exceeds a threshold of $200,000.

-

What is Section 3 of Article 4?

The Congress shall have Power to dispose of and make all needful Rules and Regulations respecting the Territory or other Property belonging to the United States; and nothing in this Constitution shall be so construed as to Prejudice any Claims of the United States, or of any particular State.

-

What is section 3 of the act?

Section 3 is a provision of the Housing and Urban Development Act of 1968 whose purpose is to ensure that employment and other economic opportunities generated by certain HUD financial assistance shall, to the greatest extent feasible, and consistent with existing federal, state, and local laws and regulations, be ...

-

What is Section 3 Clause 4?

The Vice President of the United States shall be President of the Senate, but shall have no Vote, unless they be equally divided.

Get more for Sections 3 And 4 Are To Be Completed Where Applicable

- Change of address form non hub access registrar university at registrar buffalo

- Oit office of information technology

- Ucla cs account form ucla computer science department cs ucla

- Brand new online database platform grey house publishing

- Sec entitlement packet hedge fund law blog form

- In the county court of the eighth judicial circuit alachuaclerk form

- Visiting graduate student application form virginia tech graduate graduateschool vt

- Instructions to obtain a birth certificate form

Find out other Sections 3 And 4 Are To Be Completed Where Applicable

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online