Report by a Corporation Included in a Combined Franchise Tax Tax Ny Form

What is the Report By A Corporation Included In A Combined Franchise Tax Tax Ny

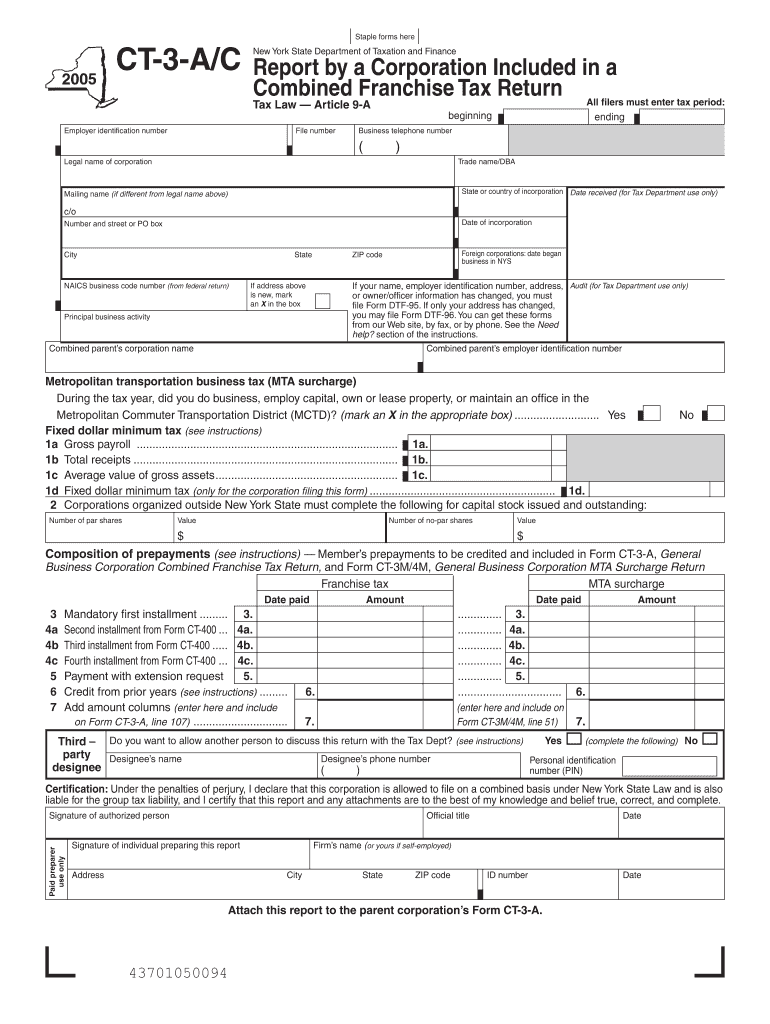

The Report By A Corporation Included In A Combined Franchise Tax Tax Ny is a document required by the New York State Department of Taxation and Finance. This report is typically filed by corporations that are part of a combined group for franchise tax purposes. It consolidates the financial information of multiple entities into a single report, allowing the state to assess the combined tax liability of the group. This form ensures that all applicable income and deductions are accurately reported, reflecting the overall financial position of the corporation and its affiliates.

Steps to complete the Report By A Corporation Included In A Combined Franchise Tax Tax Ny

Completing the Report By A Corporation Included In A Combined Franchise Tax Tax Ny involves several key steps:

- Gather financial statements for all entities in the combined group.

- Determine the appropriate tax year for the report.

- Calculate the combined income and deductions for the group.

- Fill out the required sections of the form accurately, ensuring all figures are consistent with the gathered financial data.

- Review the completed report for accuracy and completeness.

- Submit the report by the specified filing deadline.

Required Documents

To complete the Report By A Corporation Included In A Combined Franchise Tax Tax Ny, several documents are necessary:

- Financial statements for each corporation in the combined group.

- Tax returns from previous years for reference.

- Documentation supporting any deductions or credits claimed.

- Any additional schedules required by the New York State Department of Taxation and Finance.

Filing Deadlines / Important Dates

Filing deadlines for the Report By A Corporation Included In A Combined Franchise Tax Tax Ny are crucial to avoid penalties. Typically, the report is due on the fifteenth day of the fourth month following the end of the corporation's tax year. For example, if the tax year ends on December thirty-first, the report must be filed by April fifteenth of the following year. It is important to check for any updates or changes to these deadlines annually.

Penalties for Non-Compliance

Failure to file the Report By A Corporation Included In A Combined Franchise Tax Tax Ny on time can result in significant penalties. These may include:

- Monetary fines based on the amount of tax owed.

- Interest charges on any unpaid taxes.

- Potential legal action for continued non-compliance.

It is essential for corporations to adhere to filing requirements to avoid these repercussions.

Legal use of the Report By A Corporation Included In A Combined Franchise Tax Tax Ny

The legal use of the Report By A Corporation Included In A Combined Franchise Tax Tax Ny is primarily for compliance with state tax laws. Corporations must accurately report their financial activities to ensure that they meet their tax obligations. This form also serves as a legal document that may be reviewed during audits or investigations by tax authorities. Proper completion and submission of the report help maintain a corporation's good standing with the state.

Quick guide on how to complete report by a corporation included in a combined franchise tax tax ny

Effortlessly Prepare [SKS] on Any Gadget

Digital document management has become increasingly favored by businesses and individuals. It serves as an excellent environmentally friendly alternative to conventional printed and signed documents, allowing you to easily locate the right form and securely keep it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents quickly and efficiently. Manage [SKS] on any device with airSlate SignNow’s Android or iOS applications and simplify your document-related tasks today.

The Easiest Method to Edit and Electronically Sign [SKS] with Ease

- Find [SKS] and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of the documents or conceal sensitive information using tools designed specifically for those purposes by airSlate SignNow.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to保存 your changes.

- Choose your preferred method to share your form, via email, text message (SMS), or a link invitation, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow manages all your document administration needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] while ensuring excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Report By A Corporation Included In A Combined Franchise Tax Tax Ny

Create this form in 5 minutes!

How to create an eSignature for the report by a corporation included in a combined franchise tax tax ny

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Does an S Corp pay franchise tax in NY?

New York has a corporation franchise tax, which applies to both traditional (C-type) corporations and to S corporations, and a tax known simply as the "filing fee," which applies to LLCs, limited liability partnerships (LLPs), and some regular partnerships.

-

Are corporations subject to double taxation?

Most commonly, double taxation happens when a company earns a profit in the form of dividends. The company pays the taxes on its annual profits first. Then, after the company pays its dividends to shareholders, shareholders pay a second tax.

-

What is the difference between franchise tax and corporate tax?

The corporate franchise tax is paid by most businesses in the state for the privilege of doing business in California, while the corporate income tax is paid by businesses which do not have sufficient presence or activity in the state for franchise tax purposes. The bank tax is paid by banks and financial institutions.

-

How much are franchise taxes in New York?

Corporation franchise tax distribution Tax yearTax amountPercent of total tax 2019 less than or equal to $999 0.96% greater than or equal to $1 million 73.75% 2020 less than or equal to $999 0.85% greater than or equal to $1 million 73.95%8 more rows • Aug 20, 2024

-

How to calculate New York State franchise tax?

New York's corporate franchise tax applies to both C and S corporations. To calculate and pay it, you must fill out and file Form CT-3, your New York corporate tax return. For many businesses, this tax ends up being somewhere around 6.5% of their business income earned in New York.

-

How do I calculate NYS sales tax?

How to calculate NYC sales tax? To calculate the amount of sales tax to charge in New York City, use this simple formula: Sales tax = total amount of sale x sales tax rate (in this case 8%).

-

Is NYS franchise tax based on income?

For traditional corporations, the amount of corporation franchise tax due is the highest of the following three tax bases: the corporation's business income base. the corporation's business capital base, or. a fixed dollar minimum (FDM) tax.

-

How to calculate NY franchise tax?

New York's corporate franchise tax applies to both C and S corporations. To calculate and pay it, you must fill out and file Form CT-3, your New York corporate tax return. For many businesses, this tax ends up being somewhere around 6.5% of their business income earned in New York.

Get more for Report By A Corporation Included In A Combined Franchise Tax Tax Ny

- Support your library talcott library form

- Welcome to lifeline form

- Reedsburg public library donation form reedsburglibrary

- Orall application form ohio regional association of law orall

- Application form montana state library msl mt

- Jetform80001102 library ifd dor ms

- Report of personal property for sale aphis aphis usda form

- Ucsd library system registration form campus libraries ucsd

Find out other Report By A Corporation Included In A Combined Franchise Tax Tax Ny

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document