Managing General AgentUnderwriter Supplemental Application NOTE Please Attach a Sample Contract of Engagement Form

Understanding the Managing General AgentUnderwriter Supplemental Application

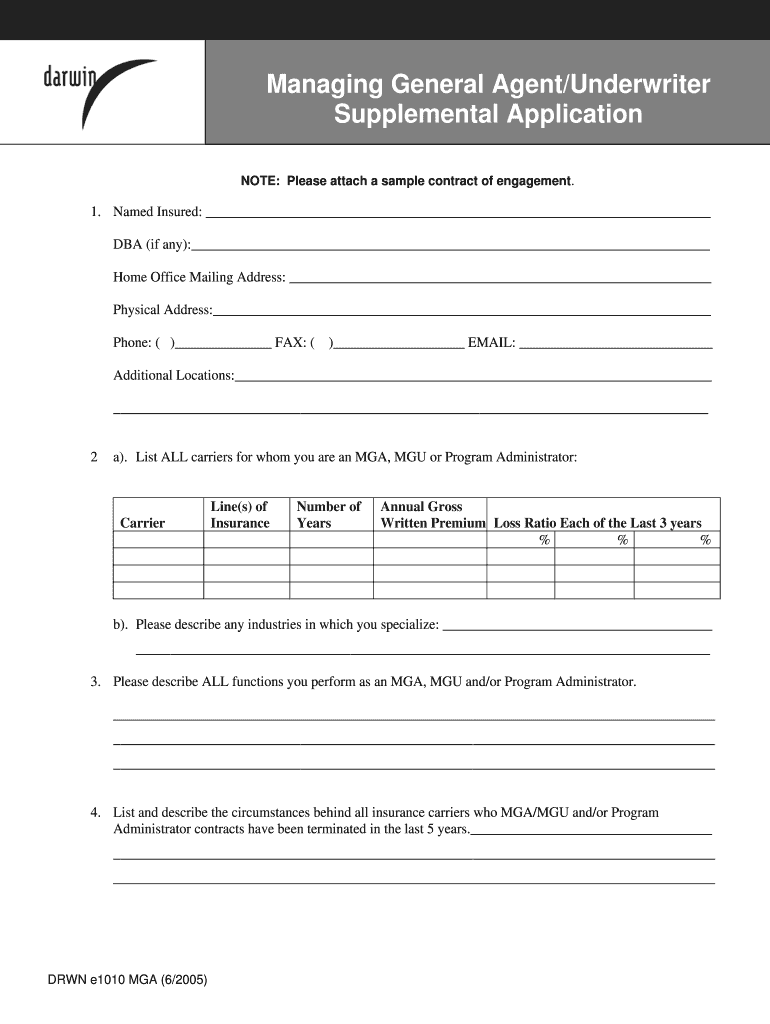

The Managing General AgentUnderwriter Supplemental Application is a specialized form used in the insurance industry. This application is essential for agents and underwriters seeking to establish or maintain a contractual relationship with insurance companies. It typically requires detailed information about the agent's qualifications, business practices, and the types of insurance products they intend to offer. The form aims to ensure that all parties involved understand their roles and responsibilities, thereby facilitating a smoother engagement process.

Steps to Complete the Managing General AgentUnderwriter Supplemental Application

Completing the Managing General AgentUnderwriter Supplemental Application involves several key steps:

- Gather Required Information: Collect all necessary documents and information, including your business license, proof of insurance, and financial statements.

- Fill Out the Application: Carefully complete each section of the application, ensuring that all information is accurate and up to date.

- Attach Supporting Documents: Include a sample contract of engagement and any other required documents as specified in the application instructions.

- Review the Application: Double-check all entries for accuracy and completeness before submission.

- Submit the Application: Follow the specified submission method, whether online, by mail, or in-person, as indicated in the application guidelines.

Legal Use of the Managing General AgentUnderwriter Supplemental Application

The Managing General AgentUnderwriter Supplemental Application is legally binding once signed by all parties involved. It serves as a formal agreement that outlines the expectations and responsibilities of the agent and the underwriter. Compliance with state regulations and industry standards is crucial when using this application. Failure to adhere to these legal requirements can result in penalties or the invalidation of the contract.

Key Elements of the Managing General AgentUnderwriter Supplemental Application

Several key elements are essential to the Managing General AgentUnderwriter Supplemental Application:

- Agent Information: Details about the managing general agent, including business name, address, and contact information.

- Underwriter Information: Information about the underwriter or insurance company involved.

- Scope of Authority: A clear outline of the authority granted to the agent, including types of insurance products and limits of coverage.

- Contractual Terms: Specific terms and conditions that govern the relationship between the parties.

- Signatures: Required signatures from both parties to validate the agreement.

Required Documents for Submission

When submitting the Managing General AgentUnderwriter Supplemental Application, certain documents are typically required:

- A completed application form.

- A sample contract of engagement.

- Proof of licensing and regulatory compliance.

- Financial statements or proof of financial stability.

- Any additional documentation as specified by the underwriter.

Application Process and Approval Time

The application process for the Managing General AgentUnderwriter Supplemental Application generally involves the following stages:

- Submission: Submit the completed application and required documents to the underwriter.

- Review: The underwriter reviews the application for completeness and compliance with their requirements.

- Approval: Once reviewed, the application may be approved, denied, or returned for additional information.

Approval times can vary based on the underwriter's workload and the complexity of the application, typically ranging from a few days to several weeks.

Quick guide on how to complete managing general agentunderwriter supplemental application note please attach a sample contract of engagement

Complete [SKS] seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the features required to create, modify, and eSign your documents quickly without delays. Handle [SKS] on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign [SKS] effortlessly

- Locate [SKS] and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or black out sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign [SKS] and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Managing General AgentUnderwriter Supplemental Application NOTE Please Attach A Sample Contract Of Engagement

Create this form in 5 minutes!

How to create an eSignature for the managing general agentunderwriter supplemental application note please attach a sample contract of engagement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What does MGA stand for in insurance?

While an insurance broker works on behalf of the policyholder, an MGA works on behalf of the insurance company. An MGA can be used by an insurance company in order to outsource certain tasks, such as claims handling or underwriting.

-

What is the difference between a general agent and a managing general agent?

A managing general agent (MGA) is a specialized type of insurance agent/broker that, unlike traditional agents/brokers, is vested with underwriting authority from an insurer.

-

What is a managing general agent in insurance?

An MGA: acts as a distributor and outsourced service provider for both insurers and reinsurers. provides underwriting expertise, insurance cover, and related services. to insurers on behalf of reinsurers; and. to insurance buyers on behalf of insurers via insurance brokers and retail agents.

-

What is the difference between program administrator and managing general agent?

There is a difference between a program administrator and an agency with binding authority. In the former case, an MGA can underwrite, rate, quote, bind, issue and service policies. ing to Victoria Webb, the MGA is, in fact, the carrier bearing the profit and loss that comes from placement.

-

What does an MGA do in insurance?

Insurance MGA's, or Managing General Agents, perform many tasks that typical insurance companies normally handle. These tasks can include binding coverage, underwriting, settling claims, and appointing retail agents in a certain region.

-

What is the difference between managing general agent and coverholder?

Managing Agents select and oversee Coverholders. Coverholder: Is a company that underwrites risk on behalf of a Managing Agent.

-

How do managing general agents make money?

Compensation - MGAs usually earn a commission based on the amount of business they generate. Some companies pay commissions at different levels depending on the type of policy sold.

Get more for Managing General AgentUnderwriter Supplemental Application NOTE Please Attach A Sample Contract Of Engagement

- Learning disabilities foundation of america form

- Change of major major declaration form edison state

- Department of counseling and human development services form

- 2018 2019 gold verification form v4 nauedu

- Fellowship trainingdepartment of urology form

- Btravelb pre approval bformb stony brook university stonybrook

- Verify that you provided correct information the uco financial aid office will compare your fafsa with the

- A dependency override generally can be considered for an otherwise dependent fafsa applicant if one or more of form

Find out other Managing General AgentUnderwriter Supplemental Application NOTE Please Attach A Sample Contract Of Engagement

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile