EMPLOYEE PAYROLL REIMBURSEMENTS ATTACH Form

What is the EMPLOYEE PAYROLL REIMBURSEMENTS ATTACH

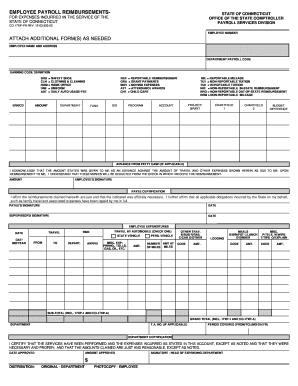

The EMPLOYEE PAYROLL REIMBURSEMENTS ATTACH is a crucial document used by businesses to manage and document reimbursements made to employees for various expenses incurred during the course of their work. This form serves as a formal record to ensure that reimbursements are properly accounted for in payroll and tax reporting. It typically includes details such as the employee's name, the nature of the expenses, and the amounts being reimbursed. Proper use of this form helps maintain transparency and compliance with tax regulations.

How to use the EMPLOYEE PAYROLL REIMBURSEMENTS ATTACH

To effectively use the EMPLOYEE PAYROLL REIMBURSEMENTS ATTACH, employers should follow a systematic approach. First, gather all necessary receipts and documentation that support the reimbursement claims. Next, fill out the form accurately, ensuring all required fields are completed, including the employee's information and a breakdown of the expenses. After completing the form, submit it to the payroll department for processing. It is essential to keep a copy for record-keeping and future reference.

Steps to complete the EMPLOYEE PAYROLL REIMBURSEMENTS ATTACH

Completing the EMPLOYEE PAYROLL REIMBURSEMENTS ATTACH involves several key steps:

- Collect all relevant receipts and documentation for the expenses.

- Fill out the form with the employee's name, ID, and the details of each expense.

- Calculate the total amount to be reimbursed and ensure it matches the receipts.

- Review the completed form for accuracy and completeness.

- Submit the form to the payroll department along with the supporting documents.

Key elements of the EMPLOYEE PAYROLL REIMBURSEMENTS ATTACH

The EMPLOYEE PAYROLL REIMBURSEMENTS ATTACH includes several key elements that are essential for proper processing:

- Employee Information: Name, employee ID, and department.

- Expense Details: A description of each expense, including date, purpose, and amount.

- Total Reimbursement Amount: The sum of all expenses being claimed.

- Signatures: Required signatures from both the employee and a supervisor or manager for approval.

Legal use of the EMPLOYEE PAYROLL REIMBURSEMENTS ATTACH

The EMPLOYEE PAYROLL REIMBURSEMENTS ATTACH must be used in accordance with federal and state regulations governing employee reimbursements. Employers should ensure that the expenses claimed are legitimate and directly related to business activities. Misuse of this form can lead to legal repercussions, including audits and penalties. It is advisable for businesses to maintain clear policies regarding what constitutes reimbursable expenses and to educate employees accordingly.

Required Documents

When submitting the EMPLOYEE PAYROLL REIMBURSEMENTS ATTACH, several documents are typically required to support the reimbursement claims:

- Receipts: Original receipts for each expense being claimed.

- Approval Signatures: Signatures from supervisors or managers approving the expenses.

- Expense Reports: Any additional documentation that outlines the nature of the expenses.

Quick guide on how to complete employee payroll reimbursements attach

Effortlessly Complete [SKS] on Any Device

Managing documents online has gained popularity among companies and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly and without delays. Handle [SKS] on any platform using the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

The easiest way to edit and electronically sign [SKS] without hassle

- Obtain [SKS] and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with the tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature using the Sign feature, which only takes seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and then click the Done button to save your edits.

- Select your preferred method to send your form, by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to EMPLOYEE PAYROLL REIMBURSEMENTS ATTACH

Create this form in 5 minutes!

How to create an eSignature for the employee payroll reimbursements attach

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

Do employee reimbursements have to go through payroll?

You can integrate reimbursements directly into your payroll system or reimburse employees separately for expenses via check or direct deposit. While convenient for the employer, keep in mind that expense reimbursements via payroll may mean employees have to wait longer to receive their money back.

-

How to account for employee reimbursements in QuickBooks?

Check the mapping for your reimbursements Go to the Gear icon on the top right and select Payroll Settings. Under Accounting, select the Pencil icon. Scroll down to Wage Expenses and select the Pencil icon. Scroll down to Reimbursements and choose the liability account you made earlier. Select Save, then Done.

-

How do I account for employee reimbursements in Quickbooks?

Check the mapping for your reimbursements Go to the Gear icon on the top right and select Payroll Settings. Under Accounting, select the Pencil icon. Scroll down to Wage Expenses and select the Pencil icon. Scroll down to Reimbursements and choose the liability account you made earlier. Select Save, then Done.

-

How do you record employee reimbursed expenses?

How to record and reimburse employee expenses Create an expense reimbursement report form. Create a spreadsheet with the expense report format you prefer. ... Set rules for expense reimbursement. ... Decide who will be responsible for approving or denying expense reimbursement. ... Pay employee approved reimbursable expenses.

-

How do I record a reimbursement in QuickBooks?

Select Journal Entry. Click the Account column to open a dropdown menu of accounts that are connected to QuickBooks and that you conduct the majority of your business through. Choose the bank account you use to pay employee expenses. Enter the reimbursement amount under the Credits column.

-

How do you account for employee reimbursement?

Enter each reimbursement item as a Manual Journal Entry (MJE), debiting the expense, and crediting "Employee Reimbursement - Clearing" (you could do a full expense report in one go or one MJE for each individual receipt).

-

How do you account for employee reimbursement?

Enter each reimbursement item as a Manual Journal Entry (MJE), debiting the expense, and crediting "Employee Reimbursement - Clearing" (you could do a full expense report in one go or one MJE for each individual receipt).

-

How do you record employee reimbursed expenses?

How to record and reimburse employee expenses Create an expense reimbursement report form. Create a spreadsheet with the expense report format you prefer. ... Set rules for expense reimbursement. ... Decide who will be responsible for approving or denying expense reimbursement. ... Pay employee approved reimbursable expenses.

Get more for EMPLOYEE PAYROLL REIMBURSEMENTS ATTACH

- New prescription fax order form 1 please fill out section 1 then have your physician fill out section 2 and fax it to

- Nhamcs 173 12 18 2014 sample national hospital ambulatory medical care survey 2015 emergency department patient record form

- Rare species reporting form maryland dnr wildlife and heritage service species name dates species was located county name

- Multi jurisdictional personal history disclosure form multi jurisdictional casinogaming license personal history disclosure

- State of florida department of highway safety and motor vehicles division of motorist services 2900 apalachee parkway ms72 form

- Dlab 1 rev 212 west virginia department of transportation division of motor vehicles wv dmv medical review services po box form

- Deland police department ridealong program application name age dob address home phone work phone schoolemployer have you read form

- Antidegradation policy implementation internal management directive for npdes permits and section 401 water quality form

Find out other EMPLOYEE PAYROLL REIMBURSEMENTS ATTACH

- Electronic signature Legal PDF Vermont Online

- How Can I Electronic signature Utah Legal Separation Agreement

- Electronic signature Arizona Plumbing Rental Lease Agreement Myself

- Electronic signature Alabama Real Estate Quitclaim Deed Free

- Electronic signature Alabama Real Estate Quitclaim Deed Safe

- Electronic signature Colorado Plumbing Business Plan Template Secure

- Electronic signature Alaska Real Estate Lease Agreement Template Now

- Electronic signature Colorado Plumbing LLC Operating Agreement Simple

- Electronic signature Arizona Real Estate Business Plan Template Free

- Electronic signature Washington Legal Contract Safe

- How To Electronic signature Arkansas Real Estate Contract

- Electronic signature Idaho Plumbing Claim Myself

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement