MICHIGAN Business Tax Film Credit State of Michigan Michigan Form

What is the MICHIGAN Business Tax Film Credit

The MICHIGAN Business Tax Film Credit is a financial incentive offered by the State of Michigan to encourage film production within the state. This credit allows eligible businesses to receive a percentage of their qualified production expenses as a tax credit. The aim is to stimulate economic growth by attracting filmmakers and production companies to Michigan, thereby creating jobs and boosting local economies. The credit is designed to support a range of production activities, including feature films, television shows, and other media projects that meet specific criteria set by the state.

Eligibility Criteria for the MICHIGAN Business Tax Film Credit

To qualify for the MICHIGAN Business Tax Film Credit, applicants must meet several criteria. The production must be filmed in Michigan and must incur a minimum amount of qualified expenses. Additionally, the project must be a feature film or television series that meets the state's definition of a qualified production. Certain types of productions, such as documentaries or commercials, may not be eligible. Applicants must also be registered businesses in Michigan and comply with all local regulations and tax obligations.

Steps to Complete the MICHIGAN Business Tax Film Credit Application

Completing the application for the MICHIGAN Business Tax Film Credit involves several key steps:

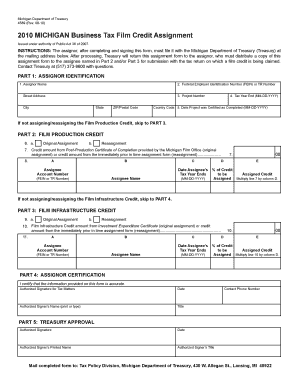

- Gather necessary documentation, including proof of production expenses and business registration.

- Complete the application form, ensuring all required information is accurately filled out.

- Submit the application along with supporting documents to the appropriate state department.

- Await confirmation of application receipt and any further instructions from the state.

- Upon approval, ensure compliance with any ongoing reporting requirements to maintain eligibility for the credit.

Required Documents for the MICHIGAN Business Tax Film Credit

When applying for the MICHIGAN Business Tax Film Credit, specific documents must be submitted to verify eligibility and expenses. These documents typically include:

- Proof of production expenses, such as invoices and receipts.

- Business registration documentation to confirm the applicant's status as a Michigan business.

- A detailed budget outlining the production costs.

- Any additional forms required by the state, which may vary depending on the specific project.

Filing Deadlines for the MICHIGAN Business Tax Film Credit

It is crucial to be aware of the filing deadlines associated with the MICHIGAN Business Tax Film Credit. Applications must typically be submitted within a specific timeframe following the completion of the production. This deadline ensures that the state can process the credit in a timely manner. Additionally, there may be annual deadlines for claiming the credit on tax returns, so it is important to stay informed about any changes to these dates.

Examples of Using the MICHIGAN Business Tax Film Credit

Various productions have successfully utilized the MICHIGAN Business Tax Film Credit to offset their costs. For instance, feature films that have filmed significant portions in Michigan can claim credits based on their local expenditures. Television series that regularly shoot in the state also benefit from this incentive, which can lead to substantial savings. These examples highlight the credit's role in making Michigan an attractive location for media production.

Quick guide on how to complete michigan business tax film credit state of michigan michigan

Accomplish [SKS] effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the right format and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without delays. Administer [SKS] on any device using airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to alter and eSign [SKS] with ease

- Find [SKS] and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal authority as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you wish to send your form, through email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] to ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MICHIGAN Business Tax Film Credit State Of Michigan Michigan

Create this form in 5 minutes!

How to create an eSignature for the michigan business tax film credit state of michigan michigan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

How to claim film tax credit?

What is the Film Tax Relief claim process? Film Tax Relief is claimed by the film production company for each accounting period through the Corporation Tax Self-Assessment process (CTSA). The Film Production Company must complete the relevant section on the Corporation Tax Return (CT600).

-

What is the difference between CIT and MBT in Michigan?

The CIT replaces the Michigan Business Tax; however, MBT taxpayers who have received or been assigned certain certificated credits may elect to continue to file under the MBT rather than the new CIT in order to claim such credits.

-

What is the 50 cent film tax credit?

On Nov. 13, Louisiana's House of Representatives voted to repeal the $150 million film tax credit, known as House Bill 2, KSLA reports. As the bill heads to the Senate, 50 Cent addressed the news on social media, highlighting its potential impact on the media empire he established in Shreveport earlier this year.

-

How does production tax credit work?

The production tax credit (PTC) is a per kilowatt-hour (kWh) tax credit for electricity generated by solar and other qualifying technologies for the first 10 years of a system's operation. It reduces the federal income tax liability and is adjusted annually for inflation.

-

Does Michigan have a film tax credit?

The Michigan Film and Digital Media Office could approve credits for 30% of the qualified production expenditures if the proposed production includes approved logos or 25% if it does not.

-

What is the cap on production tax credits?

The California Film Commission administers the Film & Television Tax Credit Program 3.0 which provides tax credits based on qualified expenditures for eligible productions that are produced in California. The $1.55 billion program runs for 5 years, with a sunset date of June 30, 2025.

-

How do tax credits work for film production?

Tax Credits: Tax credits are the most prevalent form of film incentive. Production companies receive credits against their tax liability, often based on a percentage of qualified production expense incurred within the jurisdiction.

-

How to calculate film tax credit?

The qualifying expenditure figure is multiplied by the credit rate of 53% to give the amount of the “above the line” credit before tax. The maximum credit a film can receive is £6.36 million, which is based on the maximum amount a film would be entitled to if it had total core expenditure of £15 million.

Get more for MICHIGAN Business Tax Film Credit State Of Michigan Michigan

- News ampamp multimedia form

- You may qualify to file your federal and arizona form

- It 20np nonprofit organization unrelated business income tax booklet edition of the indiana department of revenue it 20np form

- Short year or fiscal year return due before tax forms

- Tax credit scottsdale unified school form

- 140ez form fill out ampamp sign online

- Arizona individual income tax forms

- Divorce form criteria azcourthelp org

Find out other MICHIGAN Business Tax Film Credit State Of Michigan Michigan

- eSignature Nebraska Rental lease agreement forms Fast

- eSignature Delaware Rental lease agreement template Fast

- eSignature West Virginia Rental lease agreement forms Myself

- eSignature Michigan Rental property lease agreement Online

- Can I eSignature North Carolina Rental lease contract

- eSignature Vermont Rental lease agreement template Online

- eSignature Vermont Rental lease agreement template Now

- eSignature Vermont Rental lease agreement template Free

- eSignature Nebraska Rental property lease agreement Later

- eSignature Tennessee Residential lease agreement Easy

- Can I eSignature Washington Residential lease agreement

- How To eSignature Vermont Residential lease agreement form

- How To eSignature Rhode Island Standard residential lease agreement

- eSignature Mississippi Commercial real estate contract Fast

- eSignature Arizona Contract of employment Online

- eSignature Texas Contract of employment Online

- eSignature Florida Email Contracts Free

- eSignature Hawaii Managed services contract template Online

- How Can I eSignature Colorado Real estate purchase contract template

- How To eSignature Mississippi Real estate purchase contract template