Life Insurance Claimant Statement Generic Form

Understanding the Life Insurance Claimant Statement

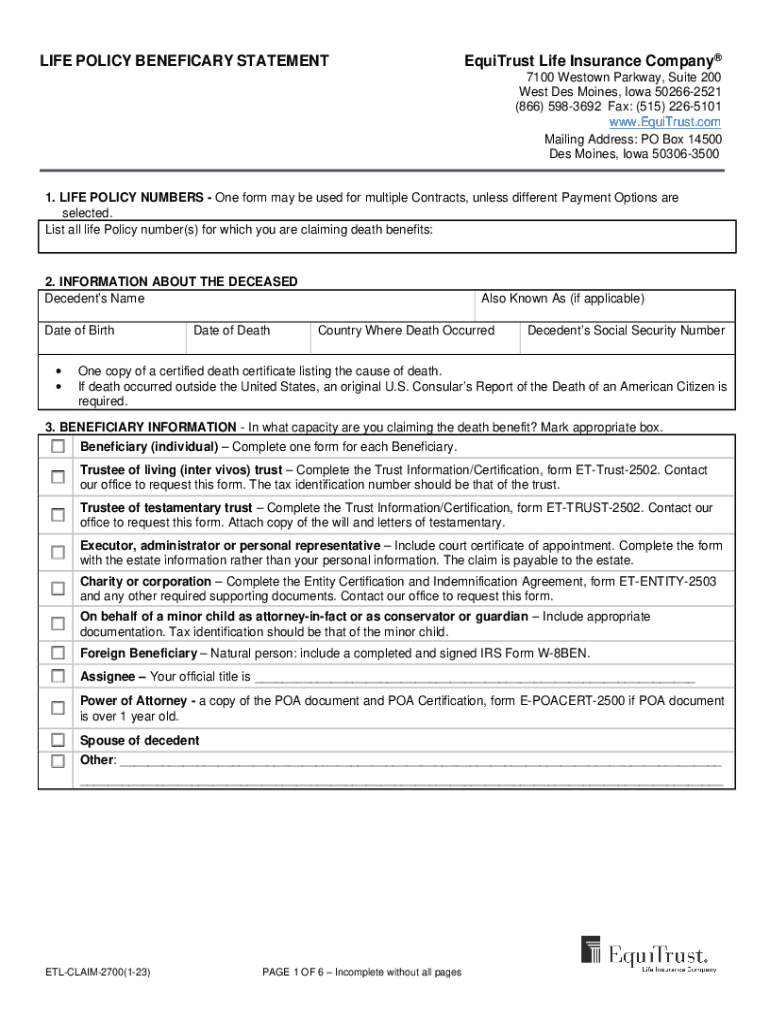

The Life Insurance Claimant Statement is a crucial document used to initiate the claims process for life insurance benefits. It serves as a formal request for the insurance company to review and process a claim following the death of the insured individual. This statement typically requires detailed information about the deceased, the claimant, and the policy itself, ensuring that all necessary data is captured to facilitate a smooth claims process.

How to Complete the Life Insurance Claimant Statement

Completing the Life Insurance Claimant Statement involves several key steps. First, gather all relevant information, including the policy number, the insured's details, and your relationship to the deceased. Next, fill out the statement accurately, ensuring that all required fields are completed. It is essential to provide truthful information, as discrepancies can lead to delays or denials of the claim. After completing the form, review it for accuracy before submission.

Required Documents for Submission

When submitting the Life Insurance Claimant Statement, certain documents are typically required to support your claim. These may include:

- A certified copy of the death certificate

- Proof of identity for the claimant

- Any additional documentation requested by the insurance company, such as medical records or policy documents

Ensuring that you have all necessary documents will help expedite the claims process.

Submission Methods for the Life Insurance Claimant Statement

The Life Insurance Claimant Statement can usually be submitted through various methods. Common submission options include:

- Online submission via the insurance company's website

- Mailing the completed form and supporting documents to the insurance company

- In-person submission at a local insurance office

Choosing the method that is most convenient for you can help streamline the claims process.

Key Elements of the Life Insurance Claimant Statement

Several key elements are essential to include in the Life Insurance Claimant Statement. These elements typically encompass:

- The full name and address of the claimant

- The deceased's full name, date of birth, and date of death

- The policy number and type of insurance

- A description of the relationship between the claimant and the deceased

Including these details ensures that the insurance company has the necessary information to process the claim efficiently.

Legal Considerations for the Life Insurance Claimant Statement

The Life Insurance Claimant Statement is a legally binding document. It is important to understand that providing false information can lead to legal repercussions, including denial of the claim or potential fraud charges. Therefore, it is vital to complete the statement with accurate and truthful information, as this can significantly impact the claims process and the outcome.

Quick guide on how to complete life insurance claimant statement generic

Effortlessly Prepare Life Insurance Claimant Statement Generic on Any Device

Online document handling has gained traction among businesses and individuals. It offers an ideal eco-conscious alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without issues. Manage Life Insurance Claimant Statement Generic on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Life Insurance Claimant Statement Generic with ease

- Obtain Life Insurance Claimant Statement Generic and click Get Form to initiate.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive data with the tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form via email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you choose. Edit and eSign Life Insurance Claimant Statement Generic and ensure exceptional communication at every phase of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the life insurance claimant statement generic

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Life Insurance Claimant Statement Generic?

A Life Insurance Claimant Statement Generic is a standardized form used to collect essential information from beneficiaries when filing a life insurance claim. This document helps streamline the claims process, ensuring that all necessary details are captured efficiently.

-

How does airSlate SignNow facilitate the completion of a Life Insurance Claimant Statement Generic?

airSlate SignNow provides an intuitive platform that allows users to easily fill out and eSign the Life Insurance Claimant Statement Generic. With its user-friendly interface, you can complete the form quickly, reducing the time it takes to submit your claim.

-

What are the benefits of using airSlate SignNow for Life Insurance Claimant Statements?

Using airSlate SignNow for Life Insurance Claimant Statements offers several benefits, including enhanced security, easy document tracking, and the ability to eSign from anywhere. This ensures that your claim is processed smoothly and securely.

-

Is there a cost associated with using airSlate SignNow for Life Insurance Claimant Statements?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. These plans are designed to be cost-effective, ensuring that you can manage your Life Insurance Claimant Statement Generic without breaking the bank.

-

Can I integrate airSlate SignNow with other software for managing Life Insurance Claimant Statements?

Absolutely! airSlate SignNow supports integrations with various software applications, allowing you to manage your Life Insurance Claimant Statement Generic alongside your existing tools. This enhances workflow efficiency and ensures seamless document management.

-

How secure is the information provided in a Life Insurance Claimant Statement Generic using airSlate SignNow?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect your data. When you submit a Life Insurance Claimant Statement Generic, you can trust that your information is safe and secure.

-

What features does airSlate SignNow offer for Life Insurance Claimant Statements?

airSlate SignNow offers features such as customizable templates, automated reminders, and real-time tracking for Life Insurance Claimant Statements. These features help streamline the claims process and improve overall efficiency.

Get more for Life Insurance Claimant Statement Generic

- Express waste profile republic services form

- The musicians way pdf form

- Reglamento interno de higiene y seguridad form

- Gvni79 annex etm1ni application to add a transport doeni gov form

- Employabilitylife skills assessment parent form ocali

- Investor investment agreement template form

- Investor financing agreement template form

- Investor equity buyout agreement template form

Find out other Life Insurance Claimant Statement Generic

- How Can I Sign West Virginia Courts Quitclaim Deed

- Sign Courts Form Wisconsin Easy

- Sign Wyoming Courts LLC Operating Agreement Online

- How To Sign Wyoming Courts Quitclaim Deed

- eSign Vermont Business Operations Executive Summary Template Mobile

- eSign Vermont Business Operations Executive Summary Template Now

- eSign Virginia Business Operations Affidavit Of Heirship Mobile

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement