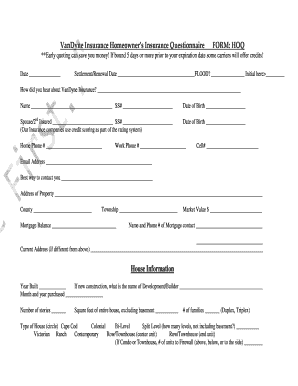

Homeowners Insurance Questionnaire Form

What is the homeowners insurance questionnaire

The homeowners insurance questionnaire is a comprehensive document designed to gather essential information from property owners. This form helps insurance companies assess risks and determine appropriate coverage options for homeowners. It typically includes questions about the property’s location, size, age, and construction materials, as well as details regarding the homeowner's personal circumstances, such as previous claims and security features. By completing this questionnaire, homeowners can ensure they receive tailored insurance solutions that meet their specific needs.

Key elements of the homeowners insurance questionnaire

Understanding the key elements of the homeowners insurance questionnaire is crucial for providing accurate information. Important sections often include:

- Property details: Information about the home’s address, type, and square footage.

- Coverage needs: Questions regarding desired coverage levels for dwelling, personal property, and liability.

- Home features: Details about safety features like smoke detectors, security systems, and fire extinguishers.

- Previous claims: A history of any past insurance claims made by the homeowner.

- Occupancy status: Whether the home is owner-occupied, rented, or vacant.

Steps to complete the homeowners insurance questionnaire

Completing the homeowners insurance questionnaire involves several straightforward steps:

- Gather information: Collect necessary details about your property and personal insurance history.

- Review the questionnaire: Familiarize yourself with the questions to understand what information is required.

- Provide accurate answers: Fill in the questionnaire carefully, ensuring all information is correct and up to date.

- Submit the form: Follow the specified submission method, whether online or via mail.

How to obtain the homeowners insurance questionnaire

The homeowners insurance questionnaire can typically be obtained directly from your insurance provider. Many companies offer this form on their websites, allowing homeowners to download and print it. Alternatively, you can request a physical copy from your insurance agent or customer service representative. Ensure you have the latest version of the questionnaire to avoid any outdated information that could affect your coverage.

Legal use of the homeowners insurance questionnaire

The homeowners insurance questionnaire serves a legal purpose in the insurance process. It is a binding document that helps establish the terms of coverage between the homeowner and the insurance company. Providing false information on this form can lead to penalties, including denial of claims or cancellation of the policy. Homeowners should ensure that all answers are truthful and reflect their current situation to maintain compliance with insurance regulations.

Form submission methods

Submitting the homeowners insurance questionnaire can typically be done through various methods, including:

- Online submission: Many insurance companies allow direct online submission through their portals.

- Mail: Homeowners can print the completed questionnaire and send it to the insurance provider’s designated address.

- In-person: Some homeowners may prefer to deliver the form directly to their insurance agent during a meeting.

Quick guide on how to complete homeowners insurance questionnaire

Effortlessly Prepare Homeowners Insurance Questionnaire on Any Gadget

Digital document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely save it online. airSlate SignNow provides all the tools you require to create, modify, and eSign your documents swiftly without delays. Manage Homeowners Insurance Questionnaire on any gadget using airSlate SignNow's Android or iOS applications, and simplify any document-oriented task today.

How to Modify and eSign Homeowners Insurance Questionnaire with Ease

- Obtain Homeowners Insurance Questionnaire and select Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from your chosen device. Modify and eSign Homeowners Insurance Questionnaire to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the homeowners insurance questionnaire

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a homeowners insurance questionnaire?

A homeowners insurance questionnaire is a document designed to gather essential information about your property and personal circumstances to help insurance providers assess risk and determine coverage options. By completing this questionnaire, you can ensure that you receive the most accurate quotes and coverage tailored to your needs.

-

How can airSlate SignNow help with homeowners insurance questionnaires?

airSlate SignNow streamlines the process of sending and eSigning homeowners insurance questionnaires, making it easy for both homeowners and insurance agents to collaborate. Our platform allows you to create, send, and manage these documents efficiently, ensuring a smooth experience for all parties involved.

-

What features does airSlate SignNow offer for homeowners insurance questionnaires?

With airSlate SignNow, you can customize your homeowners insurance questionnaire with various templates, add fields for signatures, and track document status in real-time. Our user-friendly interface ensures that you can easily manage your documents and keep everything organized.

-

Is airSlate SignNow cost-effective for managing homeowners insurance questionnaires?

Yes, airSlate SignNow offers a cost-effective solution for managing homeowners insurance questionnaires. Our pricing plans are designed to fit various budgets, allowing you to save time and money while ensuring that your documents are handled efficiently.

-

Can I integrate airSlate SignNow with other tools for homeowners insurance questionnaires?

Absolutely! airSlate SignNow integrates seamlessly with various applications, including CRM systems and cloud storage services. This allows you to streamline your workflow and manage your homeowners insurance questionnaires alongside other essential business processes.

-

What are the benefits of using airSlate SignNow for homeowners insurance questionnaires?

Using airSlate SignNow for homeowners insurance questionnaires provides numerous benefits, including enhanced efficiency, reduced paperwork, and improved collaboration. Our platform ensures that you can quickly gather necessary information and expedite the insurance process.

-

How secure is airSlate SignNow when handling homeowners insurance questionnaires?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and security protocols to protect your homeowners insurance questionnaires and sensitive information, ensuring that your data remains safe and confidential throughout the signing process.

Get more for Homeowners Insurance Questionnaire

- Wands for wildlife submission form

- Hicaps add provider 399722793 form

- Breach of commercial lease complaint form

- Twic card miami form

- Member sangguniang bayan form

- Form 4170

- Bylaws of trussville united soccer club leagueathleticscom form

- Conflict of interest declaration and contribution to the paper form

Find out other Homeowners Insurance Questionnaire

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile

- How Do I eSign Texas Renter's contract

- eSign Hawaii Sales contract template Myself

- How Can I eSign Washington Real estate sales contract template

- How To eSignature California Stock Certificate

- How Can I eSignature Texas Stock Certificate

- Help Me With eSign Florida New employee checklist

- How To eSign Illinois Rental application

- How To eSignature Maryland Affidavit of Identity

- eSignature New York Affidavit of Service Easy

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later