EZ DO NOT WRITE or STAPLE in THIS AREA DELAWARE INDIVIDUAL RESIDENT INCOME TAX RETURN FORM 200 03 EZ or Fiscal Year Beginning Yo

What is the EZ DO NOT WRITE OR STAPLE IN THIS AREA DELAWARE INDIVIDUAL RESIDENT INCOME TAX RETURN FORM 200 03 EZ

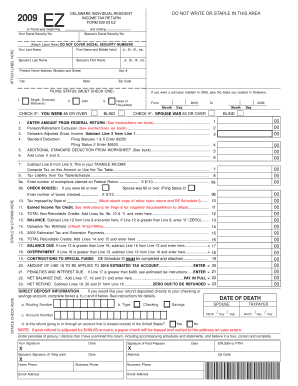

The EZ Delaware Individual Resident Income Tax Return Form 200 03 EZ is a simplified tax form designed for individuals residing in Delaware. It is intended for those who meet specific eligibility criteria, allowing them to file their state income tax returns with ease. This form is particularly useful for taxpayers with straightforward financial situations, such as those who do not have complex deductions or multiple sources of income. It streamlines the filing process, making it accessible for residents who may find traditional tax forms overwhelming.

How to use the EZ DO NOT WRITE OR STAPLE IN THIS AREA DELAWARE INDIVIDUAL RESIDENT INCOME TAX RETURN FORM 200 03 EZ

Using the EZ Delaware Individual Resident Income Tax Return Form 200 03 EZ involves several straightforward steps. First, ensure that you meet the eligibility requirements to use this simplified form. Gather all necessary documents, including your Social Security number and any relevant income statements. Carefully fill out the form, ensuring that you do not write or staple in the designated area. After completing the form, review it for accuracy before submitting it according to the provided instructions. This ensures that your tax return is processed efficiently.

Steps to complete the EZ DO NOT WRITE OR STAPLE IN THIS AREA DELAWARE INDIVIDUAL RESIDENT INCOME TAX RETURN FORM 200 03 EZ

Completing the EZ Delaware Individual Resident Income Tax Return Form 200 03 EZ involves a series of clear steps:

- Verify your eligibility to use the EZ form.

- Gather required documents, including your Social Security number and income records.

- Fill out the form accurately, ensuring to leave the specified area blank.

- Double-check all entries for accuracy.

- Submit the completed form via the designated method, either online or by mail.

Key elements of the EZ DO NOT WRITE OR STAPLE IN THIS AREA DELAWARE INDIVIDUAL RESIDENT INCOME TAX RETURN FORM 200 03 EZ

Several key elements are essential when using the EZ Delaware Individual Resident Income Tax Return Form 200 03 EZ. These include:

- Your Social Security number, which is crucial for identification purposes.

- Income information, including wages, pensions, and any other taxable income.

- Filing status, which may affect your tax rate and eligibility for certain deductions.

- Any applicable tax credits that can reduce your overall tax liability.

Filing Deadlines / Important Dates

It is important to be aware of the filing deadlines associated with the EZ Delaware Individual Resident Income Tax Return Form 200 03 EZ. Typically, the deadline for filing your state income tax return is April fifteenth of each year. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, if you require more time to prepare your return, you may request an extension, but it is crucial to pay any estimated taxes owed by the original deadline to avoid penalties.

Required Documents

To successfully complete the EZ Delaware Individual Resident Income Tax Return Form 200 03 EZ, you will need several documents, including:

- Your Social Security number.

- W-2 forms from employers detailing your income.

- Any 1099 forms for additional income sources.

- Records of any tax credits or deductions you plan to claim.

Form Submission Methods (Online / Mail / In-Person)

The EZ Delaware Individual Resident Income Tax Return Form 200 03 EZ can be submitted through various methods. Taxpayers may choose to file online through the Delaware Division of Revenue's website, which often provides a faster processing time. Alternatively, you can mail your completed form to the appropriate address provided in the instructions. In-person submissions may also be possible at designated tax offices, allowing for immediate assistance if needed.

Quick guide on how to complete ez do not write or staple in this area delaware individual resident income tax return form 200 03 ez or fiscal year beginning

Easily Prepare [SKS] on Any Device

Digital document management has gained popularity among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and simplify any document-related process today.

Effortlessly Modify and eSign [SKS]

- Obtain [SKS] and click on Get Form to initiate the process.

- Utilize the tools available to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes just a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form searches, and errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign [SKS] to ensure excellent communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to EZ DO NOT WRITE OR STAPLE IN THIS AREA DELAWARE INDIVIDUAL RESIDENT INCOME TAX RETURN FORM 200 03 EZ Or Fiscal Year Beginning Yo

Create this form in 5 minutes!

How to create an eSignature for the ez do not write or staple in this area delaware individual resident income tax return form 200 03 ez or fiscal year beginning

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the EZ DO NOT WRITE OR STAPLE IN THIS AREA DELAWARE INDIVIDUAL RESIDENT INCOME TAX RETURN FORM 200 03 EZ?

The EZ DO NOT WRITE OR STAPLE IN THIS AREA DELAWARE INDIVIDUAL RESIDENT INCOME TAX RETURN FORM 200 03 EZ is a simplified tax return form designed for individual residents of Delaware. It allows eligible taxpayers to file their income tax returns easily and efficiently, ensuring compliance with state tax regulations.

-

How can airSlate SignNow help with the EZ DO NOT WRITE OR STAPLE IN THIS AREA DELAWARE INDIVIDUAL RESIDENT INCOME TAX RETURN FORM 200 03 EZ?

airSlate SignNow provides a user-friendly platform to eSign and send the EZ DO NOT WRITE OR STAPLE IN THIS AREA DELAWARE INDIVIDUAL RESIDENT INCOME TAX RETURN FORM 200 03 EZ. This streamlines the filing process, allowing you to complete your tax return quickly and securely.

-

What are the pricing options for using airSlate SignNow for tax forms?

airSlate SignNow offers various pricing plans to accommodate different needs, including options for individuals and businesses. Each plan provides access to features that simplify the completion and signing of documents like the EZ DO NOT WRITE OR STAPLE IN THIS AREA DELAWARE INDIVIDUAL RESIDENT INCOME TAX RETURN FORM 200 03 EZ.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow includes features such as document templates, eSignature capabilities, and secure cloud storage. These tools are particularly beneficial for managing the EZ DO NOT WRITE OR STAPLE IN THIS AREA DELAWARE INDIVIDUAL RESIDENT INCOME TAX RETURN FORM 200 03 EZ, ensuring that your documents are organized and easily accessible.

-

Is airSlate SignNow compliant with tax regulations?

Yes, airSlate SignNow is designed to comply with various legal and regulatory standards, including those related to tax documents. This compliance ensures that your use of the EZ DO NOT WRITE OR STAPLE IN THIS AREA DELAWARE INDIVIDUAL RESIDENT INCOME TAX RETURN FORM 200 03 EZ is secure and valid.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow offers integrations with popular tax preparation software, enhancing your ability to manage the EZ DO NOT WRITE OR STAPLE IN THIS AREA DELAWARE INDIVIDUAL RESIDENT INCOME TAX RETURN FORM 200 03 EZ seamlessly. This integration allows for a more efficient workflow when preparing your taxes.

-

What are the benefits of using airSlate SignNow for my tax documents?

Using airSlate SignNow for your tax documents, including the EZ DO NOT WRITE OR STAPLE IN THIS AREA DELAWARE INDIVIDUAL RESIDENT INCOME TAX RETURN FORM 200 03 EZ, offers numerous benefits. These include increased efficiency, reduced paperwork, and enhanced security for your sensitive information.

Get more for EZ DO NOT WRITE OR STAPLE IN THIS AREA DELAWARE INDIVIDUAL RESIDENT INCOME TAX RETURN FORM 200 03 EZ Or Fiscal Year Beginning Yo

- Denton county justice of the peace precinct 4 denton county form

- Application and affidavit trespass enforcement form

- Absentee affidavit tarrant county form

- Signature affidavit with passport photo form

- Fillable online charlestoncounty motor vehicle high form

- Hawaii quit claim deed form pdfword

- 155 351 legis iowa gov form

- Decedents last mailing address horrycounty form

Find out other EZ DO NOT WRITE OR STAPLE IN THIS AREA DELAWARE INDIVIDUAL RESIDENT INCOME TAX RETURN FORM 200 03 EZ Or Fiscal Year Beginning Yo

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement

- eSign Virginia Government POA Simple

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free