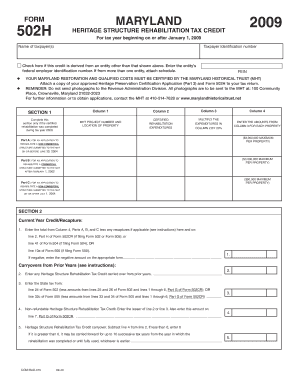

MARYLAND FORM 502H HERITAGE STRUCTURE REHABILITATION TAX CREDIT for Tax Year Beginning on or After January 1, Name of Taxpayers

Understanding the MARYLAND FORM 502H Heritage Structure Rehabilitation Tax Credit

The MARYLAND FORM 502H Heritage Structure Rehabilitation Tax Credit is a tax incentive designed to encourage the rehabilitation of historic structures in Maryland. This credit is applicable for tax years beginning on or after January 1. It allows taxpayers to receive a credit against their state income tax for qualified rehabilitation expenditures incurred during the restoration of eligible properties. Taxpayers must provide their identification number and relevant details about the property to claim this credit effectively.

Steps to Complete the MARYLAND FORM 502H

Completing the MARYLAND FORM 502H involves several key steps:

- Gather documentation regarding the property, including its historical significance and details of the rehabilitation work performed.

- Fill out the form with accurate taxpayer information, including the name and taxpayer identification number.

- Detail the qualified rehabilitation expenditures, ensuring all costs are documented and justified.

- Review the form for completeness and accuracy before submission.

Eligibility Criteria for the Tax Credit

To qualify for the MARYLAND FORM 502H Heritage Structure Rehabilitation Tax Credit, certain criteria must be met:

- The property must be a certified heritage structure listed on the National Register of Historic Places or designated as a historic site by the Maryland Historical Trust.

- Rehabilitation work must be substantial, meeting specific expenditure thresholds established by the state.

- Taxpayers must retain ownership of the property for a specified period after completing the rehabilitation.

Required Documents for Submission

When submitting the MARYLAND FORM 502H, taxpayers must include several essential documents:

- Proof of ownership of the property, such as a deed or title.

- Detailed invoices and receipts for all rehabilitation expenditures claimed.

- Photographs of the property before and after rehabilitation to demonstrate the work completed.

- Any additional documentation required by the Maryland Historical Trust or local authorities.

Form Submission Methods

The MARYLAND FORM 502H can be submitted through various methods:

- Online submission through the Maryland Comptroller's website.

- Mailing the completed form and required documents to the appropriate state office.

- In-person submission at designated state offices for immediate processing.

Filing Deadlines for the Tax Credit

It is essential to adhere to filing deadlines to ensure eligibility for the MARYLAND FORM 502H Heritage Structure Rehabilitation Tax Credit. Generally, the form must be submitted by the tax return due date for the year in which the rehabilitation expenditures were incurred. Taxpayers should verify specific deadlines for their tax year to avoid penalties and ensure timely processing.

Quick guide on how to complete maryland form 502h heritage structure rehabilitation tax credit for tax year beginning on or after january 1 name of taxpayers

Complete [SKS] effortlessly on any device

Online document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, as you can locate the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without delays. Manage [SKS] on any platform with airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to alter and eSign [SKS] with ease

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to preserve your changes.

- Choose your preferred method to deliver your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate the hassle of lost or misplaced files, the tedious search for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from any device of your choice. Modify and eSign [SKS] and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to MARYLAND FORM 502H HERITAGE STRUCTURE REHABILITATION TAX CREDIT For Tax Year Beginning On Or After January 1, Name Of Taxpayers

Create this form in 5 minutes!

How to create an eSignature for the maryland form 502h heritage structure rehabilitation tax credit for tax year beginning on or after january 1 name of taxpayers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the MARYLAND FORM 502H HERITAGE STRUCTURE REHABILITATION TAX CREDIT?

The MARYLAND FORM 502H HERITAGE STRUCTURE REHABILITATION TAX CREDIT is a tax incentive designed to encourage the rehabilitation of historic structures in Maryland. This credit allows taxpayers to receive a percentage of their rehabilitation expenses as a tax credit, making it financially beneficial for those looking to restore heritage properties.

-

Who is eligible for the MARYLAND FORM 502H HERITAGE STRUCTURE REHABILITATION TAX CREDIT?

Eligibility for the MARYLAND FORM 502H HERITAGE STRUCTURE REHABILITATION TAX CREDIT includes individuals or entities that own a qualified heritage structure and have incurred eligible rehabilitation expenses. Taxpayers must also provide their Taxpayer Identification Number when applying for the credit.

-

How do I apply for the MARYLAND FORM 502H HERITAGE STRUCTURE REHABILITATION TAX CREDIT?

To apply for the MARYLAND FORM 502H HERITAGE STRUCTURE REHABILITATION TAX CREDIT, you need to complete the appropriate application forms and submit them along with your Taxpayer Identification Number. It's important to follow the guidelines provided by the Maryland State Historic Preservation Office to ensure your application is processed smoothly.

-

What are the benefits of using airSlate SignNow for the MARYLAND FORM 502H application?

Using airSlate SignNow for your MARYLAND FORM 502H application streamlines the document signing process, making it quick and efficient. Our platform allows you to eSign documents securely and track their status, ensuring that your application is submitted on time and with all necessary information, including your Taxpayer Identification Number.

-

Are there any costs associated with the MARYLAND FORM 502H HERITAGE STRUCTURE REHABILITATION TAX CREDIT?

While the MARYLAND FORM 502H HERITAGE STRUCTURE REHABILITATION TAX CREDIT itself does not have a direct cost, applicants should be aware of the expenses related to the rehabilitation work. Additionally, using services like airSlate SignNow may involve subscription fees, but these costs are often outweighed by the benefits of efficient document management.

-

Can I integrate airSlate SignNow with other software for managing my MARYLAND FORM 502H application?

Yes, airSlate SignNow offers integrations with various software solutions that can help you manage your MARYLAND FORM 502H application more effectively. By connecting with project management tools or accounting software, you can streamline your workflow and ensure all necessary documentation, including your Taxpayer Identification Number, is organized.

-

What features does airSlate SignNow offer for managing tax credit applications?

airSlate SignNow provides features such as customizable templates, secure eSigning, and document tracking, which are essential for managing tax credit applications like the MARYLAND FORM 502H HERITAGE STRUCTURE REHABILITATION TAX CREDIT. These tools help ensure that your application process is efficient and compliant with all requirements.

Get more for MARYLAND FORM 502H HERITAGE STRUCTURE REHABILITATION TAX CREDIT For Tax Year Beginning On Or After January 1, Name Of Taxpayers

- Defense awards and decorations 8th army u s army 8tharmy korea army form

- Request for ration control check form

- Date immigration counseling certificate statement of applicant and intended spouse in accordance with usfk reg 600 240 the form

- Department of state instructions application for consular report of birth abroad of a citizen of the united states of america a form

- Request for withdrawal of personal property da form 1134 r apr 1986

- Classification questionnaire for officer retained personnel da form 2672 r may 1982

- Fconverta3787r frf armypubs army form

- Form or 41 oregon fiduciary income tax return 150 101 041

Find out other MARYLAND FORM 502H HERITAGE STRUCTURE REHABILITATION TAX CREDIT For Tax Year Beginning On Or After January 1, Name Of Taxpayers

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship

- eSign South Dakota Plumbing Emergency Contact Form Myself

- eSign Texas Plumbing Resignation Letter Free

- eSign West Virginia Orthodontists Living Will Secure