Copart Invoice Form

What is the Copart Invoice

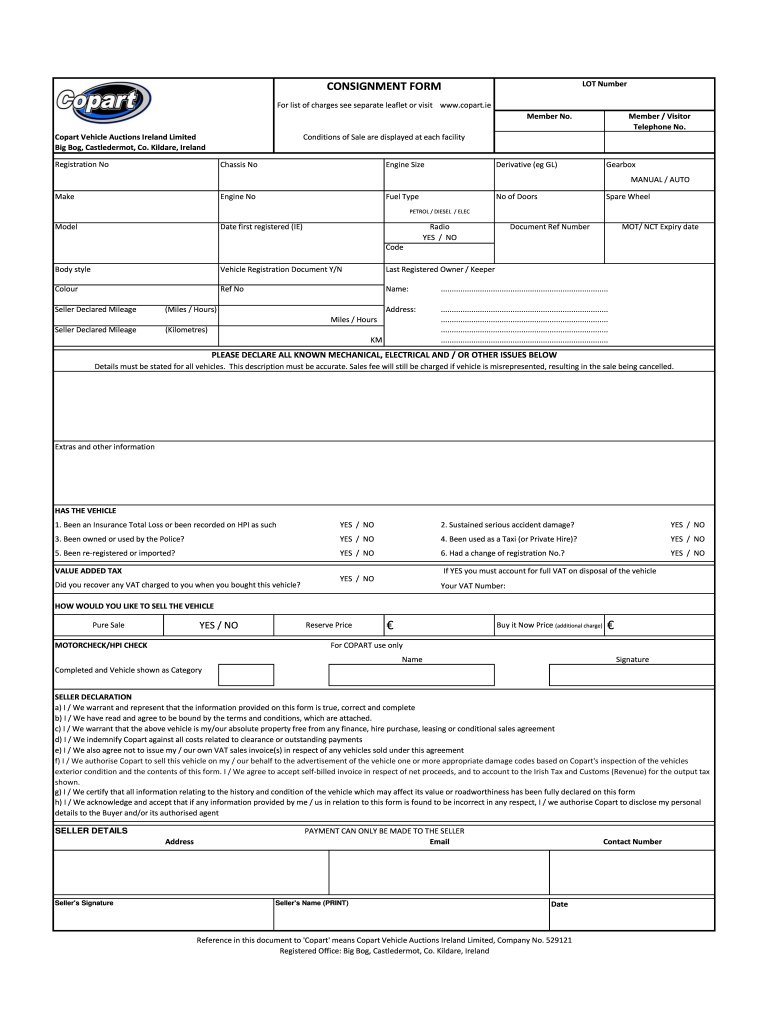

The Copart Invoice is a crucial document used in the vehicle auction process, detailing the purchase of a vehicle through Copart. This invoice outlines the total cost of the vehicle, including the auction price, buyer fees, and any applicable taxes. Understanding the components of the Copart Invoice is essential for buyers to ensure transparency and accuracy in their transactions.

How to use the Copart Invoice

Using the Copart Invoice involves several steps to ensure that all necessary details are correctly processed. First, review the invoice for accuracy, ensuring that all vehicle details match your purchase. Next, retain a copy for your records, as it serves as proof of purchase and may be required for registration or titling purposes. Finally, present the invoice when completing any necessary paperwork related to the vehicle transfer.

Steps to complete the Copart Invoice

Completing the Copart Invoice requires careful attention to detail. Follow these steps:

- Verify the vehicle information, including VIN and auction number.

- Check the total amount due, including all fees and taxes.

- Fill in your personal details accurately, including name and address.

- Sign and date the invoice to confirm your acceptance of the terms.

Legal use of the Copart Invoice

The legal use of the Copart Invoice is fundamental in establishing ownership of the vehicle purchased. This document serves as a binding agreement between the buyer and Copart, confirming the transaction's legitimacy. It is important to keep this invoice safe, as it may be required for legal purposes, such as vehicle registration or in the event of a dispute.

Key elements of the Copart Invoice

The Copart Invoice contains several key elements that are vital for understanding your purchase. These include:

- Buyer Information: Name, address, and contact details of the buyer.

- Vehicle Information: Details such as make, model, VIN, and auction number.

- Financial Breakdown: Itemized costs including the auction price, buyer fees, and taxes.

- Payment Terms: Information on payment methods and deadlines.

Who Issues the Form

The Copart Invoice is issued by Copart, the auction company facilitating the sale of vehicles. Once a bid is won and payment is processed, Copart generates the invoice for the buyer. This document is essential for the buyer to complete the purchase and is a formal record of the transaction.

Quick guide on how to complete consignment form lot number member no member visitor copart

A concise guide on how to create your Copart Invoice

Finding the correct template can be difficult when you need to submit official international documents. Even if you have the necessary form, it might be time-consuming to quickly fill it out according to all specifications if you are using physical copies instead of handling everything digitally. airSlate SignNow is the online electronic signature platform that assists you in overcoming these hurdles. It allows you to prepare your Copart Invoice and efficiently complete and sign it on-site without the need to reprint documents whenever you make an error.

Here are the actions you should take to prepare your Copart Invoice using airSlate SignNow:

- Click the Get Form button to upload your file to our editor instantly.

- Begin with the first blank field, input details, and continue with the Next tool.

- Complete the empty boxes using the Cross and Check tools from the panel above.

- Select the Highlight or Line options to emphasize the most crucial information.

- Click on Image and import one if your Copart Invoice necessitates it.

- Use the right-side panel to add additional fields for you or others to complete if needed.

- Review your entries and approve the form by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it using a camera or QR code.

- Conclude editing by clicking the Done button and selecting your file-sharing preferences.

Once your Copart Invoice is ready, you can share it however you prefer - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documents in your account, organized in folders according to your choices. Don’t waste time on manual document filling; try airSlate SignNow!

Create this form in 5 minutes or less

FAQs

-

As one of the cofounders of a multi-member LLC taxed as a partnership, how do I pay myself for work I am doing as a contractor for the company? What forms do I need to fill out?

First, the LLC operates as tax partnership (“TP”) as the default tax status if no election has been made as noted in Treasury Regulation Section 301.7701-3(b)(i). For legal purposes, we have a LLC. For tax purposes we have a tax partnership. Since we are discussing a tax issue here, we will discuss the issue from the perspective of a TP.A partner cannot under any circumstances be an employee of the TP as Revenue Ruling 69-184 dictated such. And, the 2016 preamble to Temporary Treasury Regulation Section 301.7701-2T notes the Treasury still supports this revenue ruling.Though a partner can engage in a transaction with the TP in a non partner capacity (Section 707a(a)).A partner receiving a 707(a) payment from the partnership receives the payment as any stranger receives a payment from the TP for services rendered. This partner gets treated for this transaction as if he/she were not a member of the TP (Treasury Regulation Section 1.707-1(a).As an example, a partner owns and operates a law firm specializing in contract law. The TP requires advice on terms and creation for new contracts the TP uses in its business with clients. This partner provides a bid for this unique job and the TP accepts it. Here, the partner bills the TP as it would any other client, and the partner reports the income from the TP client job as he/she would for any other client. The TP records the job as an expense and pays the partner as it would any other vendor. Here, I am assuming the law contract job represents an expense versus a capital item. Of course, the partner may have a law corporation though the same principle applies.Further, a TP can make fixed payments to a partner for services or capital — called guaranteed payments as noted in subsection (c).A 707(c) guaranteed payment shows up in the membership agreement drawn up by the business attorney. This payment provides a service partner with a guaranteed payment regardless of the TP’s income for the year as noted in Treasury Regulation Section 1.707-1(c).As an example, the TP operates an exclusive restaurant. Several partners contribute capital for the venture. The TP’s key service partner is the chef for the restaurant. And, the whole restaurant concept centers on this chef’s experience and creativity. The TP’s operating agreement provides the chef receives a certain % profit interest but as a minimum receives yearly a fixed $X guaranteed payment regardless of TP’s income level. In the first year of operations the TP has low profits as expected. The chef receives the guaranteed $X payment as provided in the membership agreement.The TP allocates the guaranteed payment to the capital interest partners on their TP k-1s as business expense. And, the TP includes the full $X guaranteed payment as income on the chef’s K-1. Here, the membership agreement demonstrates the chef only shares in profits not losses. So, the TP only allocates the guaranteed expense to those partners responsible for making up losses (the capital partners) as noted in Treasury Regulation Section 707-1(c) Example 3. The chef gets no allocation for the guaranteed expense as he/she does not participate in losses.If we change the situation slightly, we may change the tax results. If the membership agreement says the chef shares in losses, we then allocate a portion of the guaranteed expense back to the chef following the above treasury regulation.As a final note, a TP return requires knowledge of primary tax law if the TP desires filing a completed an accurate partnership tax return.I have completed the above tax analysis based on primary partnership tax law. If the situation changes in any manner, the tax outcome may change considerably. www.rst.tax

-

How long will it take to update my mobile number and email ID on my Aadhaar card? Earlier, no mobile number was there. I went to an Aadhaar office and filled out a form to update the mobile number and email ID.

I have also modified my Mobile number once for my aadhar, and next name was rectified for my wife.I have observed the updated card is received within 15 days. There might be postal delay. And you can download the updated card yourself also.

Create this form in 5 minutes!

How to create an eSignature for the consignment form lot number member no member visitor copart

How to create an electronic signature for your Consignment Form Lot Number Member No Member Visitor Copart online

How to make an eSignature for your Consignment Form Lot Number Member No Member Visitor Copart in Google Chrome

How to make an eSignature for signing the Consignment Form Lot Number Member No Member Visitor Copart in Gmail

How to make an electronic signature for the Consignment Form Lot Number Member No Member Visitor Copart straight from your mobile device

How to make an electronic signature for the Consignment Form Lot Number Member No Member Visitor Copart on iOS devices

How to generate an eSignature for the Consignment Form Lot Number Member No Member Visitor Copart on Android OS

People also ask

-

What is the copart visitor sign in process?

The copart visitor sign in process allows users to easily access their accounts to view and manage vehicle listings. By following a few simple steps, new and returning visitors can successfully sign in and gain instant access to Copart's auction platform.

-

Is there a fee associated with using copart visitor sign in?

There are no fees specifically tied to the copart visitor sign in process itself. However, users may encounter fees related to membership or purchases within the Copart system. It’s important to check the pricing structure for full details.

-

What features are available after copart visitor sign in?

After completing the copart visitor sign in, users can utilize features like browsing auction listings, placing bids, and managing their account preferences. This streamlined access enhances the user experience and makes participating in auctions more efficient.

-

How can I reset my copart visitor sign in credentials?

If you forget your copart visitor sign in credentials, you can easily reset them by clicking on the 'Forgot Password?' link on the sign-in page. Follow the prompts to receive a reset link in your email, ensuring you regain access swiftly.

-

Can I access copart visitor sign in from my mobile device?

Yes, the copart visitor sign in is fully optimized for mobile devices. This allows users to manage their accounts and participate in auctions on-the-go, adding convenience to the Copart experience.

-

What are the benefits of using airSlate SignNow for my copart visitor sign in?

Integrating airSlate SignNow with your copart visitor sign in process enhances document handling for bids and contracts. This ensures that all electronic signatures are legally binding, providing additional security and efficiency in document management.

-

Are there integrations available with copart visitor sign in?

Yes, there are several integrations available for the copart visitor sign in that can enhance functionality. These applications allow users to sync their Copart accounts with other platforms, streamlining their workflow and improving their overall experience.

Get more for Copart Invoice

- Kabalarian balanced name form

- Decode the secret words by writing the letter name for each note form

- Need tax return information or transcripts publication 4201

- Ifta ct form

- Child protection and welfare report form tusla

- Housing transfer form chp org uk

- Re 2090a request for course evaluation myfloridalicense com form

- Form 9400 400 taxidermist permit application

Find out other Copart Invoice

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation

- Can I Sign North Carolina Orthodontists Presentation

- How Do I Sign Rhode Island Real Estate Form

- Can I Sign Vermont Real Estate Document

- How To Sign Wyoming Orthodontists Document