3614, MICHIGAN Historic Preservation Tax State of Michigan Michigan Form

Understanding the 3614, MICHIGAN Historic Preservation Tax

The 3614, MICHIGAN Historic Preservation Tax is a tax incentive designed to encourage the preservation and rehabilitation of historic properties within the state of Michigan. This program aims to support property owners who invest in maintaining the historical integrity of their buildings while also enhancing the community's cultural landscape. By offering tax credits, the state promotes the restoration of significant structures, contributing to local economic development and heritage tourism.

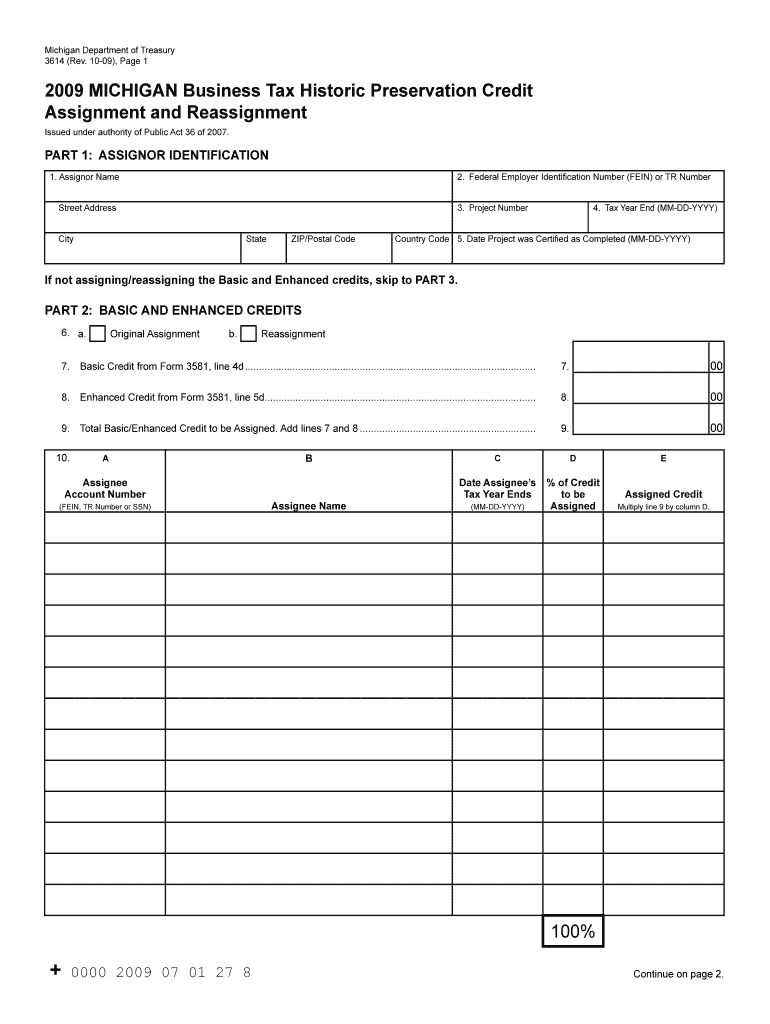

How to Complete the 3614, MICHIGAN Historic Preservation Tax Form

Completing the 3614 form requires careful attention to detail and specific information about the property in question. Begin by gathering essential documentation, including the property’s historical designation, proof of rehabilitation expenses, and any relevant photographs. Ensure that all sections of the form are filled out accurately, providing clear descriptions of the work completed and how it adheres to preservation standards. Double-check for any required signatures and dates before submission.

Eligibility Criteria for the 3614, MICHIGAN Historic Preservation Tax

To qualify for the 3614, MICHIGAN Historic Preservation Tax, properties must meet certain eligibility criteria. These include being listed on the National Register of Historic Places or designated as a Michigan Historic Site. Additionally, the rehabilitation work must adhere to the Secretary of the Interior’s Standards for Rehabilitation. Property owners should also ensure that their projects are completed within a specific timeframe to meet state guidelines.

Required Documents for the 3614, MICHIGAN Historic Preservation Tax

When applying for the 3614, MICHIGAN Historic Preservation Tax, several documents are required to support the application. These include:

- Proof of property ownership

- Documentation of the property’s historical status

- Detailed invoices and receipts for rehabilitation expenses

- Photographic evidence of the property before, during, and after rehabilitation

Having these documents organized and readily available will streamline the application process and help ensure compliance with state requirements.

Steps to Submit the 3614, MICHIGAN Historic Preservation Tax Form

Submitting the 3614 form involves a series of steps to ensure proper processing. Start by completing the form accurately, as outlined in previous sections. Once completed, submit the form along with all required documentation to the appropriate state agency. This can typically be done via mail or in person, depending on the specific submission guidelines provided by the state. Be mindful of any filing deadlines to ensure timely processing of your application.

Key Elements of the 3614, MICHIGAN Historic Preservation Tax

Several key elements define the 3614, MICHIGAN Historic Preservation Tax. These include:

- The scope of eligible rehabilitation work

- The percentage of tax credit available based on qualified expenses

- Requirements for maintaining the property’s historical integrity

- Guidelines for reporting and documenting expenses

Understanding these elements is crucial for property owners looking to maximize their benefits from the program while ensuring compliance with state regulations.

Quick guide on how to complete 3614 michigan historic preservation tax state of michigan michigan

Compose [SKS] effortlessly on any gadget

Online document management has become favored by businesses and individuals alike. It offers a superb eco-conscious alternative to conventional printed and signed documents, as you can access the necessary template and safely keep it online. airSlate SignNow provides you with all the resources you need to create, amend, and eSign your files promptly without delays. Handle [SKS] on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign [SKS] with ease

- Find [SKS] and then click Obtain Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize pertinent sections of the documents or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Verify all the details and then click the Finish button to store your modifications.

- Choose how you want to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign [SKS] and guarantee effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to 3614, MICHIGAN Historic Preservation Tax State Of Michigan Michigan

Create this form in 5 minutes!

How to create an eSignature for the 3614 michigan historic preservation tax state of michigan michigan

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 3614, MICHIGAN Historic Preservation Tax State Of Michigan Michigan?

The 3614, MICHIGAN Historic Preservation Tax State Of Michigan Michigan is a tax incentive program designed to encourage the preservation of historic properties in Michigan. This program provides financial benefits to property owners who invest in the restoration and maintenance of their historic buildings, helping to maintain the state's cultural heritage.

-

How can airSlate SignNow assist with the 3614, MICHIGAN Historic Preservation Tax State Of Michigan Michigan?

airSlate SignNow offers a streamlined solution for managing the documentation required for the 3614, MICHIGAN Historic Preservation Tax State Of Michigan Michigan. With our eSigning capabilities, you can easily send, sign, and store important documents related to your tax incentives, ensuring compliance and efficiency.

-

What are the pricing options for airSlate SignNow when applying for the 3614, MICHIGAN Historic Preservation Tax State Of Michigan Michigan?

airSlate SignNow provides flexible pricing plans that cater to various business needs, making it cost-effective for those involved in the 3614, MICHIGAN Historic Preservation Tax State Of Michigan Michigan. Our plans are designed to fit different budgets while offering essential features to facilitate document management and eSigning.

-

What features does airSlate SignNow offer for managing historic preservation tax documents?

airSlate SignNow includes features such as customizable templates, secure cloud storage, and real-time tracking of document status. These tools are particularly beneficial for managing the paperwork associated with the 3614, MICHIGAN Historic Preservation Tax State Of Michigan Michigan, ensuring that all documents are organized and easily accessible.

-

Are there any benefits to using airSlate SignNow for the 3614, MICHIGAN Historic Preservation Tax State Of Michigan Michigan?

Using airSlate SignNow for the 3614, MICHIGAN Historic Preservation Tax State Of Michigan Michigan offers numerous benefits, including increased efficiency in document handling and reduced turnaround times for approvals. Our platform simplifies the eSigning process, allowing you to focus more on your preservation projects rather than paperwork.

-

Can airSlate SignNow integrate with other tools for managing the 3614, MICHIGAN Historic Preservation Tax State Of Michigan Michigan?

Yes, airSlate SignNow seamlessly integrates with various third-party applications, enhancing your workflow for the 3614, MICHIGAN Historic Preservation Tax State Of Michigan Michigan. This integration capability allows you to connect with project management tools, CRM systems, and more, ensuring a cohesive approach to managing your historic preservation efforts.

-

How secure is airSlate SignNow for handling sensitive documents related to the 3614, MICHIGAN Historic Preservation Tax State Of Michigan Michigan?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and compliance measures to protect sensitive documents related to the 3614, MICHIGAN Historic Preservation Tax State Of Michigan Michigan, ensuring that your information remains confidential and secure throughout the signing process.

Get more for 3614, MICHIGAN Historic Preservation Tax State Of Michigan Michigan

- Home urine collection nhanes home urine collection component cdc form

- Organic toxicology branch cdc form

- National home and hospiice care survey and national home healrh aide survey survey documentation cdc form

- National health statistics reports number 17 july 1 health insurance coverage trends 1959 form

- Nnhs survey methodology and documentation national nursing home survey cdc form

- Link to each section in document cdc form

- Mortgage interest deduction limit how it works taxes form

- National vessel documentation center instructions and forms

Find out other 3614, MICHIGAN Historic Preservation Tax State Of Michigan Michigan

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free

- eSignature Ohio Guaranty Agreement Myself