Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable 2015

What is the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable

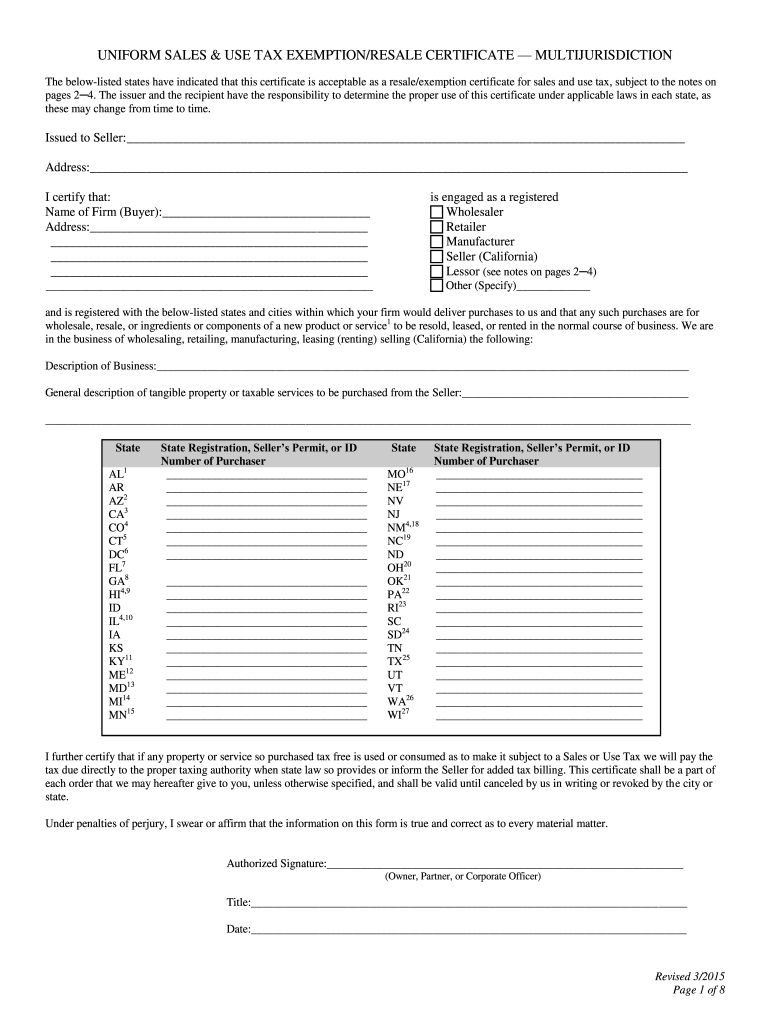

The Uniform Sales Use Tax Certificate Multijurisdiction is a standardized document used by businesses to claim tax exemption on purchases intended for resale. This form allows buyers to avoid paying sales tax at the point of sale, provided they are purchasing items for resale purposes. The fillable version of this form facilitates electronic completion, making it easier for users to provide necessary information without the need for physical paperwork. It is recognized across multiple states, streamlining the process for businesses operating in various jurisdictions.

Steps to Complete the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable

Completing the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable involves several key steps:

- Begin by entering your business name and address in the designated fields.

- Provide your sales tax identification number, which is essential for verifying your tax-exempt status.

- Clearly indicate the type of items being purchased for resale.

- Sign and date the form to certify that the information provided is accurate and truthful.

- Submit the completed form to the seller to ensure tax exemption is applied to your purchase.

Legal Use of the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable

The legal use of the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable is governed by state laws regarding sales tax exemptions. To be valid, the form must be completed accurately and submitted to the seller at the time of purchase. Misuse or incorrect completion can lead to penalties, including back taxes owed and fines. It is crucial for businesses to understand the legal implications of using this form to ensure compliance with tax regulations.

Key Elements of the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable

Several key elements must be included in the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable for it to be valid:

- Purchaser Information: Business name, address, and sales tax identification number.

- Seller Information: Name and address of the seller from whom goods are being purchased.

- Description of Goods: A detailed description of the items being purchased for resale.

- Signature: The authorized signature of the purchaser, along with the date of signing.

Examples of Using the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable

Businesses can use the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable in various scenarios, such as:

- A retail store purchasing inventory from a wholesaler.

- An online seller acquiring products for resale through e-commerce platforms.

- A manufacturer buying raw materials intended for production and resale.

Eligibility Criteria for the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable

To be eligible to use the Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable, businesses must meet certain criteria:

- The business must possess a valid sales tax identification number.

- The items being purchased must be intended for resale, not for personal use.

- The purchaser must be a registered business entity, such as a corporation or LLC.

Quick guide on how to complete uniform sales use tax certificate form mtc

Complete Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable seamlessly on any device

Digital document management has become favored among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can access the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Handle Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable on any device using airSlate SignNow Android or iOS applications and enhance any document-centric operation today.

How to adjust and eSign Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable effortlessly

- Obtain Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable and click on Get Form to begin.

- Employ the tools we offer to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from a device of your choice. Modify and eSign Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct uniform sales use tax certificate form mtc

FAQs

-

Why don't schools teach children about taxes and bills and things that they will definitely need to know as adults to get by in life?

Departments of education and school districts always have to make decisions about what to include in their curriculum. There are a lot of life skills that people need that aren't taught in school. The question is should those skills be taught in schools?I teach high school, so I'll talk about that. The typical high school curriculum is supposed to give students a broad-based education that prepares them to be citizens in a democracy and to be able to think critically. For a democracy to work, we need educated, discerning citizens with the ability to make good decisions based on evidence and objective thought. In theory, people who are well informed about history, culture, science, mathematics, etc., and are capable of critical, unbiased thinking, will have the tools to participate in a democracy and make good decisions for themselves and for society at large. In addition to that, they should be learning how to be learners, how to do effective, basic research, and collaborate with other people. If that happens, figuring out how to do procedural tasks in real life should not provide much of a challenge. We can't possibly teach every necessary life skill people need, but we can help students become better at knowing how to acquire the skills they need. Should we teach them how to change a tire when they can easily consult a book or search the internet to find step by step instructions for that? Should we teach them how to balance a check book or teach them how to think mathematically and make sense of problems so that the simple task of balancing a check book (which requires simple arithmetic and the ability to enter numbers and words in columns and rows in obvious ways) is easy for them to figure out. If we teach them to be good at critical thinking and have some problem solving skills they will be able to apply those overarching skills to all sorts of every day tasks that shouldn't be difficult for someone with decent cognitive ability to figure out. It's analogous to asking why a culinary school didn't teach its students the steps and ingredients to a specific recipe. The school taught them about more general food preparation and food science skills so that they can figure out how to make a lot of specific recipes without much trouble. They're also able to create their own recipes.So, do we want citizens with very specific skill sets that they need to get through day to day life or do we want citizens with critical thinking, problem solving, and other overarching cognitive skills that will allow them to easily acquire ANY simple, procedural skill they may come to need at any point in their lives?

-

How do I fill taxes online?

you can file taxes online by using different online platforms. by using this online platform you can easily submit the income tax returns, optimize your taxes easily.Tachotax provides the most secure, easy and fast way of tax filing.

-

How do I fill out the income tax for online job payment? Are there any special forms to fill it?

I am answering to your question with the UNDERSTANDING that you are liableas per Income Tax Act 1961 of Republic of IndiaIf you have online source of Income as per agreement as an employer -employee, It will be treated SALARY income and you will file ITR 1 for FY 2017–18If you are rendering professional services outside India with an agreement as professional, in that case you need to prepare Financial Statements ie. Profit and loss Account and Balance sheet for FY 2017–18 , finalize your income and pay taxes accordingly, You will file ITR -3 for FY 2017–1831st Dec.2018 is last due date with minimum penalty, grab that opportunity and file income tax return as earliest

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

Create this form in 5 minutes!

How to create an eSignature for the uniform sales use tax certificate form mtc

How to create an eSignature for the Uniform Sales Use Tax Certificate Form Mtc in the online mode

How to create an eSignature for the Uniform Sales Use Tax Certificate Form Mtc in Google Chrome

How to make an eSignature for putting it on the Uniform Sales Use Tax Certificate Form Mtc in Gmail

How to generate an eSignature for the Uniform Sales Use Tax Certificate Form Mtc right from your smart phone

How to make an eSignature for the Uniform Sales Use Tax Certificate Form Mtc on iOS

How to make an eSignature for the Uniform Sales Use Tax Certificate Form Mtc on Android devices

People also ask

-

What is an MTC resale certificate?

An MTC resale certificate is a document that allows businesses to purchase goods without paying sales tax, provided those goods are intended for resale. It is essential for retailers and wholesalers who want to streamline their purchasing process. By using an MTC resale certificate, businesses can maximize their profit margins and reduce costs.

-

How can airSlate SignNow help with managing MTC resale certificates?

airSlate SignNow offers a seamless way to collect, store, and manage MTC resale certificates electronically. With our eSignature solution, businesses can easily send resale certificates for signature and keep track of them in a secure digital format. This ensures compliance and simplifies record-keeping.

-

What are the pricing options for using airSlate SignNow with MTC resale certificates?

airSlate SignNow provides a variety of subscription plans tailored to different business needs, making it affordable to manage MTC resale certificates. Pricing varies based on features and the number of users. We offer a free trial, so you can test the platform before committing to a subscription.

-

Are there any specific features for handling MTC resale certificates in airSlate SignNow?

Yes, airSlate SignNow includes features specifically designed for managing MTC resale certificates, such as customizable templates, automated reminders, and secure storage options. These features enhance efficiency and ensure that all necessary documents are easily accessible and organized.

-

What benefits does using airSlate SignNow provide for MTC resale certificates?

Using airSlate SignNow for MTC resale certificates streamlines the eSigning process and reduces paperwork. It also enhances compliance by securely storing documents and providing a clear audit trail. This not only saves time but also minimizes the risk of errors or mismanagement of certificates.

-

Can airSlate SignNow integrate with other systems for MTC resale certificate management?

Absolutely! airSlate SignNow offers integrations with various business management systems and CRMs, making it easier to manage MTC resale certificates within your existing workflow. These integrations ensure that your documents synchronize smoothly with your other business processes.

-

Is airSlate SignNow suitable for small businesses needing MTC resale certificates?

Yes, airSlate SignNow is ideal for small businesses looking to manage MTC resale certificates efficiently. Our platform is designed to be user-friendly and cost-effective, allowing smaller operations to benefit from robust eSignature solutions without breaking the bank. Plus, our customer support is always available to assist you.

Get more for Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable

- Rx relief timesheet 212649030 form

- Aerial lift written test merrick construction llc form

- 36b certificate of divorce form

- Editable utah involuntary commitment form

- Dd form 877 100111651

- 1111 superior avenue cleveland oh 44114 phone 2 form

- Lorain county department of job and family services form

- Woodgate farms form

Find out other Uniform Sales Use Tax Certificate Multijurisdiction Form Fillable

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form