California Form 5805 Underpayment of Ftb Ca Gov Ftb Ca

What is the California Form 5805 Underpayment Of Ftb ca gov Ftb Ca

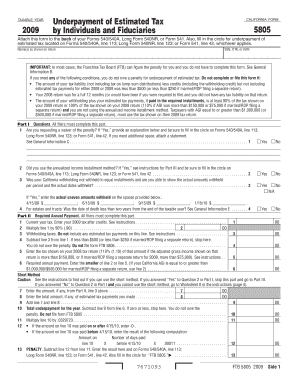

The California Form 5805 is a tax document used by individuals and businesses to report underpayment of estimated tax to the Franchise Tax Board (FTB). This form is essential for those who have not paid enough tax throughout the year and need to calculate any penalties associated with the underpayment. It is specifically designed for California taxpayers to ensure compliance with state tax laws and to avoid additional penalties.

How to use the California Form 5805 Underpayment Of Ftb ca gov Ftb Ca

To effectively use the California Form 5805, taxpayers must first determine if they have underpaid their estimated tax. This involves calculating the total tax liability for the year and comparing it to the amount already paid through withholding or estimated payments. If the total payments are less than the required amount, the form must be completed to report the underpayment and calculate any potential penalties. It's important to follow the instructions carefully to ensure accurate reporting.

Steps to complete the California Form 5805 Underpayment Of Ftb ca gov Ftb Ca

Completing the California Form 5805 involves several key steps:

- Gather all necessary financial information, including total income and tax withheld.

- Calculate your total tax liability for the year.

- Determine the total amount of estimated tax payments made.

- Compare your total tax liability with your total payments to identify any underpayment.

- Fill out the form by entering the required information, including your personal details and tax calculations.

- Review the completed form for accuracy before submission.

Key elements of the California Form 5805 Underpayment Of Ftb ca gov Ftb Ca

Key elements of the California Form 5805 include sections for personal identification, tax liability calculations, and details regarding payments made. Taxpayers must provide their name, address, and Social Security number or taxpayer identification number. The form also requires a breakdown of total income, tax withheld, and any estimated payments made throughout the year. Understanding these elements is crucial for accurate completion and compliance.

Filing Deadlines / Important Dates

Filing deadlines for the California Form 5805 align with the state tax filing deadlines. Typically, taxpayers must submit the form by the original due date of their tax return, which is usually April 15 for most individuals. However, if an extension is filed, the deadline may be extended. It is important to stay informed about any changes in deadlines to avoid penalties.

Penalties for Non-Compliance

Failure to file the California Form 5805 when required can result in significant penalties. The FTB may impose a penalty based on the amount of underpayment and the duration of the underpayment period. Taxpayers may also be subject to interest on any unpaid tax amounts. Understanding these penalties emphasizes the importance of timely and accurate filing to maintain compliance with California tax laws.

Quick guide on how to complete california form 5805 underpayment of ftb ca gov ftb ca

Finish [SKS] effortlessly on any gadget

Online document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage [SKS] on any gadget with airSlate SignNow’s Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign [SKS] with ease

- Obtain [SKS] and select Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize key sections of your documents or obscure sensitive details using tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign [SKS] and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to California Form 5805 Underpayment Of Ftb ca gov Ftb Ca

Create this form in 5 minutes!

How to create an eSignature for the california form 5805 underpayment of ftb ca gov ftb ca

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is California Form 5805 Underpayment Of Ftb ca gov Ftb Ca?

California Form 5805 is used to calculate and report any underpayment of estimated tax to the Franchise Tax Board (FTB) of California. This form helps taxpayers determine if they owe a penalty for underpayment and how much they need to pay. Understanding this form is crucial for compliance with California tax laws.

-

How can airSlate SignNow help with California Form 5805 Underpayment Of Ftb ca gov Ftb Ca?

airSlate SignNow provides an efficient platform for eSigning and sending documents, including California Form 5805. Our solution simplifies the process, ensuring that you can complete and submit your tax forms quickly and securely. This helps you stay compliant with FTB requirements without the hassle.

-

What are the pricing options for using airSlate SignNow for California Form 5805 Underpayment Of Ftb ca gov Ftb Ca?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans are cost-effective, allowing you to choose the features that best suit your requirements for handling California Form 5805. You can start with a free trial to explore our services before committing.

-

What features does airSlate SignNow offer for managing California Form 5805 Underpayment Of Ftb ca gov Ftb Ca?

Our platform includes features such as customizable templates, secure eSigning, and document tracking, all of which are beneficial for managing California Form 5805. These tools streamline the process, making it easier to fill out and submit your tax forms accurately and on time.

-

Is airSlate SignNow compliant with California tax regulations for Form 5805?

Yes, airSlate SignNow is designed to comply with all relevant California tax regulations, including those pertaining to California Form 5805 Underpayment Of Ftb ca gov Ftb Ca. Our platform ensures that your documents are handled securely and in accordance with state laws, giving you peace of mind.

-

Can I integrate airSlate SignNow with other software for California Form 5805 Underpayment Of Ftb ca gov Ftb Ca?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow for managing California Form 5805. This allows you to connect with accounting software and other tools, making it easier to handle your tax documents efficiently.

-

What are the benefits of using airSlate SignNow for California Form 5805 Underpayment Of Ftb ca gov Ftb Ca?

Using airSlate SignNow for California Form 5805 provides numerous benefits, including time savings, increased accuracy, and enhanced security. Our platform simplifies the eSigning process, ensuring that you can focus on your business while staying compliant with tax obligations.

Get more for California Form 5805 Underpayment Of Ftb ca gov Ftb Ca

- Meter report example form

- Add and subtract whole numbers6th grade math form

- Kathmandu sponsorship form

- Rma claim form renogy

- Application for a drivers license or identification card wv form

- Eec staff schedule form

- Make sure you get the correct benefits you are eligible to receive form

- Math 131a real analysis form

Find out other California Form 5805 Underpayment Of Ftb ca gov Ftb Ca

- eSignature South Carolina Charity Confidentiality Agreement Easy

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later