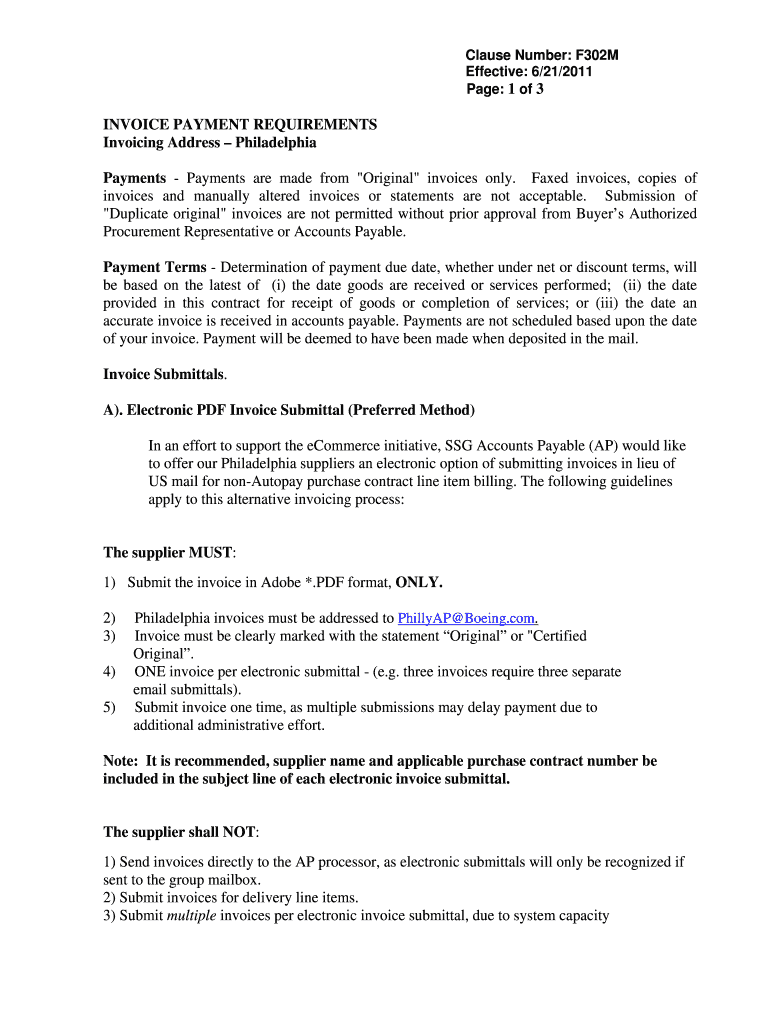

INVOICE PAYMENT REQUIREMENTS Form

What is the INVOICE PAYMENT REQUIREMENTS

The INVOICE PAYMENT REQUIREMENTS refer to the specific criteria and guidelines that businesses must follow when issuing invoices for payment. These requirements ensure that invoices are clear, accurate, and compliant with legal and financial standards. Typically, they include essential details such as the invoice number, date of issue, payment terms, itemized list of goods or services provided, and the total amount due. Adhering to these requirements helps facilitate timely payments and maintain good business relationships.

Key elements of the INVOICE PAYMENT REQUIREMENTS

Understanding the key elements of the INVOICE PAYMENT REQUIREMENTS is crucial for effective invoicing. The following components are typically included:

- Invoice Number: A unique identifier for tracking and referencing the invoice.

- Date of Issue: The date when the invoice is generated.

- Payment Terms: Conditions outlining when payment is due, such as net thirty days.

- Itemized List: A detailed description of goods or services provided, including quantities and prices.

- Total Amount Due: The sum total of all charges, including taxes and fees.

- Contact Information: Business details for inquiries, including name, address, and phone number.

Steps to complete the INVOICE PAYMENT REQUIREMENTS

To ensure compliance with the INVOICE PAYMENT REQUIREMENTS, follow these steps:

- Gather all necessary information, including customer details and service descriptions.

- Choose an appropriate invoice template that includes all required fields.

- Fill in the invoice number and date of issue.

- List each item or service provided, along with corresponding prices.

- Clearly state the payment terms and total amount due.

- Review the invoice for accuracy before sending it to the client.

Legal use of the INVOICE PAYMENT REQUIREMENTS

The legal use of the INVOICE PAYMENT REQUIREMENTS is essential for businesses to ensure compliance with tax regulations and financial reporting standards. Invoices serve as legal documents that can be used in disputes or audits. It is important to retain copies of all invoices issued and received, as they may be required for tax filings or legal proceedings. Additionally, businesses must ensure that their invoices adhere to state and federal laws regarding billing practices.

Required Documents

When preparing to issue an invoice, certain documents may be necessary to support the invoicing process. These typically include:

- Contracts or agreements outlining the terms of service.

- Purchase orders from the client, if applicable.

- Receipts for any materials or services purchased related to the invoice.

- Tax identification numbers, if required for tax purposes.

Form Submission Methods (Online / Mail / In-Person)

Businesses can submit invoices through various methods, depending on client preferences and operational capabilities. Common submission methods include:

- Online: Sending invoices via email or through a digital invoicing platform.

- Mail: Physically mailing printed invoices to clients.

- In-Person: Hand-delivering invoices during meetings or transactions.

Quick guide on how to complete invoice payment requirements

Complete [SKS] easily on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, as one can obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, amend, and electronically sign your documents quickly without delays. Manage [SKS] on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related procedure today.

How to modify and electronically sign [SKS] effortlessly

- Locate [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or obscure confidential information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Verify all information and then click on the Done button to save your modifications.

- Choose how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and electronically sign [SKS] and guarantee excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to INVOICE PAYMENT REQUIREMENTS

Create this form in 5 minutes!

How to create an eSignature for the invoice payment requirements

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the INVOICE PAYMENT REQUIREMENTS for using airSlate SignNow?

To use airSlate SignNow, businesses must ensure they meet the INVOICE PAYMENT REQUIREMENTS, which include having a valid payment method and an active subscription plan. Users can choose from various pricing tiers that best suit their needs, ensuring seamless document signing and management.

-

How does airSlate SignNow handle INVOICE PAYMENT REQUIREMENTS for different subscription plans?

airSlate SignNow offers multiple subscription plans, each with specific INVOICE PAYMENT REQUIREMENTS. Customers can select a plan based on their document volume and feature needs, ensuring they only pay for what they use while enjoying full access to the platform's capabilities.

-

Are there any hidden fees related to INVOICE PAYMENT REQUIREMENTS?

No, airSlate SignNow is transparent about its pricing structure, and there are no hidden fees associated with the INVOICE PAYMENT REQUIREMENTS. Customers can review all costs upfront, allowing for better budgeting and financial planning.

-

What payment methods are accepted to meet the INVOICE PAYMENT REQUIREMENTS?

To fulfill the INVOICE PAYMENT REQUIREMENTS, airSlate SignNow accepts various payment methods, including credit cards and PayPal. This flexibility allows businesses to choose the most convenient option for their financial transactions.

-

How can I ensure compliance with INVOICE PAYMENT REQUIREMENTS when using airSlate SignNow?

To ensure compliance with INVOICE PAYMENT REQUIREMENTS, users should regularly review their subscription status and payment methods. airSlate SignNow provides notifications for upcoming payments and renewals, helping businesses stay on track.

-

What features are included that relate to INVOICE PAYMENT REQUIREMENTS?

airSlate SignNow includes features that streamline the INVOICE PAYMENT REQUIREMENTS process, such as automated invoicing and payment tracking. These tools help businesses manage their finances efficiently while ensuring timely payments.

-

Can I integrate airSlate SignNow with other accounting software to manage INVOICE PAYMENT REQUIREMENTS?

Yes, airSlate SignNow offers integrations with popular accounting software, allowing businesses to manage their INVOICE PAYMENT REQUIREMENTS seamlessly. This integration helps automate invoicing and payment processes, reducing manual errors and saving time.

Get more for INVOICE PAYMENT REQUIREMENTS

- Title shaping up exploring the attributes of shapes all around us nsa form

- Title a parade of patterns form

- Attributes and patterns doc form

- Building patterns with polygons nsa form

- Title repeating and growing patterns calling all patterns nsa form

- Title election mania brief overview students will serve as a form

- Fun functions nsa form

- Title growing patterns how do they grow nsa form

Find out other INVOICE PAYMENT REQUIREMENTS

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template

- eSign Minnesota Real Estate Living Will Free

- eSign Massachusetts Real Estate Quitclaim Deed Myself

- eSign Missouri Real Estate Affidavit Of Heirship Simple

- eSign New Jersey Real Estate Limited Power Of Attorney Later

- eSign Alabama Police LLC Operating Agreement Fast

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed