Surplus ACH Debit OPTins Form

What is the Surplus ACH Debit OPTins

The Surplus ACH Debit OPTins is a financial form used primarily in the context of automated clearing house (ACH) transactions. This form allows businesses to obtain authorization from customers to debit their bank accounts for surplus funds. It is essential for ensuring compliance with banking regulations and for maintaining transparent financial practices. By utilizing this form, businesses can streamline their payment processes and enhance customer trust.

How to use the Surplus ACH Debit OPTins

Using the Surplus ACH Debit OPTins involves several straightforward steps. First, businesses must provide the form to customers, ensuring that it includes all necessary details such as the amount to be debited and the frequency of the transactions. Customers need to fill out their banking information accurately and sign the form to authorize the debits. Once completed, the form should be securely stored by the business for record-keeping and compliance purposes.

Steps to complete the Surplus ACH Debit OPTins

Completing the Surplus ACH Debit OPTins requires careful attention to detail. Follow these steps:

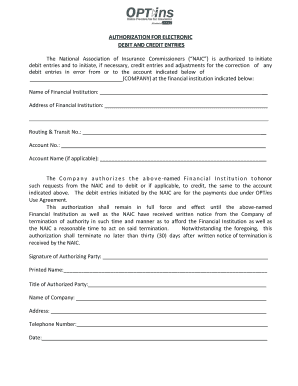

- Download the Surplus ACH Debit OPTins form from a reliable source.

- Fill in the business name and contact information at the top of the form.

- Provide a clear description of the purpose of the debits.

- Enter the customer's bank account details, including account number and routing number.

- Specify the amount to be debited and the schedule for these transactions.

- Have the customer review the form and sign it to authorize the debits.

- Keep a copy of the signed form for your records.

Key elements of the Surplus ACH Debit OPTins

Understanding the key elements of the Surplus ACH Debit OPTins is crucial for effective use. Important components include:

- Customer Information: Full name and contact details of the customer.

- Bank Account Details: Accurate bank account and routing numbers.

- Debit Amount: The specific amount to be withdrawn from the account.

- Frequency: How often the debits will occur, such as weekly or monthly.

- Customer Signature: Authorization from the customer to proceed with the debits.

Legal use of the Surplus ACH Debit OPTins

The legal use of the Surplus ACH Debit OPTins is governed by federal and state regulations regarding electronic funds transfers. Businesses must ensure that they have explicit consent from customers before initiating any debit transactions. This consent must be documented through the completed form, which serves as proof of authorization. Failure to comply with these legal requirements can result in penalties and loss of customer trust.

Eligibility Criteria

To utilize the Surplus ACH Debit OPTins, certain eligibility criteria must be met. Businesses should:

- Be registered and compliant with federal and state banking regulations.

- Ensure that customers have valid bank accounts capable of processing ACH transactions.

- Obtain clear and informed consent from customers before debiting their accounts.

Quick guide on how to complete surplus ach debit optins

Finish [SKS] effortlessly on any gadget

Managing documents online has gained traction among businesses and individuals alike. It presents an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and electronically sign your documents quickly without interruptions. Handle [SKS] on any gadget with airSlate SignNow’s Android or iOS applications and streamline any document-related task today.

The easiest method to modify and electronically sign [SKS] with ease

- Find [SKS] and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a regular wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and electronically sign [SKS] while ensuring effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Surplus ACH Debit OPTins

Create this form in 5 minutes!

How to create an eSignature for the surplus ach debit optins

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Surplus ACH Debit OPTins?

Surplus ACH Debit OPTins are a feature that allows businesses to manage and automate their ACH debit transactions efficiently. This solution helps streamline payment processes, ensuring that funds are collected seamlessly and securely. By utilizing Surplus ACH Debit OPTins, businesses can enhance their cash flow management.

-

How does airSlate SignNow support Surplus ACH Debit OPTins?

airSlate SignNow provides a user-friendly platform that integrates Surplus ACH Debit OPTins into your document workflows. This integration allows for easy eSigning and document management, ensuring that all transactions are documented and compliant. With airSlate SignNow, you can simplify the process of obtaining necessary approvals for ACH transactions.

-

What are the pricing options for using Surplus ACH Debit OPTins with airSlate SignNow?

airSlate SignNow offers competitive pricing plans that include access to Surplus ACH Debit OPTins. Depending on your business needs, you can choose from various subscription tiers that provide different levels of features and support. This flexibility ensures that you only pay for what you need while benefiting from the advantages of Surplus ACH Debit OPTins.

-

What benefits do Surplus ACH Debit OPTins provide for businesses?

The primary benefits of Surplus ACH Debit OPTins include improved cash flow management, reduced transaction costs, and enhanced security for electronic payments. By automating ACH transactions, businesses can minimize errors and save time on manual processes. Additionally, Surplus ACH Debit OPTins help ensure compliance with financial regulations.

-

Can I integrate Surplus ACH Debit OPTins with other software?

Yes, airSlate SignNow allows for seamless integration of Surplus ACH Debit OPTins with various accounting and financial software. This capability enables businesses to synchronize their payment processes and maintain accurate financial records. Integrating Surplus ACH Debit OPTins with your existing systems can enhance operational efficiency.

-

Is there a trial period for testing Surplus ACH Debit OPTins?

airSlate SignNow offers a trial period that allows prospective customers to explore the features of Surplus ACH Debit OPTins without any commitment. This trial enables you to assess how well the solution fits your business needs and workflows. During the trial, you can experience the benefits of Surplus ACH Debit OPTins firsthand.

-

How secure are Surplus ACH Debit OPTins?

Surplus ACH Debit OPTins are designed with security in mind, utilizing encryption and secure protocols to protect sensitive financial information. airSlate SignNow adheres to industry standards to ensure that all transactions are safe and compliant. By using Surplus ACH Debit OPTins, businesses can have peace of mind regarding their payment processes.

Get more for Surplus ACH Debit OPTins

- Corporate decision 02 the private trust company national association cleveland ohio occ form

- Manual check request form template

- Valley oaks elementary transportation change request valley form

- Get the acceptance of risks indemnification agreement form

- Food code variance request form

- Dairyland insurance app form

- Company license application alabama real estate commission form

- Application for prelicensepost license instructor form

Find out other Surplus ACH Debit OPTins

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure

- Sign Colorado Plumbing Emergency Contact Form Now

- Sign Colorado Plumbing Emergency Contact Form Free