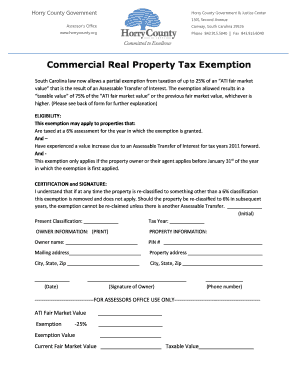

5040 Fax 843 Form

What is the South Carolina real property tax exemption?

The South Carolina real property tax exemption is a program designed to reduce the property tax burden for eligible homeowners. This exemption can significantly lower the amount of property tax owed, making homeownership more affordable. The program primarily benefits seniors, disabled individuals, and certain veterans, allowing them to qualify for reduced assessments on their property taxes. Understanding the specifics of this exemption is crucial for homeowners looking to take advantage of potential savings.

Eligibility criteria for the exemption

To qualify for the South Carolina real property tax exemption, applicants must meet specific eligibility criteria. Generally, the following conditions apply:

- Applicants must be homeowners and occupy the property as their primary residence.

- Age requirements typically include being at least sixty-five years old, or being permanently disabled.

- Veterans who have a service-related disability may also qualify for additional exemptions.

- Income limits may apply, depending on the type of exemption sought.

It is essential for applicants to review the specific requirements for the type of exemption they are applying for, as these can vary.

Steps to apply for the exemption

The application process for the South Carolina real property tax exemption involves several key steps. Homeowners should follow this procedure to ensure their application is successful:

- Gather necessary documentation, including proof of age, disability, or veteran status.

- Complete the application form, which can typically be obtained from the local county assessor's office or online.

- Submit the application form along with supporting documents to the appropriate county office before the deadline.

- Await confirmation of the application status from the county assessor's office.

Timely submission is crucial, as deadlines can vary by county.

Required documents for the application

When applying for the South Carolina real property tax exemption, homeowners must provide certain documents to support their application. Commonly required documents include:

- A copy of the homeowner's ID or driver's license.

- Proof of income, if applicable, such as tax returns or pay stubs.

- Documentation of age or disability, such as a birth certificate or medical records.

- Veterans may need to provide discharge papers or other relevant military documentation.

Having these documents prepared in advance can streamline the application process.

Form submission methods

Homeowners can submit their applications for the South Carolina real property tax exemption through various methods. The available submission options typically include:

- Online submission through the local county assessor's website, if available.

- Mailing the completed application and supporting documents to the county assessor's office.

- In-person submission at the county assessor's office during regular business hours.

Each method has its benefits, and homeowners should choose the one that best suits their needs.

Penalties for non-compliance

Failure to comply with the regulations surrounding the South Carolina real property tax exemption can result in penalties. Homeowners may face:

- Loss of the exemption, leading to an increase in property tax liability.

- Potential fines or interest on unpaid taxes if the exemption was claimed improperly.

- Legal action from the county for failure to adhere to property tax laws.

Understanding these penalties emphasizes the importance of accurate and timely applications.

Quick guide on how to complete 5040 fax 843

Complete 5040 Fax 843 effortlessly on any device

Digital document management has gained signNow traction among businesses and individuals. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, as you can acquire the necessary form and securely save it online. airSlate SignNow provides you with all the tools needed to create, modify, and electronically sign your documents swiftly without delays. Handle 5040 Fax 843 on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and electronically sign 5040 Fax 843 with ease

- Obtain 5040 Fax 843 and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important portions of the documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or downloading it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 5040 Fax 843 and guarantee outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 5040 fax 843

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the south carolina real property tax exemption?

The south carolina real property tax exemption is a program designed to reduce property taxes for eligible homeowners in South Carolina. This exemption can signNowly lower the tax burden, making homeownership more affordable. Understanding the requirements and benefits of this exemption is crucial for homeowners looking to save on taxes.

-

Who qualifies for the south carolina real property tax exemption?

To qualify for the south carolina real property tax exemption, homeowners must meet specific criteria, including age, disability status, and income limits. Generally, seniors and disabled individuals are prioritized for this exemption. It's important to check local regulations to ensure eligibility.

-

How can I apply for the south carolina real property tax exemption?

Applying for the south carolina real property tax exemption typically involves submitting an application to your local tax assessor's office. You may need to provide documentation proving your eligibility, such as income statements or proof of age. It's advisable to start the application process early to ensure timely approval.

-

What documents are needed for the south carolina real property tax exemption application?

When applying for the south carolina real property tax exemption, you will generally need to provide proof of income, age, and residency. Documents such as tax returns, identification, and property deeds may be required. Ensure you have all necessary paperwork ready to streamline the application process.

-

How does the south carolina real property tax exemption affect my property taxes?

The south carolina real property tax exemption can signNowly reduce the amount of property taxes you owe, depending on your eligibility. This exemption lowers the assessed value of your property, which directly impacts your tax bill. Homeowners can benefit from substantial savings, making it an essential consideration for budgeting.

-

Are there any deadlines for applying for the south carolina real property tax exemption?

Yes, there are specific deadlines for applying for the south carolina real property tax exemption, which can vary by county. Typically, applications must be submitted by a certain date each year to qualify for that tax year. It's crucial to check with your local tax office for exact deadlines to avoid missing out on potential savings.

-

Can I appeal a decision regarding my south carolina real property tax exemption application?

If your application for the south carolina real property tax exemption is denied, you have the right to appeal the decision. The appeal process usually involves submitting a formal request to your local tax assessor's office. Be prepared to provide additional documentation or evidence to support your case during the appeal.

Get more for 5040 Fax 843

- Opt offer letter form

- 8003386180 form

- Regence provider appeal form 467834452

- State of tennessee monthly spill bucket inspection log cn 1286 form

- Joint commission organization update form

- Town of spring lake sprinkler permit application form

- Town of spring lake mobil home permit application form

- Ilc form 328 quality systems procurement clauses ilc dover

Find out other 5040 Fax 843

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile

- How To eSign Michigan Real Estate Business Plan Template