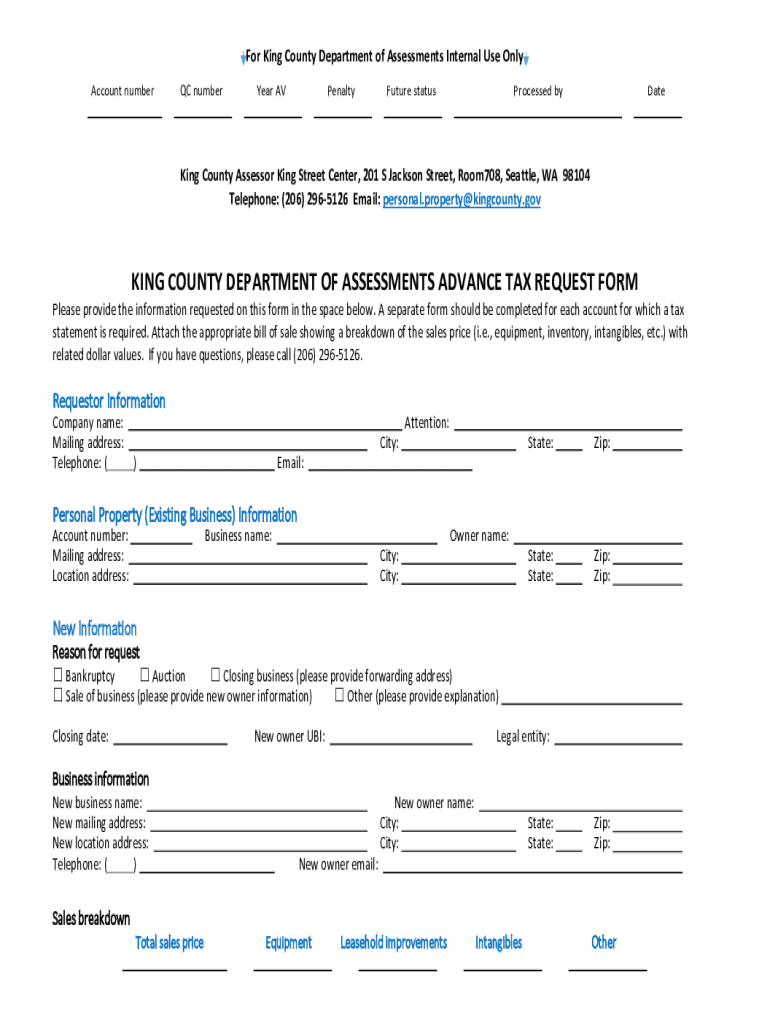

KING COUNTY DEPARTMENT of ASSESSMENTS ADVANCE TAX Form

What is the KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX

The KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX is a specific tax obligation related to property assessments in King County, Washington. This tax is typically levied on property owners to ensure that the assessed value of their properties is accurately reflected in local tax calculations. Understanding this tax is crucial for property owners, as it impacts their overall tax liabilities and financial planning.

How to use the KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX

Utilizing the KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX involves understanding your property’s assessed value and its implications on your tax bill. Property owners should regularly review their assessments and ensure they reflect the current market value. If discrepancies are found, property owners can challenge the assessment through the appropriate channels, which may include submitting an appeal to the local assessment office.

Steps to complete the KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX

Completing the KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX involves several key steps:

- Review your property assessment notice, which includes the assessed value and tax rate.

- Determine if the assessed value aligns with the current market value of your property.

- If necessary, gather supporting documentation to challenge the assessment.

- Submit your appeal or request for review to the KING COUNTY DEPARTMENT OF ASSESSMENTS by the specified deadline.

- Await the outcome of your appeal and adjust your financial planning accordingly.

Required Documents

When dealing with the KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX, certain documents may be necessary for various processes. These documents can include:

- Your property assessment notice.

- Evidence of comparable property values, such as recent sales data.

- Any previous tax documents related to your property.

- Identification documents to verify ownership.

Filing Deadlines / Important Dates

It is essential to be aware of filing deadlines associated with the KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX. Typically, property owners must file appeals within a specific timeframe following the issuance of their assessment notices. Keeping a calendar of these important dates helps ensure compliance and allows property owners to address any issues promptly.

Penalties for Non-Compliance

Failing to comply with the requirements of the KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX can lead to various penalties. These may include:

- Increased tax liabilities if assessments are not contested.

- Potential legal action for unpaid taxes.

- Accumulation of interest on overdue payments.

Quick guide on how to complete king county department of assessments advance tax

Effortlessly Prepare KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX on Any Device

Managing documents online has gained signNow traction among companies and individuals alike. It offers an ideal sustainable alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it in the cloud. airSlate SignNow equips you with all the tools required to quickly create, modify, and electronically sign your documents without delays. Handle KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX on any device using the airSlate SignNow applications for Android or iOS and simplify your document-related tasks today.

How to Edit and Electronically Sign KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX with Ease

- Locate KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature with the Sign tool, which takes seconds and carries the same legal validity as a traditional ink signature.

- Review the information and then click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced files, exhausting form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs within just a few clicks from your preferred device. Edit and electronically sign KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the king county department of assessments advance tax

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX?

The KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX is a tax program designed to help property owners manage their tax obligations effectively. It provides a streamlined process for assessing property values and calculating taxes owed, ensuring transparency and accuracy in tax assessments.

-

How can airSlate SignNow assist with the KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX?

airSlate SignNow offers a user-friendly platform that allows you to easily send and eSign documents related to the KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX. This simplifies the process of submitting necessary forms and documents, making it more efficient for property owners.

-

What are the pricing options for using airSlate SignNow with the KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX?

airSlate SignNow provides flexible pricing plans that cater to various business needs, including those dealing with the KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX. You can choose from monthly or annual subscriptions, ensuring you only pay for what you need.

-

What features does airSlate SignNow offer for managing KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX documents?

With airSlate SignNow, you can access features such as document templates, real-time tracking, and secure eSigning, all tailored for the KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX. These features enhance the efficiency of managing tax-related documents.

-

Are there any benefits of using airSlate SignNow for the KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX?

Using airSlate SignNow for the KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX offers numerous benefits, including time savings and improved accuracy in document handling. The platform also enhances collaboration among stakeholders involved in the tax process.

-

Can airSlate SignNow integrate with other tools for the KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX?

Yes, airSlate SignNow seamlessly integrates with various tools and applications that can assist with the KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX. This integration allows for a more cohesive workflow, making it easier to manage tax-related tasks.

-

How secure is airSlate SignNow when dealing with KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX documents?

airSlate SignNow prioritizes security, employing advanced encryption and compliance measures to protect documents related to the KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX. You can trust that your sensitive information is safe and secure.

Get more for KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX

- Body story crash questions and answers form

- Saint leo university admission acceptance letter form

- Character certificate for passport verification form

- West bend dyno tuning llc waiver form

- Multi step percentage word problems worksheet pdf form

- Hawaii divorce manual pdf form

- Sdsc d 241 form

- City of owensborodaviess county fiscal court summary and form

Find out other KING COUNTY DEPARTMENT OF ASSESSMENTS ADVANCE TAX

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile