NJ Form 630 Application for Extension of Time to File NJ Gross 2016

What is the NJ Form 630 Application For Extension Of Time To File NJ Gross

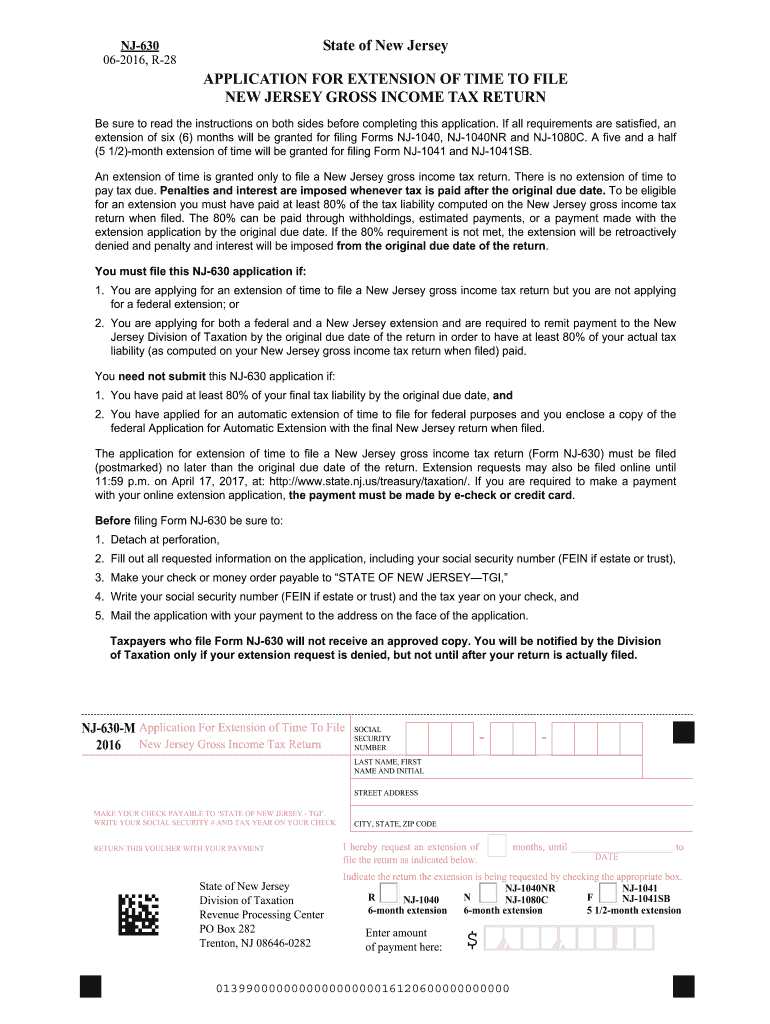

The NJ Form 630 Application For Extension Of Time To File NJ Gross is an official document that allows taxpayers in New Jersey to request an extension for filing their gross income tax returns. This form is essential for individuals or entities who need additional time beyond the standard filing deadline. By submitting this application, taxpayers can avoid penalties associated with late filings while ensuring compliance with state tax regulations.

Steps to complete the NJ Form 630 Application For Extension Of Time To File NJ Gross

Completing the NJ Form 630 involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including your personal identification details and income data. Next, accurately fill in the form, paying close attention to each section. After completing the form, review it for any errors or omissions. Once verified, you can eSign the document using a secure platform, ensuring that your submission is legally binding. Finally, submit the form electronically or via mail, depending on your preference.

Legal use of the NJ Form 630 Application For Extension Of Time To File NJ Gross

The NJ Form 630 is legally recognized as a valid request for an extension to file gross income tax returns in New Jersey. It is important to understand that this form does not extend the time to pay any taxes owed; it only provides additional time to file the return. Taxpayers must ensure that they submit the form before the original filing deadline to avoid penalties. The use of this form is governed by state tax laws, which outline the proper procedures and requirements for filing.

Filing Deadlines / Important Dates

Understanding the filing deadlines associated with the NJ Form 630 is crucial for taxpayers. Typically, the application must be submitted by the original due date of the tax return. For most individuals, this date falls on April fifteenth. However, if this date falls on a weekend or holiday, the deadline may shift to the next business day. It is advisable to check for any updates or changes to deadlines each tax year to ensure compliance.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the NJ Form 630. The form can be submitted online through secure e-filing platforms, which offer a convenient and efficient method for filing. Alternatively, taxpayers may choose to mail the completed form to the appropriate state tax office. For those who prefer in-person submissions, visiting a local tax office is also an option. Regardless of the method chosen, ensuring timely submission is essential to avoid penalties.

Eligibility Criteria

To be eligible to file the NJ Form 630, taxpayers must meet certain criteria set forth by the New Jersey Division of Taxation. Generally, this form is available to individuals, partnerships, and corporations that require additional time to file their gross income tax returns. It is important to ensure that all eligibility requirements are met before submitting the application to avoid delays or complications in the filing process.

Quick guide on how to complete nj form 630 application for extension of time to file nj gross

Aids for Preparing Your NJ Form 630 Application For Extension Of Time To File NJ Gross

If you are curious about how to generate and submit your NJ Form 630 Application For Extension Of Time To File NJ Gross, here are some quick tips to streamline your tax filing process.

First and foremost, simply sign up for your airSlate SignNow account to transform your approach to handling documents online. airSlate SignNow is a user-friendly and efficient document management tool that enables you to modify, draft, and complete your tax documents with ease. Its editor allows you to toggle between text, checkboxes, and electronic signatures, providing you the flexibility to alter responses as required. Enhance your tax management by utilizing advanced PDF editing, eSigning, and convenient sharing options.

Follow the steps below to finalize your NJ Form 630 Application For Extension Of Time To File NJ Gross in just a few minutes:

- Establish your account and begin editing PDFs within moments.

- Explore our catalog to locate any IRS tax document; browse through various versions and schedules.

- Click Retrieve form to access your NJ Form 630 Application For Extension Of Time To File NJ Gross in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Signature Tool to insert your legally binding eSignature (if required).

- Examine your document and amend any inaccuracies.

- Apply changes, print your copy, forward it to your recipient, and save it to your device.

Refer to this guide for electronically filing your taxes with airSlate SignNow. Be aware that submitting paper forms may lead to an increase in errors and delays in reimbursements. It is advisable to check the IRS website for filing regulations specific to your state before e-filing your taxes.

Create this form in 5 minutes or less

Find and fill out the correct nj form 630 application for extension of time to file nj gross

FAQs

-

For a 2 partner LLC, what forms do I have to file for tax time (NJ)?

I can’t answer for the state on NJ, but the IRS will expect an LLC with two or more members to file Form 1065 for partnership returns.LLCs also have the option of filing elections to be treated as a Corporation (filing an 1120) or an S-Corp (filing an 1120-S), but that is only if the proper elections have been made.Without the above elections the default is 1065.

-

I need to pay an $800 annual LLC tax for my LLC that formed a month ago, so I am looking to apply for an extension. It's a solely owned LLC, so I need to fill out a Form 7004. How do I fill this form out?

ExpressExtension is an IRS-authorized e-file provider for all types of business entities, including C-Corps (Form 1120), S-Corps (Form 1120S), Multi-Member LLC, Partnerships (Form 1065). Trusts, and Estates.File Tax Extension Form 7004 InstructionsStep 1- Begin by creating your free account with ExpressExtensionStep 2- Enter the basic business details including: Business name, EIN, Address, and Primary Contact.Step 3- Select the business entity type and choose the form you would like to file an extension for.Step 4- Select the tax year and select the option if your organization is a Holding CompanyStep 5- Enter and make a payment on the total estimated tax owed to the IRSStep 6- Carefully review your form for errorsStep 7- Pay and transmit your form to the IRSClick here to e-file before the deadline

-

I am moving to Parsippany, NJ in February for full time employment. How is the cost of living in the area?

When it comes to cost of living, cost to rent house plays big role.You can find apartments in Parsippany area in below price range:1 bedroom apartment - $1150 - $16002 bedroom apartment - $1450 - $2000Other than this all other expenses would be almost same as any other suburb. I have been living in Parsippany for more than 5 years and I love this place. Few reasons:- Near to NYC (city which we all love). There is good bus connectivity.- Within 1 hour drive there are 3 airports - EWR, JFK and La Guardia so well connected to world and other states in US.- Schools with good ratings- All Supermarkets within 5 mile - Wal-Mart, Costco, Wegmans etc- Two malls within 8 miles - Willowbrook and Rockaway mall- Best restaurants for all cuisines.Hope this helps.Thanks.

-

How do you file for an Automatic Extension of Time To File a Tax Return?

Use form 4868, and you can either e-file it, or just mail it in.A little warning. An extension to file is not an extension to pay. So, if you have a balance due, penalties and interest will be calculated on that balance due starting April 15th. So, you’ll want to estimate your taxes and pay that.The other thing is that if you have a refund coming, there technically is no need to file an extension. The failure-to-file penalty is based upon the amount you have due for your taxes. If you do not have a balance due, but have a refund, that failure-to-file penalty will be $0. You’ll just need to file eventually to get your refund.

-

Do we have to separately fill out the application forms of medial institutions like AMU apart from the NEET application form for 2017?

No there's no separate exam to get into AMU , the admission will be based on your NEET score.

Create this form in 5 minutes!

How to create an eSignature for the nj form 630 application for extension of time to file nj gross

How to make an electronic signature for the Nj Form 630 Application For Extension Of Time To File Nj Gross online

How to create an electronic signature for your Nj Form 630 Application For Extension Of Time To File Nj Gross in Google Chrome

How to create an electronic signature for signing the Nj Form 630 Application For Extension Of Time To File Nj Gross in Gmail

How to create an eSignature for the Nj Form 630 Application For Extension Of Time To File Nj Gross right from your mobile device

How to make an eSignature for the Nj Form 630 Application For Extension Of Time To File Nj Gross on iOS devices

How to generate an electronic signature for the Nj Form 630 Application For Extension Of Time To File Nj Gross on Android

People also ask

-

What is the NJ Form 630 Application For Extension Of Time To File NJ Gross?

The NJ Form 630 Application For Extension Of Time To File NJ Gross is a form that allows taxpayers in New Jersey to request an extension for filing their gross income tax returns. By using this form, individuals can avoid late fees and ensure compliance with state regulations while they prepare their complete tax return.

-

How can airSlate SignNow assist with the NJ Form 630 Application For Extension Of Time To File NJ Gross?

airSlate SignNow provides an efficient platform to eSign and submit your NJ Form 630 Application For Extension Of Time To File NJ Gross electronically. Our easy-to-use interface streamlines the process, allowing for quick completion and submission, ensuring you stay compliant with New Jersey tax regulations.

-

Is there a fee for using the airSlate SignNow service for the NJ Form 630 Application?

Yes, airSlate SignNow offers a cost-effective subscription model, providing access to features that facilitate signing and sending documents, including the NJ Form 630 Application For Extension Of Time To File NJ Gross. Pricing details are available on our website, allowing you to choose a plan that fits your business needs.

-

What features does airSlate SignNow offer for managing NJ Form 630 Application?

airSlate SignNow includes features such as document templates, secure eSignature capabilities, real-time tracking, and team collaboration tools. These features help streamline the process of completing the NJ Form 630 Application For Extension Of Time To File NJ Gross, making it easier and faster to manage your tax obligations.

-

Can I integrate airSlate SignNow with my existing software to file the NJ Form 630?

Absolutely! airSlate SignNow supports various integrations, allowing you to connect with your existing software like CRM systems and accounting tools. This makes the process of preparing and submitting your NJ Form 630 Application For Extension Of Time To File NJ Gross seamless and efficient.

-

What are the benefits of using airSlate SignNow for the NJ Form 630 Application?

Using airSlate SignNow for the NJ Form 630 Application For Extension Of Time To File NJ Gross provides numerous benefits, including simplified eSigning, enhanced security, and access to documents anytime, anywhere. Moreover, our platform saves time and reduces the hassle of traditional paperwork.

-

How long does it take to complete the NJ Form 630 Application using airSlate SignNow?

Completing the NJ Form 630 Application For Extension Of Time To File NJ Gross using airSlate SignNow can take just a few minutes. Our platform's user-friendly design allows for easy filling out and signing of the document, signNowly reducing the overall time required.

Get more for NJ Form 630 Application For Extension Of Time To File NJ Gross

- Cor25 form

- 8872 form

- Consultation request form pathology johns hopkins university pathology jhu

- Okc building permit application form

- Billerica pop warner youth football cheer united states form

- Cutter recognition and heritage programs u s department form

- Statement of lossrequest for replacement food due to a form

- Centralia chehalis emblem club 163 scholarship application rochester wednet form

Find out other NJ Form 630 Application For Extension Of Time To File NJ Gross

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form