Declaration of Tax Status for Other Qualified Adult Benefits Office Benefits Umich Form

What is the Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich

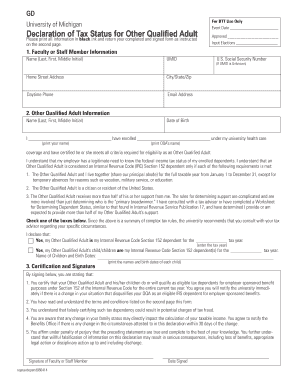

The Declaration of Tax Status for Other Qualified Adult Benefits Office Benefits at the University of Michigan (Umich) is a crucial document used to establish tax status for individuals who are considered qualified adults under specific benefit plans. This form helps determine eligibility for benefits, ensuring that the tax implications are correctly assessed. It is particularly relevant for those who are not traditional dependents but still qualify for certain benefits under the university's policies.

How to use the Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich

Using the Declaration of Tax Status involves completing the form accurately to reflect your current tax situation. Individuals should gather necessary information, including personal identification details and tax-related data. Once the form is filled out, it should be submitted to the appropriate benefits office at Umich for processing. This ensures that your benefits are aligned with your tax status, allowing for proper management of any associated tax liabilities.

Steps to complete the Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich

Completing the Declaration of Tax Status requires a systematic approach:

- Gather necessary personal and tax information, including Social Security numbers and income details.

- Download the form from the official University of Michigan benefits website or request a physical copy.

- Fill out the form carefully, ensuring all sections are completed accurately.

- Review the form for any errors or omissions before submission.

- Submit the completed form to the designated benefits office, either in person or via mail.

Key elements of the Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich

Key elements of the Declaration of Tax Status include the following:

- Personal Information: This section requires the names, addresses, and Social Security numbers of both the employee and the qualified adult.

- Tax Status Declaration: Individuals must indicate their tax filing status and provide any relevant income information.

- Signature: The form must be signed by both parties to validate the information provided.

Legal use of the Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich

The legal use of the Declaration of Tax Status is essential for compliance with tax regulations and university policies. This form serves as a formal declaration that can affect tax liabilities and eligibility for benefits. It is important to ensure that the information provided is truthful and accurate, as any discrepancies could lead to legal ramifications or penalties from tax authorities.

Required Documents

To complete the Declaration of Tax Status, individuals should prepare the following documents:

- Proof of identity for both the employee and the qualified adult, such as a driver's license or passport.

- Recent tax returns or W-2 forms to verify income and tax status.

- Any additional documentation that may support the claims made in the declaration.

Quick guide on how to complete declaration of tax status for other qualified adult benefits office benefits umich

Effortlessly Prepare [SKS] on Any Device

The management of online documents has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the proper format and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and efficiently. Handle [SKS] on any platform with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

Easily Edit and eSign [SKS] with Minimal Effort

- Locate [SKS] and click Get Form to begin.

- Use the tools available to complete your form.

- Emphasize important sections of your documents or redact sensitive information with features offered by airSlate SignNow specifically for that purpose.

- Generate your signature using the Sign tool, which takes only seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign [SKS] and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich

Create this form in 5 minutes!

How to create an eSignature for the declaration of tax status for other qualified adult benefits office benefits umich

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich?

The Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich is a document required for individuals seeking benefits for qualified adults. It helps clarify tax status and eligibility for various benefits offered by the University of Michigan. Understanding this declaration is crucial for ensuring compliance and maximizing available benefits.

-

How can airSlate SignNow assist with the Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich?

airSlate SignNow provides a seamless platform for electronically signing and sending the Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich. Our user-friendly interface simplifies the process, ensuring that you can complete and submit your documents quickly and efficiently. This saves time and reduces the hassle of paperwork.

-

What are the pricing options for using airSlate SignNow for the Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of individuals and businesses. You can choose from various subscription options that provide access to features necessary for managing the Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich. Our cost-effective solutions ensure you get the best value for your document management needs.

-

What features does airSlate SignNow offer for managing the Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking, all of which are essential for managing the Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich. These tools enhance efficiency and ensure that your documents are handled securely and professionally. You can also collaborate with others in real-time.

-

Is airSlate SignNow secure for handling sensitive documents like the Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling sensitive documents such as the Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich. Our platform uses advanced encryption and security protocols to protect your data. You can trust that your information is secure while using our services.

-

Can I integrate airSlate SignNow with other applications for the Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow when managing the Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich. Whether you use CRM systems, cloud storage, or other productivity tools, our platform can connect seamlessly to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich?

Using airSlate SignNow for the Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced collaboration. Our platform simplifies the signing process, allowing you to focus on what matters most. Additionally, you can access your documents anytime, anywhere, making it convenient for busy professionals.

Get more for Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich

- Evaluation guidebook form

- Nde rule 89 nebraska library commission state of nebraska nlc nebraska form

- Introduction to the child amp adult care food program manual for form

- Teaching strategies for enhancing curriculum nebraska department of education nlc nebraska form

- Improving learning for children with disabilities birth to 21 nebraska department of education nlc nebraska form

- Nedocs depository filming update list winter nebraska form

- Speditionsauftrag gebrder weiss form

- Speditionsauftrag gebrder weiss 348237014 form

Find out other Declaration Of Tax Status For Other Qualified Adult Benefits Office Benefits Umich

- eSign Arizona Non-Compete Agreement Easy

- eSign Connecticut Invoice for Goods (Standard Format) Secure

- eSign Arizona Non-Compete Agreement Safe

- Can I eSign Connecticut Invoice for Goods (Standard Format)

- eSign Connecticut Invoice for Goods (Standard Format) Fast

- eSign Connecticut Invoice for Goods (Standard Format) Simple

- How To eSign Arizona Non-Compete Agreement

- How Do I eSign Arizona Non-Compete Agreement

- Help Me With eSign Arizona Non-Compete Agreement

- How Can I eSign Arizona Non-Compete Agreement

- eSign Connecticut Invoice for Goods (Standard Format) Easy

- eSign Connecticut Invoice for Goods (Standard Format) Safe

- Can I eSign Arizona Non-Compete Agreement

- eSign Arkansas Non-Compete Agreement Online

- eSign Arkansas Non-Compete Agreement Computer

- eSign Arkansas Non-Compete Agreement Mobile

- eSign Missouri Profit and Loss Statement Online

- eSign Arkansas Non-Compete Agreement Later

- eSign Arkansas Non-Compete Agreement Now

- eSign Missouri Profit and Loss Statement Computer