Pennsylvania Individual Income Tax Return Instructions FormsPublications Cmu

What is the Pennsylvania Individual Income Tax Return Instructions FormsPublications Cmu

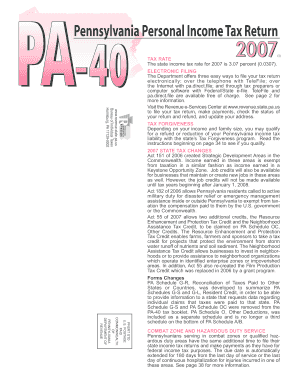

The Pennsylvania Individual Income Tax Return Instructions FormsPublications Cmu provides essential guidelines for individuals filing their state income tax returns. This document outlines the necessary steps, forms, and requirements to ensure compliance with Pennsylvania tax laws. It is designed to assist taxpayers in accurately reporting their income, claiming deductions, and calculating their tax liability.

Steps to complete the Pennsylvania Individual Income Tax Return Instructions FormsPublications Cmu

Completing the Pennsylvania Individual Income Tax Return involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Obtain the appropriate tax forms from the Pennsylvania Department of Revenue or through authorized sources.

- Fill out the forms carefully, ensuring all income and deductions are accurately reported.

- Review the completed return for any errors or omissions.

- Submit the return by the designated deadline, either electronically or by mail.

Required Documents

To complete the Pennsylvania Individual Income Tax Return, taxpayers need to gather specific documents:

- W-2 forms from employers

- 1099 forms for any freelance or contract work

- Documentation for deductions, such as receipts or statements

- Previous year’s tax return for reference

Filing Deadlines / Important Dates

Taxpayers in Pennsylvania must adhere to specific deadlines for filing their income tax returns. The standard deadline is typically April 15, unless it falls on a weekend or holiday, in which case the deadline may be adjusted. Extensions may be available, but it is essential to file for an extension before the original deadline.

Form Submission Methods (Online / Mail / In-Person)

The Pennsylvania Individual Income Tax Return can be submitted through various methods:

- Online filing through the Pennsylvania Department of Revenue’s e-file system.

- Mailing a paper return to the appropriate address provided in the instructions.

- In-person submission at designated state tax offices, if applicable.

Penalties for Non-Compliance

Failure to comply with Pennsylvania tax filing requirements can result in penalties. These may include:

- Late filing penalties, which can accumulate over time.

- Interest on unpaid taxes, calculated from the due date until payment is made.

- Potential legal action for severe cases of non-compliance.

Quick guide on how to complete pennsylvania individual income tax return instructions formspublications cmu

Handle [SKS] seamlessly on any gadget

Digital document management has gained popularity with both enterprises and individuals. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to design, modify, and eSign your documents quickly without interruptions. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The simplest way to adjust and eSign [SKS] with ease

- Find [SKS] and click on Get Form to start.

- Utilize the tools we offer to complete your form.

- Emphasize relevant sections of your documents or obscure sensitive data using tools that airSlate SignNow specifically provides for that purpose.

- Generate your eSignature with the Sign tool, which takes only a few seconds and holds the same legal validity as a conventional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your preference. Modify and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to Pennsylvania Individual Income Tax Return Instructions FormsPublications Cmu

Create this form in 5 minutes!

How to create an eSignature for the pennsylvania individual income tax return instructions formspublications cmu

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the Pennsylvania Individual Income Tax Return Instructions FormsPublications Cmu?

The Pennsylvania Individual Income Tax Return Instructions FormsPublications Cmu provide essential guidelines for completing your state tax return. These documents outline the necessary forms, filing procedures, and important deadlines to ensure compliance with Pennsylvania tax laws.

-

How can airSlate SignNow assist with Pennsylvania Individual Income Tax Return Instructions FormsPublications Cmu?

airSlate SignNow simplifies the process of signing and submitting your Pennsylvania Individual Income Tax Return Instructions FormsPublications Cmu. With our user-friendly platform, you can easily eSign documents and manage your tax forms efficiently, saving you time and reducing errors.

-

What features does airSlate SignNow offer for tax document management?

airSlate SignNow offers features such as customizable templates, secure eSigning, and document tracking, which are essential for managing your Pennsylvania Individual Income Tax Return Instructions FormsPublications Cmu. These tools help streamline your workflow and ensure that all necessary documents are completed accurately.

-

Is airSlate SignNow cost-effective for managing tax documents?

Yes, airSlate SignNow provides a cost-effective solution for managing your Pennsylvania Individual Income Tax Return Instructions FormsPublications Cmu. Our pricing plans are designed to accommodate businesses of all sizes, ensuring you get the best value for your document management needs.

-

Can I integrate airSlate SignNow with other software for tax preparation?

Absolutely! airSlate SignNow integrates seamlessly with various accounting and tax preparation software, making it easier to manage your Pennsylvania Individual Income Tax Return Instructions FormsPublications Cmu. This integration allows for a smoother workflow and better organization of your tax documents.

-

What are the benefits of using airSlate SignNow for tax filing?

Using airSlate SignNow for your Pennsylvania Individual Income Tax Return Instructions FormsPublications Cmu offers numerous benefits, including enhanced security, faster processing times, and reduced paperwork. Our platform ensures that your documents are securely stored and easily accessible whenever you need them.

-

How does airSlate SignNow ensure the security of my tax documents?

airSlate SignNow prioritizes the security of your Pennsylvania Individual Income Tax Return Instructions FormsPublications Cmu by employing advanced encryption and secure cloud storage. This ensures that your sensitive information remains protected throughout the signing and submission process.

Get more for Pennsylvania Individual Income Tax Return Instructions FormsPublications Cmu

- Complaint form american psychological association apa

- Rental assistance ihdarental help illinoishud gov u s department of2021 illinois rental payment program ihdarental help form

- Boat rental agreement and release form

- Ohfa fillable tic form

- Original court1st copy defendant2nd copy prosecu form

- Order to remit prisoner funds for fines costs and assessments procedural steps to take when drafting the order for defendants form

- 3rd copy sherifffacility form

- Mc 263 motionorder of nolle prosequi form

Find out other Pennsylvania Individual Income Tax Return Instructions FormsPublications Cmu

- How Can I Sign Alabama Charity Form

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form