Sponsor Application Form Institute for Professionals in Taxation Ipt

What is the Sponsor Application Form Institute For Professionals In Taxation Ipt

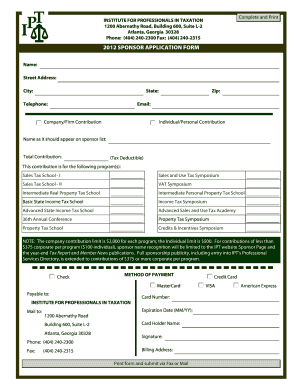

The Sponsor Application Form for the Institute for Professionals in Taxation (IPT) is a crucial document designed for individuals or organizations seeking to become recognized sponsors within the IPT framework. This form facilitates the application process by gathering essential information about the applicant, including their qualifications, experience, and intent to support IPT’s educational initiatives. The form plays a significant role in ensuring that sponsors align with the standards and goals of the IPT, ultimately contributing to the professional development of tax professionals.

How to use the Sponsor Application Form Institute For Professionals In Taxation Ipt

Using the Sponsor Application Form involves several straightforward steps. First, applicants should carefully read all instructions provided with the form to understand the requirements and necessary documentation. Next, fill out the form with accurate information, ensuring that all sections are completed thoroughly. Once the form is filled out, applicants must review their entries for accuracy before submission. Finally, the completed form can be submitted either electronically or via traditional mail, depending on the guidelines specified by the IPT.

Steps to complete the Sponsor Application Form Institute For Professionals In Taxation Ipt

Completing the Sponsor Application Form requires attention to detail. Here are the steps to follow:

- Obtain the latest version of the Sponsor Application Form from the IPT website or authorized sources.

- Read the instructions carefully to understand the eligibility criteria and required information.

- Fill out the form, providing accurate details about your organization or personal qualifications.

- Attach any required supporting documents, such as proof of credentials or previous sponsorship experience.

- Review the completed form to ensure all information is correct and complete.

- Submit the form according to the specified submission methods, ensuring it is sent before any deadlines.

Key elements of the Sponsor Application Form Institute For Professionals In Taxation Ipt

The key elements of the Sponsor Application Form include personal or organizational details, qualifications, and a statement of intent regarding sponsorship. Important sections often require information such as:

- Applicant's name and contact information

- Type of organization (if applicable)

- Relevant experience in tax education or related fields

- Details on how the sponsorship will support IPT's mission

- Signature and date to verify the authenticity of the application

Legal use of the Sponsor Application Form Institute For Professionals In Taxation Ipt

The legal use of the Sponsor Application Form ensures compliance with IPT’s standards and relevant regulations. By submitting the form, applicants agree to adhere to IPT’s guidelines and ethical standards in their sponsorship activities. This legal framework protects both the IPT and the applicants, ensuring that all sponsorships are conducted fairly and transparently, fostering a professional environment for tax education.

Eligibility Criteria

Eligibility to submit the Sponsor Application Form is typically based on specific criteria set by the IPT. Applicants must demonstrate relevant experience in the tax field or related educational initiatives. Organizations may need to provide evidence of their capacity to support IPT’s educational goals. Additionally, applicants should have a commitment to upholding the values and standards of the IPT, which may include a review of past sponsorships or educational contributions.

Quick guide on how to complete sponsor application form institute for professionals in taxation ipt

Effortlessly Prepare [SKS] on Any Device

Managing documents online has gained considerable traction among businesses and individuals. It serves as an excellent environmentally friendly substitute for conventional printed and signed papers, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly and seamlessly. Manage [SKS] on any device using airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The Easiest Way to Modify and eSign [SKS] Without Stress

- Locate [SKS] and click Get Form to begin.

- Make use of the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors necessitating new document copies. airSlate SignNow takes care of all your document management needs in just a few clicks from any device you choose. Modify and eSign [SKS], ensuring excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sponsor application form institute for professionals in taxation ipt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Sponsor Application Form Institute For Professionals In Taxation Ipt?

The Sponsor Application Form Institute For Professionals In Taxation Ipt is a document designed for organizations seeking to become sponsors for IPT programs. This form collects essential information about the sponsoring entity and ensures compliance with IPT standards. Completing this form is the first step in establishing a partnership with IPT.

-

How can I access the Sponsor Application Form Institute For Professionals In Taxation Ipt?

You can easily access the Sponsor Application Form Institute For Professionals In Taxation Ipt on our website. Simply navigate to the IPT section and download the form directly. If you have any issues, our support team is available to assist you.

-

What are the benefits of submitting the Sponsor Application Form Institute For Professionals In Taxation Ipt?

Submitting the Sponsor Application Form Institute For Professionals In Taxation Ipt allows your organization to gain recognition as a reputable sponsor. This can enhance your brand visibility and credibility within the tax profession. Additionally, it opens up opportunities for collaboration and networking with other professionals in the field.

-

Is there a fee associated with the Sponsor Application Form Institute For Professionals In Taxation Ipt?

There is typically no fee for submitting the Sponsor Application Form Institute For Professionals In Taxation Ipt. However, certain sponsorship programs may have associated costs. It’s best to review the specific program details on our website for any potential fees.

-

What information is required on the Sponsor Application Form Institute For Professionals In Taxation Ipt?

The Sponsor Application Form Institute For Professionals In Taxation Ipt requires basic information about your organization, including contact details, business structure, and relevant experience in the tax field. Providing accurate and comprehensive information will facilitate a smoother review process.

-

How long does it take to process the Sponsor Application Form Institute For Professionals In Taxation Ipt?

Processing times for the Sponsor Application Form Institute For Professionals In Taxation Ipt can vary, but typically it takes 2-4 weeks. Factors such as the completeness of your application and current review workloads can influence this timeline. You will be notified once your application has been reviewed.

-

Can I edit my submission after sending the Sponsor Application Form Institute For Professionals In Taxation Ipt?

Once you submit the Sponsor Application Form Institute For Professionals In Taxation Ipt, it is important to ensure all information is accurate. If you need to make changes, please contact our support team as soon as possible. They will guide you on the best steps to update your application.

Get more for Sponsor Application Form Institute For Professionals In Taxation Ipt

- Section 8 housing choice voucher program centralized form

- Amount of change at start of event form

- Crosswinds flying club form

- Los angeles county homestead declaration form

- When recorded mail document to lavote form

- Application for transfer of ownership psfapp003 form

- Ca application ampamp agreement form

- 415 north center st suite 300 hickory nc 28601 phone 8283283300 fax 8283289101 patient interview form patient information first

Find out other Sponsor Application Form Institute For Professionals In Taxation Ipt

- eSign Arkansas Military Leave Policy Myself

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure