COMPLETE ONLY IF NOT FILING FEDERAL EXTENSION SEE INSTRUCTIONS for PAYMENT REQUIREMENTS Revenue Ky Form

What is the COMPLETE ONLY IF NOT FILING FEDERAL EXTENSION SEE INSTRUCTIONS FOR PAYMENT REQUIREMENTS Revenue Ky

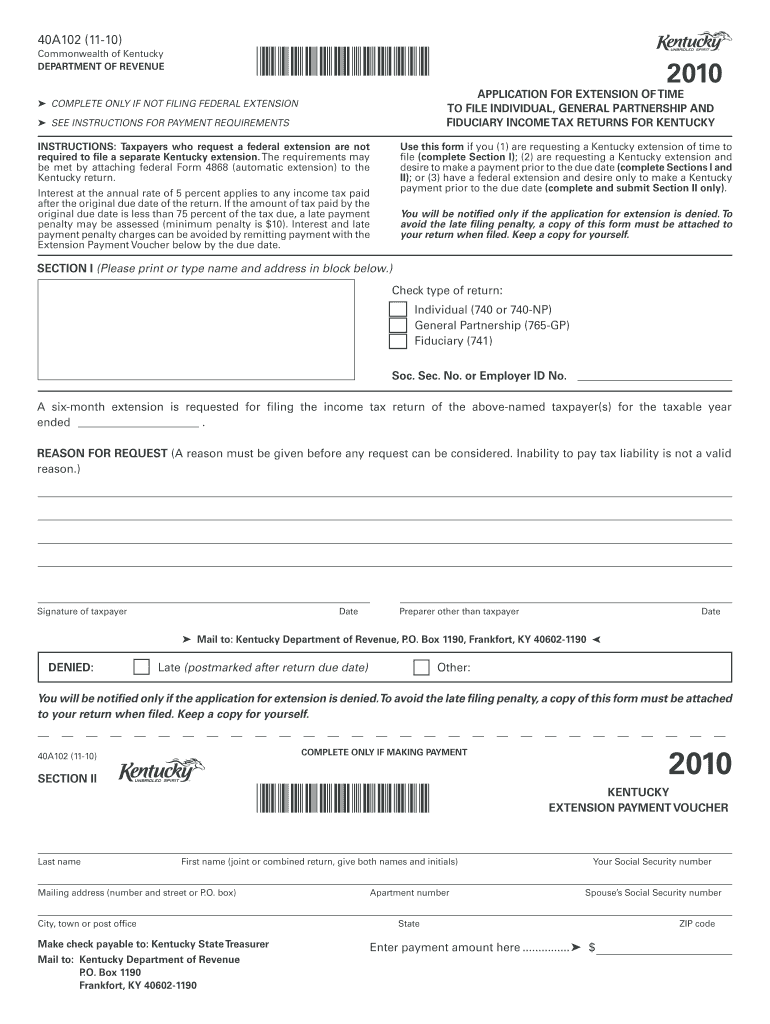

The form titled "COMPLETE ONLY IF NOT FILING FEDERAL EXTENSION SEE INSTRUCTIONS FOR PAYMENT REQUIREMENTS Revenue Ky" is a state-specific document used for tax purposes in Kentucky. It is designed for individuals and businesses who are required to report their income to the state without filing for a federal extension. This form helps ensure compliance with Kentucky tax laws and facilitates the payment of any owed state taxes.

Steps to complete the COMPLETE ONLY IF NOT FILING FEDERAL EXTENSION SEE INSTRUCTIONS FOR PAYMENT REQUIREMENTS Revenue Ky

Completing the form involves several key steps:

- Gather necessary financial documents, including income statements and previous tax returns.

- Fill out personal identification information, such as your name, address, and Social Security number.

- Report your total income and any deductions applicable to your situation.

- Calculate the total tax owed based on the provided tax rates.

- Review the form for accuracy and completeness before submission.

State-specific rules for the COMPLETE ONLY IF NOT FILING FEDERAL EXTENSION SEE INSTRUCTIONS FOR PAYMENT REQUIREMENTS Revenue Ky

Kentucky has specific regulations regarding the filing of this form. Taxpayers must adhere to the state's deadlines for submission, which typically align with federal tax deadlines unless an extension is filed. Additionally, certain deductions and credits may differ from federal guidelines, making it essential to refer to the state's tax instructions for accurate reporting.

Required Documents

To successfully complete the form, you will need several documents:

- Income statements such as W-2s or 1099s.

- Previous year’s tax return for reference.

- Documentation for any deductions you plan to claim.

- Identification documents, including your Social Security number.

Penalties for Non-Compliance

Failure to file the "COMPLETE ONLY IF NOT FILING FEDERAL EXTENSION SEE INSTRUCTIONS FOR PAYMENT REQUIREMENTS Revenue Ky" form on time may result in penalties. These can include fines and interest on any unpaid taxes. It is crucial to file accurately and on time to avoid these consequences and maintain good standing with the Kentucky Department of Revenue.

Form Submission Methods

This form can be submitted through various methods, including:

- Online submission via the Kentucky Department of Revenue's website.

- Mailing a printed version of the form to the appropriate state tax office.

- In-person delivery at designated tax offices throughout Kentucky.

Quick guide on how to complete complete only if not filing federal extension see instructions for payment requirements revenue ky

Prepare [SKS] effortlessly on any device

Digital document management has become popular among companies and individuals. It offers a perfect eco-friendly substitute for traditional printed and signed documents, as you can find the necessary form and securely save it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your documents swiftly without delays. Handle [SKS] on any platform with airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest way to modify and eSign [SKS] with ease

- Obtain [SKS] and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, time-consuming form hunts, or mistakes that require printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from a device of your choice. Modify and eSign [SKS] and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to COMPLETE ONLY IF NOT FILING FEDERAL EXTENSION SEE INSTRUCTIONS FOR PAYMENT REQUIREMENTS Revenue Ky

Create this form in 5 minutes!

How to create an eSignature for the complete only if not filing federal extension see instructions for payment requirements revenue ky

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the 'COMPLETE ONLY IF NOT FILING FEDERAL EXTENSION SEE INSTRUCTIONS FOR PAYMENT REQUIREMENTS Revenue Ky.' form?

The 'COMPLETE ONLY IF NOT FILING FEDERAL EXTENSION SEE INSTRUCTIONS FOR PAYMENT REQUIREMENTS Revenue Ky.' form is designed for individuals and businesses that need to report their income and pay taxes without filing for a federal extension. It ensures compliance with state regulations and helps avoid penalties.

-

How does airSlate SignNow simplify the process of completing the 'COMPLETE ONLY IF NOT FILING FEDERAL EXTENSION SEE INSTRUCTIONS FOR PAYMENT REQUIREMENTS Revenue Ky.' form?

airSlate SignNow streamlines the process by providing an intuitive platform for filling out and eSigning documents. Users can easily upload their forms, fill in the required information, and securely send them, ensuring that the 'COMPLETE ONLY IF NOT FILING FEDERAL EXTENSION SEE INSTRUCTIONS FOR PAYMENT REQUIREMENTS Revenue Ky.' form is completed accurately and efficiently.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. Whether you are a small business or a large enterprise, you can choose a plan that fits your budget while ensuring you can complete forms like the 'COMPLETE ONLY IF NOT FILING FEDERAL EXTENSION SEE INSTRUCTIONS FOR PAYMENT REQUIREMENTS Revenue Ky.' without hassle.

-

Can I integrate airSlate SignNow with other software for better workflow?

Yes, airSlate SignNow integrates seamlessly with various software applications, enhancing your workflow. This means you can easily manage documents related to the 'COMPLETE ONLY IF NOT FILING FEDERAL EXTENSION SEE INSTRUCTIONS FOR PAYMENT REQUIREMENTS Revenue Ky.' form alongside your existing tools.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow provides features such as eSigning, document templates, and real-time tracking. These tools help ensure that your 'COMPLETE ONLY IF NOT FILING FEDERAL EXTENSION SEE INSTRUCTIONS FOR PAYMENT REQUIREMENTS Revenue Ky.' form is processed quickly and securely.

-

Is airSlate SignNow secure for handling sensitive information?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your sensitive information. This is crucial when dealing with forms like the 'COMPLETE ONLY IF NOT FILING FEDERAL EXTENSION SEE INSTRUCTIONS FOR PAYMENT REQUIREMENTS Revenue Ky.' which may contain personal data.

-

How can airSlate SignNow benefit my business?

By using airSlate SignNow, your business can save time and reduce paperwork associated with document signing. This efficiency is particularly beneficial when completing forms like the 'COMPLETE ONLY IF NOT FILING FEDERAL EXTENSION SEE INSTRUCTIONS FOR PAYMENT REQUIREMENTS Revenue Ky.', allowing you to focus on core business activities.

Get more for COMPLETE ONLY IF NOT FILING FEDERAL EXTENSION SEE INSTRUCTIONS FOR PAYMENT REQUIREMENTS Revenue Ky

- Connecticut real estate contract forms and agreementsus legal

- Utah legal form titles legal documentsus legal forms

- Mortgage deed formfree mortgage deed sample ampamp definition

- Landlord tenant handbook form

- Form ca 988lt

- Adoption legal formsus legal forms

- Alaska home sale package form

- Washington landlord tenant package form

Find out other COMPLETE ONLY IF NOT FILING FEDERAL EXTENSION SEE INSTRUCTIONS FOR PAYMENT REQUIREMENTS Revenue Ky

- How To eSignature Idaho Affidavit of Title

- eSign Wisconsin Real estate forms Secure

- How To eSign California Real estate investment proposal template

- eSignature Oregon Affidavit of Title Free

- eSign Colorado Real estate investment proposal template Simple

- eSign Louisiana Real estate investment proposal template Fast

- eSign Wyoming Real estate investment proposal template Free

- How Can I eSign New York Residential lease

- eSignature Colorado Cease and Desist Letter Later

- How Do I eSignature Maine Cease and Desist Letter

- How Can I eSignature Maine Cease and Desist Letter

- eSignature Nevada Cease and Desist Letter Later

- Help Me With eSign Hawaii Event Vendor Contract

- How To eSignature Louisiana End User License Agreement (EULA)

- How To eSign Hawaii Franchise Contract

- eSignature Missouri End User License Agreement (EULA) Free

- eSign Delaware Consulting Agreement Template Now

- eSignature Missouri Hold Harmless (Indemnity) Agreement Later

- eSignature Ohio Hold Harmless (Indemnity) Agreement Mobile

- eSignature California Letter of Intent Free