H&R Block Express IRA Distribution Form 2013

What is the H&R Block Express IRA Distribution Form

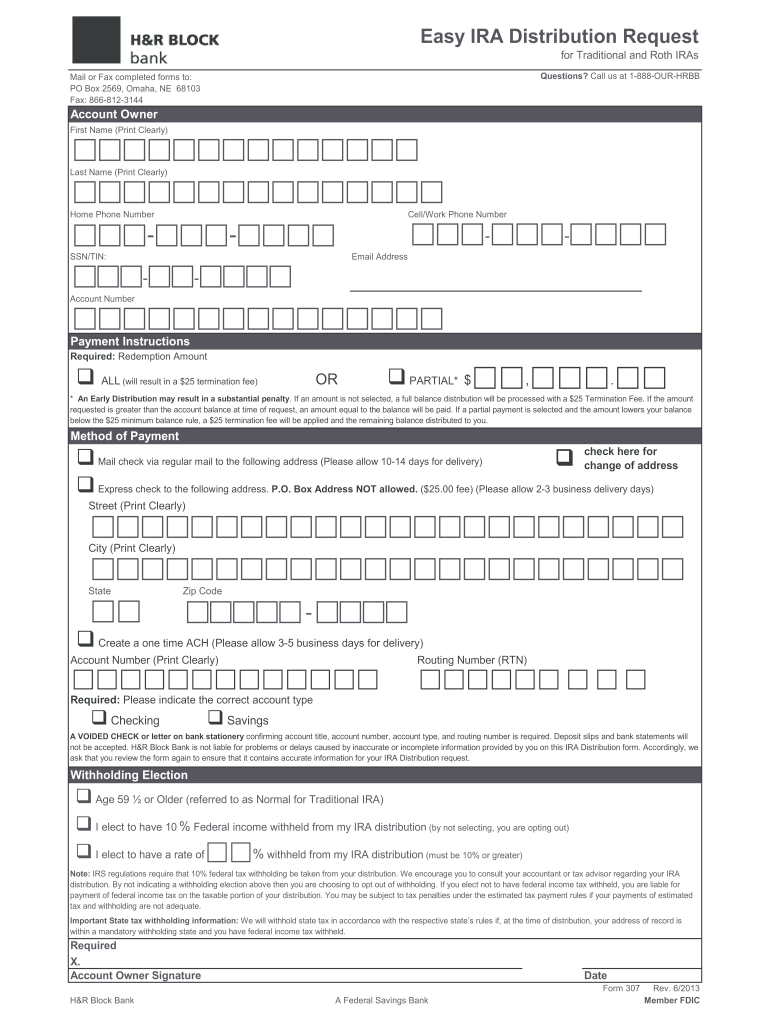

The H&R Block Express IRA Distribution Form is a document used by individuals to request distributions from their Individual Retirement Accounts (IRAs). This form is essential for managing retirement funds, allowing account holders to withdraw money from their IRAs in a structured manner. It serves to ensure compliance with IRS regulations regarding distributions, helping users avoid potential penalties associated with improper withdrawals.

How to use the H&R Block Express IRA Distribution Form

To use the H&R Block Express IRA Distribution Form, individuals must first obtain the form, which can typically be found on the H&R Block website or through their tax preparation services. After acquiring the form, users should fill in the necessary personal information, including their name, address, and Social Security number. The form also requires details about the IRA account and the specific amount being withdrawn. Once completed, the form should be submitted according to the instructions provided, either online, by mail, or in person.

Steps to complete the H&R Block Express IRA Distribution Form

Completing the H&R Block Express IRA Distribution Form involves several key steps:

- Obtain the form from H&R Block.

- Fill in your personal information accurately.

- Indicate the type of distribution you are requesting.

- Specify the amount to be withdrawn from your IRA.

- Review the form for accuracy and completeness.

- Submit the form as directed, ensuring that you follow the submission guidelines.

Legal use of the H&R Block Express IRA Distribution Form

The H&R Block Express IRA Distribution Form must be used in accordance with IRS regulations to ensure that all distributions are legally compliant. This includes understanding the tax implications of the withdrawal, as certain distributions may be subject to income tax or penalties if taken before the age of fifty-nine and a half. Users should consult with a tax professional if they have questions about the legal aspects of their IRA distributions.

Key elements of the H&R Block Express IRA Distribution Form

Key elements of the H&R Block Express IRA Distribution Form include:

- Personal Information: Name, address, and Social Security number.

- Account Information: Details about the IRA account from which funds are being withdrawn.

- Distribution Type: Options for different types of distributions, such as regular or early withdrawals.

- Withdrawal Amount: The specific amount of money being requested for distribution.

- Signature: The account holder's signature to authorize the transaction.

Form Submission Methods

The H&R Block Express IRA Distribution Form can be submitted through various methods, providing flexibility for users. The submission options typically include:

- Online: Submit the form electronically through the H&R Block website.

- Mail: Send the completed form to the designated address provided on the form.

- In-Person: Deliver the form directly to an H&R Block office for processing.

Quick guide on how to complete hampr block express ira distribution form

The simplest method to obtain and sign H&R Block Express IRA Distribution Form

Across the breadth of your entire organization, ineffective workflows concerning document authorization can consume a signNow amount of work hours. Executing documentation like H&R Block Express IRA Distribution Form is an inherent component of operations in any enterprise, which is the reason why the productivity of every agreement’s lifecycle is crucial to the overall success of the company. With airSlate SignNow, signing your H&R Block Express IRA Distribution Form is as straightforward and prompt as it can be. You’ll discover on this platform the latest version of nearly any form. Even better, you can sign it instantly without the need for third-party applications on your computer or printing physical copies.

Steps to obtain and sign your H&R Block Express IRA Distribution Form

- Explore our library by category or use the search box to find the form you require.

- View the form preview by selecting Learn more to confirm it’s the correct one.

- Click Get form to begin editing immediately.

- Fill out your form and input any essential details using the toolbar.

- Once finished, select the Sign tool to sign your H&R Block Express IRA Distribution Form.

- Choose the signature method that works best for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize your edits and proceed to document-sharing options if needed.

With airSlate SignNow, you possess everything necessary to handle your documents efficiently. You can locate, complete, modify and even send your H&R Block Express IRA Distribution Form all within one tab effortlessly. Optimize your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

Find and fill out the correct hampr block express ira distribution form

FAQs

-

How do I fill out the application for IIIT-H CLD impressively?

I assume you mean the Biography section. My advice would be to just be as honest as possible. The key to an application being impressive is not what you have done, but how you portray it. Just be creative and original in explaining your experience.Please do comment if you have any other questions and check out the councelling forum on Facebook. Cheers!

-

Do you love your name or do you wish your name to be some other name?

I don’t like my name. Well not as much as my ex-name.My name is Divyansh Mundra (currently). The first name Divyansh was picked up by me when I was about 15 years old and legally changed.Divyansh is not the name by which my family knows me, nor do the people who’ve known me since the time that I was born call me ‘Divyansh’ because Divyansh was not my birth name.My grandfather gave me the coolest of names, and I wish that I could have kept it with me.Sadly, English happened.You’ll know why.When this guy was born, he looked like this-(My mom drew a sketch of me after a few days when I was born. My dad was away and there were no cell phones available then to just click and WhatsApp the pic of your baby)And my grandfather gave me the name दिव्य (Divya), which means divine or angelic or heavenly.It’s quite awesome if you ask me.(Translations have been included in the picture)But there was a catch-दिव्य (Divya) cannot be written in English without meaning something else. दिव्या (Divya) on the other hand can be.दिव्या (pronounced like Divyaaa) and दिव्य (pronounced somewhat like Divyha) are both spelled the same in English as Divya. But दिव्या is the name of a girl, while दिव्य is the name of a boy.So courtesy of English medium schools across the country, I had to write my beautiful name दिव्य as Divya, which is popularly the name of a girl.So while marking attendance, the teacher would look up in surprise after hearing a male voice.Also, when you’re writing your name as that of a girl, you’re handing out a loaded weapon to your friends. They don’t even have to try to come up with names to tease you.Naturally, by the time I was in eighth standard, I was a shy little kid who’ll have stage fear— not because he was afraid to speak in front of a crowd, but because of the humiliation he’d have to face when the announcer would spell the name of a girl instead.After facing a lot of ridicule and shattered ego on many instances, I forced my parents to get my name changed.What could I name myself without doing any damage?Divya became Divyansh, and I finally breathed a whiff of fresh air. Divyansh just means part-divine, but if it saves you the embarrassment of the name of a girl, it’s fine with me.If you can’t be the god, you be the demi-god. And this literally sums up the transition of my name.The rest, as they say, is history.Well, not really, my friends still teased me by that name and I’m still shy, so it didn’t really matter....I just wish English wasn’t this funny of a language.Peace Out!(Image Source: Instagram- Divyansh Mundra (@divyansh_mundra) •

-

For the new 2018 W-4 form, do I also print out the separate A-H worksheet and fill that out for my employer?

No, an employee is not required to give the separate worksheet to the employer. Keep it for your own records.

-

A hole is made in the bottom of a container having water filled up to a height h. What is the velocity of water flowing out of the hole?

The basic formula for velocity of water flowing out of the small hole in the wall or in the bottom of the container can be derived from Bernoulli’s equation and is called Torricelli’s law:[math]v=\sqrt{2gh} \tag*{}[/math]But to get actual velocity magnitude you must also include velocity loss coefficient φ:[math]v=\varphi \cdot \sqrt{2gh} \tag*{}[/math]

-

What will happen if the United States revokes all Indian H-1B visas, sending all H-1B holders back to India? How would it affect the U.S., as well as India?

There is already a per country limit per year for Greencard. So, if the similar policy is applied to H1B, there may be a possibility to limit H1Bs from a given country in the future. But, if were to happen, here is what I believe would happen:Everyone boards their flight and returns to India.30% of them start their own companies in India.All the companies in the U.S that employed on H1B visa holders would be struggling to find replacements to get a U.S Citizen with the same commitment to perform the job with the same salary.The immigration attorney business goes into a recession.40% of the U.S Universities will be struggling to attract Indian students on F1 visa.30% of the professors in U.S Universities without tenure will be removed from their jobs.Canada, New Zealand, Australia will be the new USA for Indians.USD-INR rate will go down atleast by 15% in 1 year.The rental prices for the apartments in metro areas like SFO, NJ, Chicago, Detroit, Houston etc will go down by 20% in 1 year.Last but not the least, 30% of the people sent back on H1B will be back to the USA on L1B/L1A visas !Special mention from Clay Schumacher :11. My family and I will miss our indian friends.March 17 2017:Related to the point 5 above that I mentioned 6 weeks back, I see an article today in TOI. 40% of US colleges see dip in foreign applicants - Times of IndiaAug 4 2017:Many people are asking about the point 3 above and asking if Indians are working for lesser salaries today. Well, ANY country person on H1B “should” work per the H1B LCA salaries. The H1B LCA salaries are set by the US Government - not Indian companies. All the US Companies hire any H1B person only after an “approved H1B LCA petition” given by the US Government. It’s only the H1B LCA salaries set by the US Government to blame. Even all the H1B holders want the LCA salaries to be increased !

-

What is it like in Tokyo, Japan?

It’s very different than living in any other city I’ve lived in (Boston, Los Angeles, and San Francisco). Here are some unique things I noticed, in no particular order:Having 24-hour convenience stores for food and basic necessities makes life very… convenient.Trash and recycling needs to be thoroughly sorted by type (e.g. combustible, non-combustible, PET bottle etc…) before taken out on its designated day. Failure to sort your trash properly will result in your trash being put back on your doorstep :( I never figured out how they could tell whose bag of trash was whose.There aren’t very many public trash cans so you need to carry your trash around until you got home to dispose of it properly.Subways and buses are frequent and almost always run on schedule. Even a few minutes of delay can cause restlessness.Riding on the subway is very quiet. Chatting loudly and talking on your phone is discouraged.Sexual harassment on subways is not uncommon. During rush hour, busy subways lines usually provide a female only car.People won’t tell you if you’re in their way or inconveniencing them. If you’re blocking the “walk” side of an escalator, people usually just wait (impatiently) behind you until you notice and move.I always carried cash with me. A lot of local stores don’t accept credit card.You go to international supermarkets to buy American and European goods.Meat is expensive.Some areas are extremely hipster and very obsessed with coffee. (I guess this is not that different from cities I’ve lived in…)It’s almost always acceptable (and normal) to drink beer with dinner.Restaurants don’t serve wine often, but if they do, you can only choose between white or red. You only see wine selections at wine bars or high class restaurants.Usually only men go by themselves to ramen and beef bowl shops. Going in by yourself as a female can be quite uncomfortable. Lately though, ramen stores targeted to females (modern decor and healthier/“lighter” flavors) have been popping up and are becoming more popular.On the other hand, going to a cake shop by yourself as a female is normal and acceptable. It is pretty uncommon to see a guy eat at a cake shop, let alone by himself.Saying or hearing things like “Because I’m a man…” or “Because you are a woman…” is pretty common and acceptable, I guess.You can microwave the plastic wrap.I would refer to myself and the person I’m talking to in the third person.Service is great. Retail and restaurant workers generally treat their guests very well and are very attentive. For example, if you buy sweets from the food level of a large department store, they will always take the extra minute to wrap it very nicely for you.It’s uncommon to find soap in bathrooms.It is extremely safe. I used to leave my laptop at a cafe to keep my spot and go out for lunch. I’ve heard that petty crimes have been increasing lately though.There are very different norms and customs around working, see Kristin Au's answer to What were the biggest surprises when working in Japan?Hitting on people/ being hit on by random people happens a lot. One time I was walking home from a long day of work and errands when a middle-aged salary man starting walking next to me and very bluntly asked me “Onee-san, would you like to accompany me to dinner?”There are a few “designated” nampa, or pick-up, places, including in front of the Tsutaya at the famous Shibuya Crossing. I have never experienced it but have heard that there are people (usually males) who hang out there to nampa as a hobby as well as people (usually females) who stand around waiting to be hit on.People will set up events, called goukons, to find a boyfriend/ girlfriend. One girl and one guy, who are acquaintances, will each recruit the same number of girls and guys (usually around 2 to 4 people) to go to dinner, usually at an izakaya, or Japanese pub. After dinner, the girls and guys will pair up via a “deciding” game or by taking turns to choose who they want to be with. Afterwards, they will either do a group activity or separate pair activities. Goukons are pretty common-place, and have even been used as settings for commercials.Books at bookstores are usually plastic wrapped. Sometimes there might be a “sample” book you could take a look through.Almost everything has a mascot. My office building’s mascot was a tiger Doraemon.

-

What are some names you should not name your child?

Let's talk some data here -The twenty “Whitest” girl names -MollyAmyClaireEmilyKatieMadelineKatelynEmmaAbigailCarlyJennaHeatherKatherineCaitlinKaitlinHollyAllisonKaitlynHannahKathrynThe twenty “Blackest” girl names -ImaniEbonyShaniceAaliyahPreciousNiaDejaDiamondAsiaAliyahJadaTierraTiaraKiaraJasmineJasminJazminJasmineAlexisRavenThe twenty “Whitest” boy names -JakeConnorTannerWyattCodyDustinLukeJackScottLoganColeLucasBradleyJacobGarrettDylanMaxwellHunterBrettColinThe twenty “Blackest” boy names -DeShawnDeAndreMarquisDarnellTerrellMalikTrevonTyroneWillieDominiqueDemetriusReginaldJamalMauriceJalenDariusXavierTerranceAndreDarrylSo how does it matter if you have a very white name or a very black name? Over the years, a series of “audit studies” have tried to measure how people perceive different names. In a typical audit study, a researcher would send two identical (and fake) resumes, one with a traditionally white name and the other with an immigrant or minority-sounding name, to potential employers. The “white” resumes have always gleaned more job interviews.According to such a study, if DeShawn Williams and Jake Williams sent identical resumes to the same employer, Jake Williams would be more likely to get a callback.The implication is that black-sounding names carry an economic penalty. Such studies are tantalizing but severely limited for they can't explain why DeShwan didn't get the call. Was he rejected because the employer is a racist and is convinced that DeShawn Williams is black? Or did he reject him because “DeShawn” sounds like someone from a low-income, low-education family? A resume is a Fairly undependable set of clues - a recent study showed that more than 50 percent of them contain lies - so “DeShawn” may simply signal a disadvantaged background to an employer who believes that workers from such backgrounds are undependable.Nor do the black-white audit studies predict what might have happened in a job interview. What if the employer is racist, and if he unwittingly agreed to interview a black person who happened to have a white-sounding name - would he be any more likely to hire the black applicant after meeting face-to-face? Or is the interview a painful and discouraging waste of time for the black applicant - that is, an economic penalty of having a white sounding name? Along those same lines, perhaps a black person with a white name pays an economic penatly in the black community; and what of the potential advantage to be gained in the black community by having a distinctively black name? But because the audit studies can't measure the actual life outcomes of the dictious DeShawn Williams versus Jake Williams, they can't assess the broader impact of a distinctively black name.Maybe DeShawn should just change his name.So does a name matter?The data show that, on average, a person with a distinctively black name - whether it is a woman named Imani or a man named DeShawn- does have a worse life outcome than a woman named Molly or a man named Jake. But it isn't the fault of their names. If two black boys, Jake Williams and DeShawn Williams, are born in the same neighborhood and into the same family and economic circumstances, they would likely to have similar life outcomes. But the kind of parents who name their son Jake don't tend to live in the same neighborhoods or share economic circumstances with the kind of parents who name their son DeShawn. And that's why, on average, a boy named Jake will tend to earn more money and get more education than a boy named DeShawn. A DeShawn is more likely to have been handicapped by a low-income, low-education, single parent background. His name is an indicator - not a cause - of his outcome. Just as a child with no books in his home isn't likely to test well in school, a boy named DeShawn isn't likely to do well in life.And what if DeShawn had changed his name to Jake or Connor: would his situation improve? Here's a guess: anybody who bothers to change his name in the name of economic success is - at least highly motivated, and motivation is probably a stronger indicator of success than, well, a name.—It would go very big, but you can get the essence of the impact of names of people on their lives.Source: FreakonomicsI recommend this book to all and to read this full study on parenting and naming children, its just awesome.

Create this form in 5 minutes!

How to create an eSignature for the hampr block express ira distribution form

How to generate an eSignature for the Hampr Block Express Ira Distribution Form in the online mode

How to generate an eSignature for the Hampr Block Express Ira Distribution Form in Google Chrome

How to generate an eSignature for signing the Hampr Block Express Ira Distribution Form in Gmail

How to create an electronic signature for the Hampr Block Express Ira Distribution Form right from your smart phone

How to create an electronic signature for the Hampr Block Express Ira Distribution Form on iOS devices

How to make an electronic signature for the Hampr Block Express Ira Distribution Form on Android devices

People also ask

-

What is the H&R Block Express IRA Distribution Form?

The H&R Block Express IRA Distribution Form is a document used to request withdrawals from an Individual Retirement Account (IRA) managed by H&R Block. This form ensures that your distribution is processed correctly and in compliance with IRS regulations. Utilizing this form can help streamline your IRA distribution process.

-

How do I complete the H&R Block Express IRA Distribution Form?

To complete the H&R Block Express IRA Distribution Form, gather the necessary personal and account information, such as your account number and the amount you wish to withdraw. Follow the instructions provided on the form to ensure accuracy. If you're using airSlate SignNow, you can conveniently fill out and eSign the form digitally.

-

What are the benefits of using the H&R Block Express IRA Distribution Form with airSlate SignNow?

Using the H&R Block Express IRA Distribution Form with airSlate SignNow offers several benefits, including a user-friendly interface for easy form completion and eSignature capabilities. This digital solution reduces paperwork and speeds up the processing time for your distribution requests. Additionally, it provides enhanced security for your sensitive financial information.

-

Is there a fee to use the H&R Block Express IRA Distribution Form?

There is no fee specifically associated with the H&R Block Express IRA Distribution Form itself; however, H&R Block may charge fees depending on your account type and the nature of your distribution. Using airSlate SignNow may involve a subscription or per-document fee, but it enhances your overall document handling efficiency. Always check with your financial advisor for potential costs.

-

Can I integrate the H&R Block Express IRA Distribution Form with other software?

Yes, you can integrate the H&R Block Express IRA Distribution Form with various software applications through airSlate SignNow. This integration allows for seamless document management and electronic signature capabilities. Check the integration options available within airSlate SignNow to enhance your workflow.

-

How long does it take to process the H&R Block Express IRA Distribution Form?

Processing time for the H&R Block Express IRA Distribution Form can vary based on several factors, including the method of submission and the specific H&R Block office handling your request. Generally, using airSlate SignNow expedites the process by allowing instant eSigning and submission. It’s advisable to follow up with H&R Block to confirm the status of your distribution.

-

What information do I need to provide on the H&R Block Express IRA Distribution Form?

When filling out the H&R Block Express IRA Distribution Form, you need to provide personal identification details, your IRA account number, and specify the type and amount of distribution you are requesting. Additionally, ensure that you provide your preferred method of receiving the funds. Accurate information will facilitate a smoother processing experience.

Get more for H&R Block Express IRA Distribution Form

- Cal ema 89 california emergency management agency state of calema ca form

- Form 410 proof of claim example

- Advance care plan vanderbilt university medical center mc vanderbilt form

- Adding a base camp assessment bca to doehrs army mil form

- Pet agreement 100326853 form

- Death certificate information mountain high funeral home of

- State environmental quality review act negative declaration form

- User contract template form

Find out other H&R Block Express IRA Distribution Form

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast

- eSignature Pennsylvania Life Sciences Rental Lease Agreement Easy