AUTHORIZATION to RELEASE CREDIT INFORMATION

Understanding the AUTHORIZATION TO RELEASE CREDIT INFORMATION

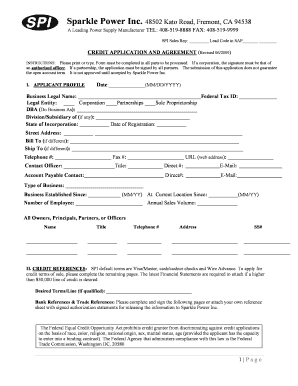

The AUTHORIZATION TO RELEASE CREDIT INFORMATION is a crucial document that allows individuals to grant permission for a third party, such as a lender or financial institution, to access their credit history. This form is often necessary when applying for loans, credit cards, or other financial products, as it provides the necessary consent for credit checks. Understanding this form is essential for ensuring that your financial information is handled appropriately and securely.

Steps to Complete the AUTHORIZATION TO RELEASE CREDIT INFORMATION

Completing the AUTHORIZATION TO RELEASE CREDIT INFORMATION involves several straightforward steps:

- Provide Personal Information: Fill in your full name, address, and Social Security number. This information is necessary for identifying your credit report.

- Specify the Recipient: Indicate the name of the organization or individual who will receive your credit information. This could be a bank, credit union, or another financial entity.

- Define the Purpose: Clearly state the reason for the credit inquiry, such as applying for a loan or a credit card.

- Sign and Date: Ensure that you sign and date the form to validate your authorization. Without your signature, the form is not legally binding.

Key Elements of the AUTHORIZATION TO RELEASE CREDIT INFORMATION

Several key elements must be included in the AUTHORIZATION TO RELEASE CREDIT INFORMATION to ensure its validity:

- Personal Identification: Your complete name and contact information.

- Recipient Details: The name and contact information of the entity requesting your credit information.

- Purpose of Release: A clear statement outlining why your credit information is being requested.

- Effective Dates: Specify the duration for which the authorization is valid, if applicable.

- Signature: Your signature, confirming that you authorize the release of your credit information.

Legal Use of the AUTHORIZATION TO RELEASE CREDIT INFORMATION

The legal framework surrounding the AUTHORIZATION TO RELEASE CREDIT INFORMATION is governed by federal and state laws, including the Fair Credit Reporting Act (FCRA). This act mandates that individuals must provide explicit consent before their credit information can be accessed. It also ensures that the information is used only for the purposes specified in the authorization. Understanding these legal requirements can help protect your rights and ensure that your credit information is handled responsibly.

Who Issues the AUTHORIZATION TO RELEASE CREDIT INFORMATION

The AUTHORIZATION TO RELEASE CREDIT INFORMATION is typically issued by financial institutions, lenders, or credit reporting agencies. These entities require the form to ensure they have the necessary permission to access your credit history. When applying for credit, you may be asked to complete this form as part of the application process, allowing the lender to evaluate your creditworthiness.

Examples of Using the AUTHORIZATION TO RELEASE CREDIT INFORMATION

There are various scenarios where the AUTHORIZATION TO RELEASE CREDIT INFORMATION is commonly used:

- Loan Applications: When applying for a mortgage or personal loan, lenders require this authorization to assess your credit history.

- Credit Card Applications: Credit card issuers often request this form to evaluate your creditworthiness before approving your application.

- Rental Applications: Landlords may ask for this authorization to check your credit report as part of the tenant screening process.

Quick guide on how to complete authorization to release credit information

Effortlessly Prepare [SKS] on Any Device

Digital document management has gained traction among businesses and individuals alike. It serves as a superb eco-friendly alternative to conventional printed and signed paperwork, allowing you to find the appropriate template and securely store it online. airSlate SignNow provides you with all the tools required to create, alter, and electronically sign your documents quickly and efficiently. Manage [SKS] on any device using the airSlate SignNow Android or iOS applications and enhance any document-focused procedure today.

The Easiest Way to Edit and Electronically Sign [SKS] with Minimal Effort

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal authority as a conventional handwritten signature.

- Review all the information and click the Done button to save your changes.

- Select your preferred method for sending your form: via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, frustrating form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and electronically sign [SKS] to ensure seamless communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to AUTHORIZATION TO RELEASE CREDIT INFORMATION

Create this form in 5 minutes!

How to create an eSignature for the authorization to release credit information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an Authorization to Release Credit Information?

An Authorization to Release Credit Information is a document that allows a third party to access your credit history. This is often required by lenders or service providers to evaluate your creditworthiness. Using airSlate SignNow, you can easily create and eSign this document securely.

-

How does airSlate SignNow help with Authorization to Release Credit Information?

airSlate SignNow streamlines the process of creating and signing an Authorization to Release Credit Information. Our platform provides templates and an intuitive interface, making it easy for businesses to obtain necessary approvals quickly and efficiently.

-

Is there a cost associated with using airSlate SignNow for Authorization to Release Credit Information?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that simplify the process of managing documents, including the Authorization to Release Credit Information. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing Authorization to Release Credit Information?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These tools enhance the efficiency of handling Authorization to Release Credit Information, ensuring that you can manage your documents seamlessly and securely.

-

Can I integrate airSlate SignNow with other applications for Authorization to Release Credit Information?

Absolutely! airSlate SignNow offers integrations with various applications, allowing you to streamline your workflow. This means you can easily manage your Authorization to Release Credit Information alongside other business processes, enhancing productivity.

-

What are the benefits of using airSlate SignNow for Authorization to Release Credit Information?

Using airSlate SignNow for Authorization to Release Credit Information provides numerous benefits, including time savings, enhanced security, and improved compliance. Our platform ensures that your documents are handled efficiently, allowing you to focus on your core business activities.

-

How secure is the process of signing Authorization to Release Credit Information with airSlate SignNow?

Security is a top priority at airSlate SignNow. We utilize advanced encryption and secure storage to protect your Authorization to Release Credit Information and other sensitive documents. You can trust that your data is safe with us.

Get more for AUTHORIZATION TO RELEASE CREDIT INFORMATION

- Chaperone consent form bdagorhirbbcomb

- Oklahoma turnpike authority sample clauses form

- Verified petition for order of protection montgomery county form

- Senior property tax homestead exemption form

- Illinois standardized forms approved petition order of protection

- Form of medical certificate for persons with disabilities pwd fill

- Registration of a birthimmigration department form

- Ar 300 ar 300 compilation reports on financial statements form

Find out other AUTHORIZATION TO RELEASE CREDIT INFORMATION

- Electronic signature Alabama High Tech Stock Certificate Fast

- Electronic signature Insurance Document California Computer

- Electronic signature Texas Education Separation Agreement Fast

- Electronic signature Idaho Insurance Letter Of Intent Free

- How To Electronic signature Idaho Insurance POA

- Can I Electronic signature Illinois Insurance Last Will And Testament

- Electronic signature High Tech PPT Connecticut Computer

- Electronic signature Indiana Insurance LLC Operating Agreement Computer

- Electronic signature Iowa Insurance LLC Operating Agreement Secure

- Help Me With Electronic signature Kansas Insurance Living Will

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template