SENIOR PROPERTY TAX HOMESTEAD EXEMPTION 2018-2026

What is the Senior Property Tax Homestead Exemption

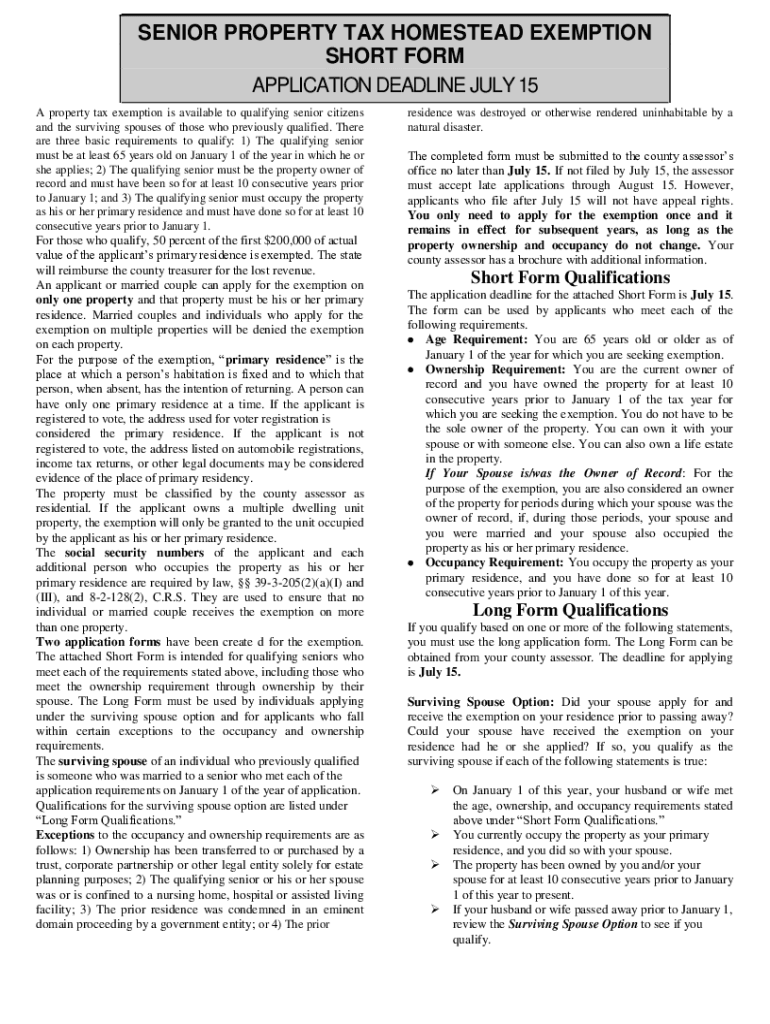

The Senior Property Tax Homestead Exemption is a tax benefit designed to reduce the property tax burden for eligible senior citizens. This exemption allows qualifying homeowners to lower the assessed value of their property, resulting in reduced property taxes. Each state in the U.S. has its own specific criteria and regulations governing this exemption, which typically includes age requirements, income limits, and residency status. Understanding these criteria is essential for seniors looking to take advantage of this financial relief.

Eligibility Criteria

To qualify for the Senior Property Tax Homestead Exemption, applicants generally must meet specific eligibility requirements. Common criteria include:

- Age: Applicants are often required to be at least sixty-five years old.

- Residency: The property must be the applicant's primary residence.

- Income: Many states impose income limits to ensure that the exemption benefits those who need it most.

- Ownership: Applicants must own the property for which they are claiming the exemption.

It is important for seniors to check their state's guidelines, as these criteria can vary significantly.

How to Obtain the Senior Property Tax Homestead Exemption

Obtaining the Senior Property Tax Homestead Exemption typically involves several steps. Seniors should start by researching their state's specific application process. Generally, the steps include:

- Gathering necessary documentation, such as proof of age, income statements, and property ownership records.

- Completing the application form, which may be available online or at local government offices.

- Submitting the application by the designated deadline, which varies by state.

- Awaiting confirmation of approval from the local tax authority.

Some states allow for online applications, making the process more convenient for seniors.

Steps to Complete the Senior Property Tax Homestead Exemption

Completing the Senior Property Tax Homestead Exemption application involves a series of straightforward steps:

- Verify eligibility by reviewing state-specific requirements.

- Collect all required documents, including identification and financial records.

- Access the application form, either online or in person.

- Fill out the form accurately, ensuring all information is complete.

- Submit the application before the deadline, either online or by mail.

- Keep a copy of the submitted application for personal records.

Following these steps can help ensure a smooth application process.

Required Documents

When applying for the Senior Property Tax Homestead Exemption, applicants typically need to provide several key documents, including:

- Proof of age, such as a birth certificate or driver's license.

- Income verification, which may include tax returns or pay stubs.

- Property ownership documents, like a deed or mortgage statement.

- Any additional forms required by the state or local tax authority.

Having these documents ready can expedite the application process and help avoid delays.

State-Specific Rules for the Senior Property Tax Homestead Exemption

Each state in the U.S. has its own regulations regarding the Senior Property Tax Homestead Exemption. These rules can dictate eligibility, the amount of the exemption, and application procedures. Some states may offer additional benefits, such as:

- Increased exemptions for low-income seniors.

- Automatic renewal processes for long-term residents.

- Additional exemptions for disabled seniors.

It is crucial for applicants to familiarize themselves with their state's specific rules to maximize their benefits.

Create this form in 5 minutes or less

Find and fill out the correct senior property tax homestead exemption

Create this form in 5 minutes!

How to create an eSignature for the senior property tax homestead exemption

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the SENIOR PROPERTY TAX HOMESTEAD EXEMPTION?

The SENIOR PROPERTY TAX HOMESTEAD EXEMPTION is a tax benefit designed to reduce property taxes for eligible senior citizens. This exemption allows seniors to lower their taxable property value, resulting in signNow savings on their property tax bills. Understanding this exemption can help seniors manage their finances more effectively.

-

How can I apply for the SENIOR PROPERTY TAX HOMESTEAD EXEMPTION?

To apply for the SENIOR PROPERTY TAX HOMESTEAD EXEMPTION, you typically need to fill out an application form provided by your local tax authority. It's important to gather necessary documentation, such as proof of age and residency, to support your application. Once submitted, your application will be reviewed, and you will be notified of your eligibility.

-

What are the eligibility requirements for the SENIOR PROPERTY TAX HOMESTEAD EXEMPTION?

Eligibility for the SENIOR PROPERTY TAX HOMESTEAD EXEMPTION generally includes being a senior citizen, usually 65 years or older, and owning and residing in the property for which the exemption is sought. Some jurisdictions may have additional requirements, such as income limits or disability status. It's essential to check with your local tax office for specific criteria.

-

How does the SENIOR PROPERTY TAX HOMESTEAD EXEMPTION affect my property taxes?

The SENIOR PROPERTY TAX HOMESTEAD EXEMPTION reduces the assessed value of your property, which directly lowers your property tax bill. This exemption can lead to substantial savings, especially for seniors on fixed incomes. By taking advantage of this exemption, seniors can retain more of their income for other essential expenses.

-

Can I combine the SENIOR PROPERTY TAX HOMESTEAD EXEMPTION with other tax exemptions?

Yes, in many cases, you can combine the SENIOR PROPERTY TAX HOMESTEAD EXEMPTION with other tax exemptions, such as those for veterans or disabled individuals. However, the specific rules can vary by state or locality, so it's advisable to consult your local tax authority for guidance on combining exemptions. This can maximize your tax savings.

-

What documents do I need to provide for the SENIOR PROPERTY TAX HOMESTEAD EXEMPTION application?

When applying for the SENIOR PROPERTY TAX HOMESTEAD EXEMPTION, you will typically need to provide proof of age, such as a birth certificate or driver's license, and documentation showing ownership of the property. Some jurisdictions may also require proof of residency and income statements. Ensuring you have all necessary documents can streamline the application process.

-

Is there a deadline for applying for the SENIOR PROPERTY TAX HOMESTEAD EXEMPTION?

Yes, there is usually a deadline for applying for the SENIOR PROPERTY TAX HOMESTEAD EXEMPTION, which varies by state or locality. Many jurisdictions require applications to be submitted by a specific date, often before the tax year begins. It's crucial to check with your local tax office to ensure you meet the application deadline.

Get more for SENIOR PROPERTY TAX HOMESTEAD EXEMPTION

- Agreement to provide renovation services to church washington form

- Quitclaim deed from husband and wife to two individuals washington form

- Washington special deed form

- Washington motion form

- Quitclaim deed from llc to llc washington form

- Washington personal representative deed form

- Washington motion 497429311 form

- Non responsive form

Find out other SENIOR PROPERTY TAX HOMESTEAD EXEMPTION

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors